Net Sales is the sales or revenue that your business has earned after all sales adjustments have been taken. Net sales is reported on your income statement, and should always be calculated for any business that sells products.

A service business needs to calculate net sales, such as when a customer discount is provided or a dissatisfied customer is refunded their payment, but these instances are much less common.

Overview: What are net sales?

Net sales is your total sales revenue left after deductions for sales returns, sale allowances, and discounts have been calculated.

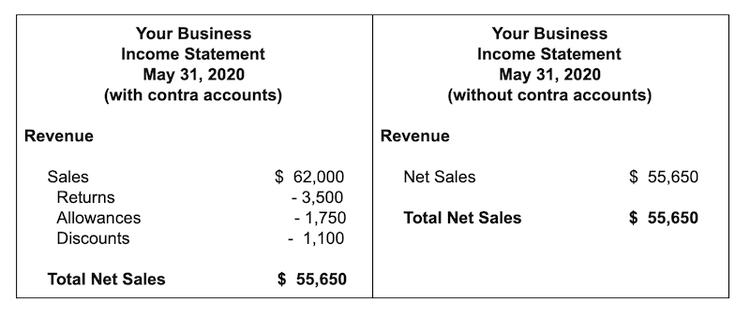

As a business owner, you have the choice to report net sales on your income statement with these deductions already included in the sales total, or report gross sales figures and list each allowance or deduction separately.

It’s important that all deductions and allowances be calculated accurately, as they directly affect your gross profit. However, your sales allowances and deductions should not include cost of goods sold, which is subtracted separately from your net sales total.

Net sales vs. gross sales: What's the difference?

Gross sales are your total sales for a specific period before accounting for any deductions such as sales allowances, sales discounts, and sales returns.

Applicable mainly to businesses that sell products, service businesses rarely have to worry about gross sales and net sales, with only an occasional discount or allowance given.

It’s important that all sales adjustments are properly accounted for. For example, if you have sales of $100,000 and returns and allowances of $25,000, your net sales amount is $75,000.

If you don’t properly account for these adjustments, your gross profit will be overstated as will your total revenue number. This simple omission can cause incorrect financial statements, which leads to inaccurate financial ratios and misstated profit levels for your business.

It can also result in overpaying on your taxes.

How to calculate net sales

To calculate net sales, familiarize yourself with the three common sales deductions mentioned above:

- Sales allowances: Sales allowances are typically offered to your customers if there is a product defect. A sales allowance is similar to a sales discount, but is not offered as a reduction in pricing to induce more sales, but because there is something wrong with the product. Total allowances should be calculated monthly to determine sales revenue.

- Sales discounts: Sales discounts, like sales allowances, reduce product pricing, though discounts are given for a variety of reasons. One of the most common reasons for sales discounts are the sales terms you offer to your customers. For example, you invoice your customer for $1,000 worth of products, offering them payment terms of 2/10, net 30. What that means is that the total amount of the invoice ($1,000) must be paid within 30 days of the invoice date, but if your customer pays within 10 days, they can take advantage of a 2% discount; and pay you $980 instead of $1,000.

- Sales returns: When a customer returns an item for a refund, the amount of the refund needs to be subtracted from gross sales. Both sales returns and allowances should be accounted for regularly.

If you’re ready to calculate your net sales, use this simple formula:

Gross Sales - Returns - Allowances - Discounts = Net Sales

To properly track return, allowance, and discount totals, you will need to create contra accounts for your sales account. Contra accounts are income/revenue accounts that will maintain a debit balance instead of their normal credit balance. On your chart of accounts, your contra accounts would look like this:

| Account Name | Type |

|---|---|

| REVENUE | Income |

| 4000 - Sales | Income |

| 4010 - Sales Returns | Income |

| 4020 - Sales Allowances | Income |

| 4030 - Sales Discounts | Income |

The sales returns, sales allowances, and sales discounts accounts are all considered contra accounts of the main sales account and will have a debit balance. At the end of the accounting period, any debit balance in the contra accounts will be subtracted from the sales account balance to obtain net sales totals.

Now that your contra accounts have been created, you can record your sales journal entry for the following sales transactions.

In the month of May, your business sold $62,000 worth of products on credit. One customer returned products in the amount of $3,500. You also gave discounts to three early-paying customers that totaled $1,100. In addition, one of the orders you shipped was slightly damaged.

Since the customer chose to keep the slightly damaged goods, you gave him a sales allowance in the amount of $1,750. The journal entry would be:

| Date | Account | Debit | Credit |

| 5-31-2020 | Sales | $62,000 | |

| 5-31-2020 | Sales Returns | $ 3,500 | |

| 5-31-2020 | Sales Allowances | $ 1,750 | |

| 5-31-2020 | Sales Discounts | $ 1,100 | |

| 5-31-2020 | Accounts Receivable | $55,650 |

By recording the adjustments this way, gross sales will be reduced from the original $62,000 by the debit amounts in the contra accounts, with net sales revenue totalling $55,650.

If additional customers end up taking a discount, you will need to adjust the sales discount account and the accounts receivable account in order to reflect the additional discount.

In order to record sales numbers manually, you’ll need to add your gross sales and then subtract returns, allowances, and discounts from that total. If you’re using accounting software, you can record your adjustments directly into the software application.

After all journal entries have been recorded, your income statement will reflect the adjustments. You can create an income statement listing all of the sales adjustments individually, or just use the net sales number.

If you use the income statement without the contra account amounts displayed, you will still have access to the adjusted totals in your general ledger.

This is important, since you’ll want to know how much the adjustments are costing your business. The only difference is that the totals will not be displayed on the income statement.

Tracking net sales

It’s equally important to track gross and net sales. While gross sales provides information such as how well your products are selling and how successful your business is in reaching customers, tracking net sales totals are just as important.

For instance, inadequate tracking of net sales can lead to over-inflated revenue totals, a possible overpayment on taxes, and inaccurate financial statements.

Tracking net sales also addresses the underlying reason for the sales adjustments. For instance, if your sales allowances are high, you might need to address product defects and perhaps look for a new supplier. If your product returns are high, investigate why so many customers are returning your product.

The best way to keep track of both gross and net sales is to use accounting software. If you’re thinking about making the move from manual ledgers and spreadsheets, check out The Ascent’s accounting software reviews.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.