Westport Innovations (WPRT -0.61%) stock is up huge in the past few weeks:

The catch? Even after the big run-up, long-term shareholders are still far from getting back to even, as the company has struggled to establish traction, and actually gone backward during the past few quarters.

Westport reports financial results for the fourth quarter in the next few days, and there are a few key things that investors need to pay close attention to. Let's take a look at the most important things that investors need to keep an eye on when Westport reports earnings in late February.

1. Slow the cash burn

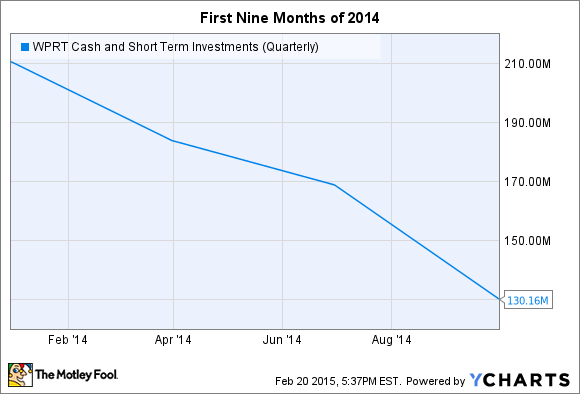

It's less about the growth potential at this point and more about how quickly -- and whether -- management can turn things around. Sales growth is the real long-term answer to Westport's woes, but in the interim, the company must quickly reduce cash burn. Last quarter, the company burned $25 million, and has gone through $80 million in the first nine months of 2014:

WPRT Cash and Short Term Investments (Quarterly) data by YCharts.

There were some positive developments last quarter, though. The company was able to reduce its R&D expense by almost $6 million in the quarter versus the year before, while SG&A expense was down 20%, even better than the 16% reduction for the year so far.

Management also announced that the company had reduced staffing, and deferred some "non-core" product development in an effort to further reduce cash burn. These could be worth a combined $13 million in cost reductions in 2015. Also, the executive leadership agreed to a pay cut, with long-term stock options instead, to further help cut costs.

How much of an impact these things will show in the fourth quarter isn't clear.

2. Jump-start sales... somewhere

As I wrote above, this is really the only long-term fix for what ails Westport. Unfortunately, there isn't any one area of the business that's showing strong and sustained growth.

On-Road Systems is the source of much of Westport's potential, via development of its high-pressure, direct-injection (HPDI) technology that makes natural gas a suitable fuel for heavy-duty trucking applications. The challenge has been that, so far, none of the company's development partners has come to market with an engine. The closest is Volvo, which had announced a 13-liter HPDI engine, only to indefinitely delay commercial availability. Until someone brings an engine to the market, HPDI remains little more than potential.

Westport is also Ford's largest QVM partner, converting factory-built F-Series trucks and Transit van/Transit Connect to run on NG. Westport just received EPA certification for the 2015 Transit van, which has sold very well in gasoline versions. Only time will tell if that will translate to sales for the NG version.

Applied Technologies has been the core business, supplying vehicle OEMs with components to build NG versions of their vehicles. However, this business has faced serious struggles in recent months, as its core markets of Europe, China, and Russia all face serious economic challenges. Factor in the huge drop in oil prices, and it's not clear that this business will return to stability or growth in the short term. In the interim, Westport has taken steps to reduce overhead, and streamline operations and product development.

Prins Autogassystemen is expected to contribute to Westport's 2015 results. Source: Prins.

Westport spent some money to grow in Europe in Q4, investing $15.1 million to acquire Dutch OEM supplier Prins Autogassystemen. This could turn out to be a great acquisition, as Prins shares a lot of potential synergies with Westport. Both operate in similar spaces and there is some overlap, but this investment looks to strengthen Westport in an important part of its core business.

This acquisition will probably further reduce cash on hand, but if the business is accretive to 2015 sales -- as management claims -- then it sounds like the right kind of cash burn: Investment that quickly generates returns.

There is some hope that Westport's joint ventures, Weichai Westport (WWI) and Cummins Westport (CWI), could help. Both are profitable enough to self-fund, but Westport's share of the income has fallen significantly from $10 million in 2013 to $2.9 million in three quarters through 2014. The big driver at both has been falling margins, but that's expected to reverse at CWI, which had some big warranty issues early in 2014 that have been addressed. WWI, on the other hand, may not work out the same, as competition is driving prices down. Either way, these look to be the only profitable parts of Westport for now.

Off-Road Systems is primarily a development-stage segment, with products for rail and marine applications still years from commercial application. So far in 2014, the company had only spent $2.6 million combined between R&D and SG&A in this segment. That could get cut further pending development of a commercially viable product.

Looking ahead

At the end of the day, it's going to take a combination of cost improvement measures and increased sales to right the ship before too much water gets in. I do think the operational and financial leaders at Westport have the skill to do it, but they face an uphill climb, with both macroeconomic and internal financial headwinds to fight through.

Investors shouldn't count on major breakthroughs in the Q4 earnings, but should instead expect moderate improvements in the financial results. It's almost a guarantee that the company will have burned through more cash in the quarter, but there was more than $130 million at the end of Q3. If management can make a big dent in cash burn going forward, I think chances are better than even that they can turn things around.

Will the company ever reach the promise investors were paying $45 per share for a few years ago? It's way too early to make that call. A turnaround is more than enough for now.