U.S. savings bonds are one of the most basic financial instruments backed by the full faith and credit of the U.S. government. Here we'll review what savings bonds are, how they make money over time, how to figure out the value of your savings bonds, and how to cash in your savings bonds.

Bonds

Understanding savings bonds

Understanding savings bonds

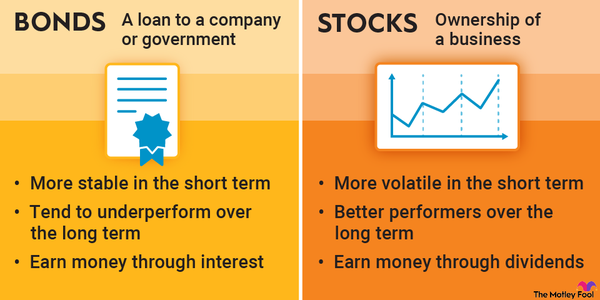

Savings bonds are securities that the U.S. government issues to pay for its borrowing needs. When you buy a U.S. savings bond, you're in effect lending your money to the government at a certain rate of interest, and the government will be responsible for repaying the loan in full -- that's principal, plus interest.

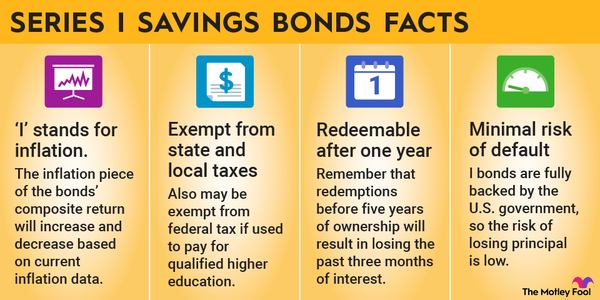

Savings bonds are considered low-risk investments because they're backed by the U.S. government. In other words, the probability of the U.S. government not being able to repay its savings bond obligations is extremely low. Therefore, the risk to the individual investor is also extremely small, especially compared to stock market investments.

When you buy a savings bond, you'll earn compound interest. With the two primary types of savings bonds -- Series I and Series EE -- you'll earn interest that compounds semiannually, so, every six months, interest is added to the principal amount. Then, for the following six months, interest is calculated on the new, and higher, principal amount. Savings bonds are the only government bonds that earn compound interest.

U.S. savings bonds are tax-deferred, which means you don't pay any tax as you earn interest from a bond. You'll only pay tax at redemption -- or at the time you cash in the bond. You have the option of reporting interest as it's earned throughout the life of the bond, but you'll only be liable for tax once the bond has been cashed.

Series I and Series EE bonds are also tax-exempt on the state and local levels. That means you'll still owe tax to the IRS, but you'll be spared any tax obligation beyond that. Further, if you use savings bonds to cover qualified educational expenses and you were at least 24 years old when you purchased the bonds, you'll also be exempt from paying federal tax on any bond interest earned.

You're able to name a survivor as the beneficiary of the bond who would become the immediate owner if you were to die unexpectedly. The survivor would have the option of doing nothing (holding the bond until it matures), cashing in the bond, or having it reissued in their name. If no survivor is named, the savings bond would become part of the deceased person's estate, much like any other asset without a named beneficiary.

A wealth of detailed information about savings bonds is also available on the TreasuryDirect website.

What is my savings bond worth?

What is my savings bond worth?

You can figure out the value of your bonds on the TreasuryDirect website, which is the central repository for the sale and valuation of government-issued bonds.

You'll need to know the following information to determine the value of your savings bond:

- Series: This should be printed on the face of your savings bond or clearly described in your online account. You might own Series I, Series EE, or Series E savings bonds.

- Denomination: The face value shown on your individual bond.

- Bond Serial Number: A unique alphanumerical identifier that will assist TreasuryDirect in finding your exact bond.

- Issue Date: The month and year of your bond's issuance.

You also should know how to file a claim if you've lost a bond or had one stolen or destroyed. You'll need to file a detailed claim form that will ask for the specific month and year of purchase, as well as your Social Security number, name, and address. Needless to say, it's best to keep track of the bonds you own, especially if you own paper savings bonds.

How to cash in your savings bonds

How to cash in your savings bonds

Now comes the exciting part: actually cashing in your savings bonds. Different bonds are redeemed in different ways, but most can be redeemed at a bank or through TreasuryDirect.

Electronic savings bonds, such as those offered through the TreasuryDirect website, can be cashed through your online account. This is a pretty simple process hosted by a service called ManageDirect.

Cashing paper bonds, on the other hand, requires a bit more legwork. You'll need to bring the physical bonds to a bank or other financial institution. It's best to call ahead to make sure that the institution you have in mind will actually cash your savings bonds.

From there, it comes down to establishing identity. If you're a customer of the bank, you'll simply need to submit some form of valid identification. If not, the process may be a bit more stringent. But as long as you're the rightful owner of the bonds, you'll have no trouble cashing them in once you've proven ownership.

It's important to keep in mind that the value of your bond will be highest if you wait until maturity to cash it. This is for two reasons: First, your bond will have more time to earn compound interest, and second, some bonds (such as Series EE bonds) are guaranteed to at least double at maturity. By waiting longer to cash in your bonds, you'll earn more interest and take advantage of any built-in price adjustments.

Related investing topics

Savings bonds and you

The purchase limits for U.S. savings bonds are not astronomically high, so adding them to your investment portfolio can make sense in the right circumstances. With just some basic information about savings bonds, you can make an educated decision about whether they're a fit for you.

Remember, savings bonds are low-risk investments. This means you're very unlikely to lose any money, but at the same time, you're not going to become a millionaire from savings bonds alone. Savings bonds generally make sense as part of a broadly diversified portfolio with a clear investment objective.

Regardless, it's a smart idea to get to know the basics of savings bonds and bring them into the realm of investment consideration.