Source: Procter & Gamble Investor Relations Presentation

Investors hoping for a juicy dividend hike from Procter & Gamble Co (PG 0.68%) got an unpleasant surprise last Friday. The consumer giant lifted its dividend for the 59th year in a row, but it raised the payout just 3%, from $0.6436 to $0.6629 -- its stingiest dividend hike in over a decade.

The decision to raise the dividend only 3% was not very surprising, however. Though the household products giant is a favorite of income investors, offering a 3.2% dividend yield from a nearly 200-year-old company with two dozen billion-dollar brands, the company has run into several headwinds that should keep dividend increases modest for the foreseeable future. Let's take a look at a few reasons why.

1. The strengthening dollar

The rising dollar has presented problems for a host of American companies with significant international sales, and P&G is no different. In its last fiscal year, nearly two-thirds of its revenue came from overseas. In the quarter ended December, currency translation had an effect of -5% on sales, leading to a 4% drop on overall revenue.As the dollar has gotten even stronger in 2015, those effects should become more severe.

Management has warned that shifting currency rates would weigh on profit growth, and it expects earnings to be flat to down low-single digits, accounting for currency headwinds. Adjusting for currency effects and other non-recurring expenses, management projected earnings per share to grow by double digits, in part because of share buybacks.

While the effects of the stronger dollar will likely subside next year, unless the greenback weakens in the future, P&G and other companies like it will still find tighter margins overseas, impacting profits.

2. Market saturation

Even without the woes from the stronger dollar, the Gillette-maker is struggling to find growth avenues. In its most recent quarter, organic volume growth was flat overall and fell in three of the company's five reporting segments. Organic sales improved modestly, but that was due to price increases, which will only deliver sales growth in the short term. Volume sales growth, on the other hand, is the most important driver of overall sales and profit growth. Without it, investors should expect only modest growth in the stock and dividend in the future.

In many ways, P&G is a victim of its own success. The company has grown to a market value of over $200 billion by simply developing and marketing common household products such as detergent, razors, and paper towels. The problem, however, with such a market is that demand is relatively fixed -- it's hard to convince a family that they need more toilet paper or diapers than they've been using, after all. Earlier in its history, P&G invested more money in research and development, which led to products such as the Swiffer and Crest Whitestrips, but the company has scaled back on innovation in the last decade or so, choosing instead to return profits to shareholders through dividends and share buybacks.

While the industry leader has gotten complacent, the proliferation of e-commerce has eliminated traditional barriers to entry in the industry. Though P&G may occupy the prime shelf space at your local drugstore, start-ups like Dollar Shave Club and Harry's have taken market share from Gillette by offering lower prices for similar-quality products online.

So, even while there is little industry growth in developed countries, P&G is being threatened by smaller rivals who see opportunity where the leader has long reigned supreme. Expect that trend to continue as e-commerce grows.

3. Cash flow constraints

Dividend Aristocrats like Procter & Gamble have been able to raise their disbursements even during slow or no-growth years because of a healthy cash stockpile. However, last year, the Pampers-maker spent 68% of free cash flow on dividends and another 39% on share buybacks, meaning it returned more cash to shareholders than it brought in after capital expenditures.

This year, the company expects to spend $7.4 billion on dividends, yielding a payout ratio of 73%, assuming free cash flow is flat. With currency headwinds, FCF could easily fall, making the payout ratio even higher. The dividend payout ratio is seen as the best indicator of a company's ability to fund future dividends, and anything over 80% is generally considered to be dangerous territory. Therefore, P&G's payout ratio will likely top out around 80%.

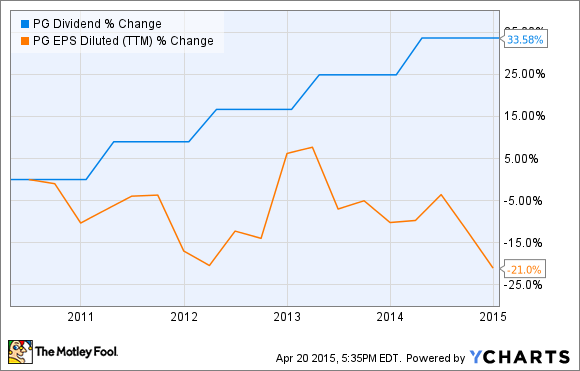

To maintain its current level of dividend payments and share buybacks, the company will either have to borrow money, cut expenses elsewhere, or deplete its cash hoard of $8 billion. As the chart below shows, P&G's dividends have gone up consistently over the past five years, even as earnings per share have fallen.

PG Dividend data by YCharts.

That kind of pattern is not sustainable. Procter & Gamble's 3% dividend increase was its lowest in over 10 years, but with currency headwinds, flat organic growth, and cash constraints, that kind of modest increase will likely become the new normal. Investors in search of more aggressive dividend growth will simply have to look elsewhere.