Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

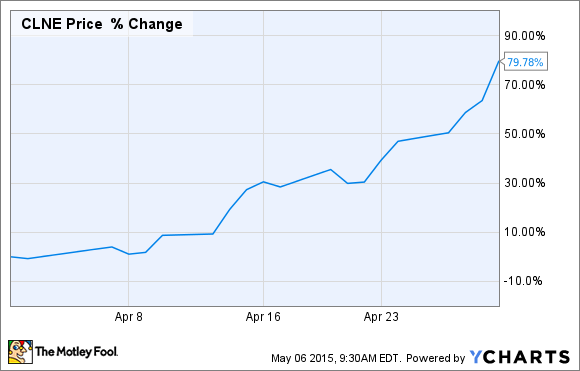

What: Shares of Clean Energy Fuels (CLNE 3.85%) jumped an astounding 79.78% in April thanks to increasing oil prices as well as a slew of new deals it has announced recently to build new fueling stations and supply several customers with natural gas.

So What: As much as Clean Energy Fuels tries to show that its business is not tied to oil because the prices of natural gas as a replacement fuel have remained much cheaper than diesel, truth is the company's shares have followed the outlook of oil quite closely for some time. When oil is cheap, trucking fleets don't see as much urgency for converting to an alternative fuel. The one advantage the company does have, though, is that once it does get a customer to convert to natural gas, chances are they aren't going back to oil any time soon. That is part of the reason that this months announcements that it had added 4.5 million gallons of diesel equivalent in supplier contracts was so significant, it showed that the company is still able to grow and lock in customers despite the decline in oil prices.

Now What: With oil back on the upswing, investors are seeing this as an opportunity to get back into Clean Energy Fuels, but as the company's results show it is starting to break away from that tight correlation between outcome and oil prices. If the company can continue to secure these supplier contracts as well as build out its own retail network, then it will go a long way in helping Clean Energy Fuels chart its own path regardless of where oil prices go.