Source: Qualcomm.

Source: Qualcomm.

Earlier this week, mobile chip giant Qualcomm (QCOM -1.87%) made headlines when activist investor JANA Partners suggested that the company should be broken up. This isn't the first time that the idea has been brought to the table -- it rears its ugly head every few years.

It's not as if Qualcomm's business model has fundamentally changed in recent years, so why would the notion carry more weight this time around?

You and what army?

JANA has taken a $2 billion stake in Qualcomm and is using that position to push for a handful of changes. That stake may not comprise a significant portion of Qualcomm's current $114 billion market cap, but it's enough to give Jana some credibility when making suggestions.

These suggestions include, but are not limited to, spinning off the chip business from the licensing business. The activist investor also wants Qualcomm to reduce costs, boost share repurchases, and revamp executive compensation.

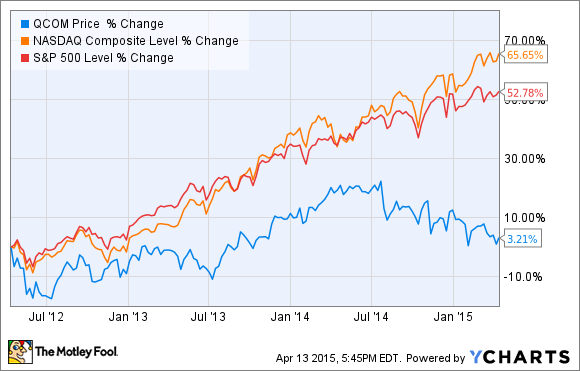

Qualcomm has an incredible business model and lies at the heart of the mobile revolution, directly (with its chips) and indirectly (with its intellectual property and patents) powering nearly all modern mobile devices. Yet shares have dramatically lagged both the Nasdaq Composite and the S&P 500 over the past three years.

The 3% gain over that timeframe looks downright paltry in comparison. As a shareholder myself, it's been a frustrating few years.

Total return including dividends is a bit better, but still lags the broader market by a notable margin. A great business with an underperforming stock is a common recipe that frequently attracts activist investors seeking a way to unlock value for shareholders, including themselves.

JANA believes that the market is undervaluing the chip business, and that a spinoff would bring the market to its senses.

A tale of two business segments

Qualcomm's corporate structure is an important aspect of how Qualcomm sustains ongoing research and development. The profits from the high-margin licensing business (QTL) are funneled into developing the applications processors, cellular basebands, and other chips that the company sells to handset manufacturers.

|

Business segment |

QCT |

QTL |

|---|---|---|

|

Revenue |

$5.2 billion |

$1.8 billion |

|

EBT |

$1.1 billion |

$1.6 billion |

|

EBT margin |

22% |

87% |

Figures shown for most recent quarter. EBT = earnings before taxes. QCT = Qualcomm CDMA technologies. QTL = Qualcomm Technology Licensing. Source: SEC filings.

For what it's worth, it seems that investors view a possible spin off favorably. Shares jumped 4% on Monday morning on the news, only to subside once analysts and Qualcomm itself downplayed the idea.

Having both businesses under the same corporate umbrella yields significant synergies that would be lost if the company was split into two. Qualcomm says that it periodically reviews its structure and is always on the lookout for ways to enhance shareholder value. It's worth remembering that Qualcomm was the one that initially suggested breaking itself up fifteen years ago, only to conclude that it wasn't the best plan of action.

JANA may rest assured that Qualcomm is very committed to ongoing capital returns. Just last month, the company announced a $15 billion share repurchase program alongside a 14% boost to its quarterly dividend. Qualcomm's operating cash flow remains strong ($2.4 billion last quarter), and it wants to keep giving back to investors. The chip maker also points out that since inception, it has always exceeded its minimum capital return target of 75% of free cash flow.

Qualcomm may have lagged in recent years amid concerns over the antitrust situation in China, intensifying competition from low-end chipmakers, and the ongoing challenge of retaining spots within Apple iPhones and Samsung Galaxies, but one of these days the market will come to its senses.