Take-Two Interactive (TTWO -0.03%) stock had a fantastic 2014. The Grand Theft Auto publisher saw its shares increase in value by nearly 60%, while the S&P 500 increased roughly 12.4% across the same period. The only big gaming company to best Take Two's stock performance was Electronic Arts (EA 1.30%), which boasted a whopping 105.9% growth across 2014.

In order to better understand what the future might hold for Take-Two, let's take a look at what propelled the company's stock to new heights in 2014.

Grand Theft Auto 5 was massive

The Grand Theft Auto series has long been Take-Two's most important property, and the most recent installment is its biggest hit yet. Grand Theft Auto 5 launched in September 2013, and wound up being the best-selling game for the year despite debuting on only Sony's PlayStation 3 and Microsoft's Xbox 360. By February 2014, Take-Two announced that it had shipped 32.5 million copies of the game.

Following the hugely successful launch of Grand Theft Auto 5, Take-Two announced that it would release the game on PlayStation 4 and Xbox One and PC, thus giving the company the opportunity to further ride the title's success and strengthen its 2014. The updated game debuted last November and, Grand Theft Auto 5 wound up as the fourth-best-selling game of the year, a highly impressive feat and testament to the franchise's appeal and staying power. Earlier this month, Take-Two announced that Grand Theft Auto 5 had shipped 45 million copies. Similarly impressive, the company is delivering big digital revenue growth, thanks largely to GTAV's online mode. Grand Theft Auto's success was even more impressive in light of declining sales for big gaming series like Activision Blizzard's Call of Duty and Ubisoft's Assassin's Creed.

Take-Two is set to release a version of GTA5 on PC next month, which means it will have released a version of the game in three consecutive calendar years.

Fears that Take-Two is a one-hit wonder lessened

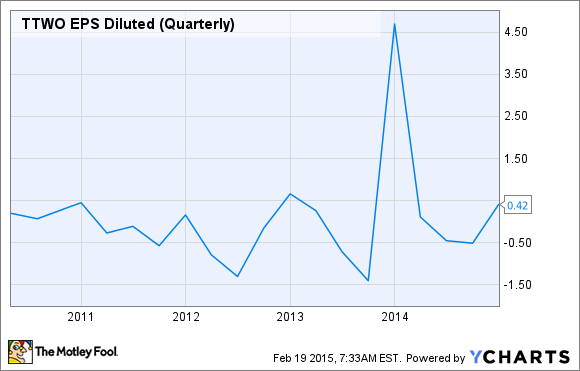

One of the biggest concerns for prospective Take-Two investors is that the company is overly reliant on its biggest property. Like most game companies, Take-Two's business is cyclical. Its biggest earnings come when there's a mainline Grand Theft Auto release, and it has frequently posted losses in quarters that don't see a new release in its marquee property.

TTWO EPS Diluted (Quarterly) data by YCharts

While Take-Two is still very dependent on the GTA franchise, the company delivered strong performers outside the series in 2014. NBA2K15, WWE 15, and Borderlands: The Pre-Sequel were all solid performers, and each of these titles is sure to receive sequels. NBA2K15 in particular did exceptionally well. The title came in as the seventh-best-selling game of 2014 and further solidified Take-Two's strength in the sports game genre. The company's basketball series has now thoroughly displaced the competing NBA Live series from Electronic Arts. Despite the fact that Take-Two is a relatively small company, it stands as EA's biggest rival in the sports genre.

In 2015, Take-Two will release new entries in the NBA2K and WWE series. The company has already released new IP Evolve and fresh downloadable content for Borderlands: The Pre-Sequel. Evolve looks to be a solid-but-not-spectacular performer for the company. Take-Two is also expected to unveil, and potentially release, a sequel to Red Dead Redemption this year. The wild west action game was one of the most successful titles of the last hardware generation, so a new release has the potential to boost Take-Two's earnings and stock.

Take-Two's earnings came in above expectations

After missing the average analyst estimate for $0.04 earnings per share by $0.08 for its quarter ended March 31, 2014, Take-Two delivered three consecutive quarters of substantial earnings beats. Take-Two's biggest stock jump in the last five-years followed the release of its second-quarter results in late October of last year. The average analyst estimate called for a loss of $0.75 a share, but actual losses came in at $0.56 a share. The beat was propelled by strong performance from the company's game catalog and digitally sold content. Those success stories held in the company's subsequent quarter, with a roughly 36.1% beat on the average analyst estimate and 64% year-over-year growth in non-GAAP net income from digital content sales.

Take-Two will likely continue to see impressive gains in digital content sales in 2015, with most sales coming from the Grand Theft Auto, NBA2K, and Borderlands series. That said, the company doesn't have a massive game release confirmed for this calendar year. The PC version of Grand Theft Auto 5 should do good numbers, but it won't make the same splash that the PlayStation 4 and Xbox One versions did in 2014. With no plans yet announced for the release of a large game this year -- a Red Dead Redemption sequel hasn't been confirmed -- there's a good chance that Take-Two's earnings in 2015 will be down from the previous calendar year.