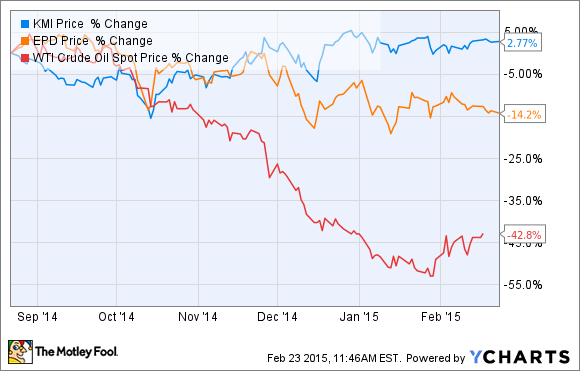

Kinder Morgan Inc (KMI 0.27%) has held up well despite the recent crash in oil prices, especially compared to some of its competitors, such as Enterprise Products Partners (EPD 0.48%).

With the market at all-time highs, and Kinder failing to follow Enterprise downward during the worst oil price crash in six years, should long-term, value-focused income investors perhaps choose Enterprise over Kinder at this time? I believe the answer is "no"; here are three reasons why.

Despite Enterprise's recent correction, Kinder Morgan makes a better dividend stock at its current price

| Company/Partnership | Yield | Projected 5-Year Payout Growth Rate | Payout Coverage Ratio |

| Kinder Morgan | 4.30% | 10% | 1.1 |

| Enterprise Products Partners | 4.40% | 6.10% | 1.55 |

| S&P 500 | 1.87% | 5.10% |

Sources: Multipl.com, Yahoo! Finance, MLPdata.com, Fastgraphs.

As this table shows, Kinder and Enterprise both pay a generous dividend and distribution, respectively -- more than twice the yield of the S&P 500. However, Kinder Morgan has a much better expected payout growth rate than Enterprise, although Enterprise's payout is more secure because of its bank-vault like distribution coverage ratio. But while Kinder's coverage ratio is substantially lower than Enterprise's, that doesn't necessarily mean its dividend isn't secure.

Kinder Morgan's dividend is unlikely to face cuts despite crashing oil prices

In the past, I've explained why I think it's unlikely cheaper oil prices will force Kinder Morgan to cut its dividend, despite the fact that every dollar crude is beneath $96.15 per barrel reduces Kinder's distributable cash flow, or DCF, by $7 million per year.

This is an opinion shared by Barclays, whose analysts recently reiterated their "overweight" recommendation based on their view that "Kinder Morgan's dividend visibility is one of the best and most extended in the space. The expected 10% annual dividend growth through 2020 is supported by a large fee-based backlog of projects and limited commodity exposure."

In fact, in 2015, only 6% of Kinder's cash flows are exposed to commodity prices, and barring a large number of cancellations in its $18 billion project backlog, Kinder should be able to achieve its dividend growth guidance. That's because the company is projecting that it will generate a $500 million excess in DCF this year, insulating the projected dividend growth from oil's recent collapse.

However, with oil prices losing steam in recent days and returning to beneath $50 per barrel some investors may be thinking it might be a good idea to wait until oil prices reach their bottom before purchasing shares of Kinder -- in hopes of securing a lower price and higher yield. However, history teaches us that this is a mistake.

Market timing is a bad idea

Oil prices are notoriously difficult to predict in the short term, and if you hold off buying shares of Kinder Morgan hoping that continued falling crude leads to a lower share price, you may end up regretting it. For one thing, the market is aware of Kinder's limited exposure to crude, which is why Kinder's share price has barely budged despite oil falling 60%.

Then there's the more basic fact that market timing just doesn't work. In fact, according to a study by research firm DALBAR, over the last 30 years, individual investors have underperformed the S&P 500 by a shocking 67%. The reason was market timing and excessive trading. Not only did this increase tax and transaction costs, but it also left investors sitting on money that would have been better put to use through good old-fashioned buy-and-hold investing.

Takeaway: Kinder Morgan is a good long-term buy at today's price even if oil keeps falling

Long-term buy-and-hold income investors shouldn't try to speculate on the short-term prices of oil or stocks that might be affected by crude prices. Numerous academic studies show that a long-term buy, hold, and accumulate approach -- through dollar-cost averaging if prices decline -- to quality dividend growth stocks like Kinder Morgan is the best way for investors to transform modest savings into enormous rivers of future cash flow and wealth that can help you achieve their financial dreams.