Information technology makes the business world go round. No corporation worth its salt would even attempt nowadays to operate without a variety of computer systems, data networks, custom software packages, and top-notch support services.

These markets added up to a stunning $3.7 trillion in worldwide sales last year, and are expected to grow to $3.9 trillion in 2015. That's a massive market, coupled with generous growth prospects.

So what are the best ways to invest in this booming industry today? Here's a handpicked selection of three options.

Investing legend Warren Buffett has built an 8.1% stake in IBM.

The grizzled veteran

Legendary investor Warren Buffett has a very simple basic philosophy.

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price," Buffett says.

That's one way to build a billion-dollar fortune. But what if you can buy a wonderful company at a wonderful price? That's what's happening today with IBM (IBM -0.12%). And wouldn't you know it -- Buffett is using this opportunity to increase his IBM position right now.

In 2011, Buffett saw IBM as "a company that helps IT departments do their job better." He bought into this top-quality business even as the stock hit a series of all-time highs, just like he did in railroads a couple years earlier. In Buffett's eyes, this was a world-class business with fantastic execution chops -- the kind of stock you should own for decades to come.

Since then, IBM has been going through a painful strategy adjustment. The company has offloaded most of its computing hardware operations to Chinese peer Lenovo, refocusing on higher-margin software and services instead. Adjusted earnings per share has increased by 7% since 2011 even though sales dropped 15% over the same period. This new direction will take a few years to mature, but should position IBM well for a more profitable future.

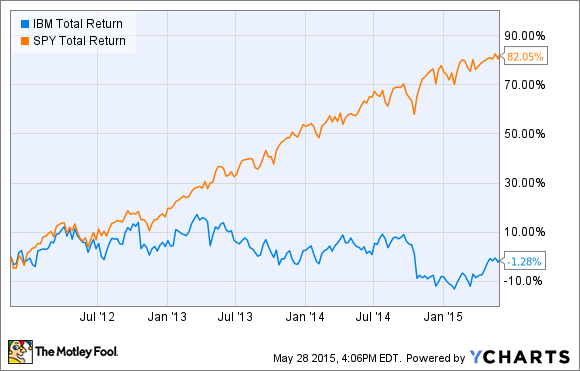

IBM investors -- Buffett included -- have missed out on a great bull market over the last three and a half years. The stock has traded sideways while the S&P 500 index gained 82%, and that's with dividends reinvested along the way:

IBM Total Return Price, data by YCharts

Let me repeat that again: IBM's profit is rising while the market hit "pause" on the share price. It's still the same great company that Buffett saw in 2011, and he's still buying more IBM shares. But now he's getting the same great business at a discount, since Big Blue these days trades for a very reasonable 12.7 times adjusted earnings. It's the best of both worlds, and this stock should rebound strongly when the software-and-services revamp starts paying off on the bottom line.

Image source: Red Hat.

The confident newcomer

IBM is a world-beater, selling at a discount. If you'd prefer an up-and-comer with momentum behind both the business and the stock, I'd recommend Red Hat (RHT).

Shares of the Linux systems vendor are trading at multiyear highs. Over the last 12 months, you're looking at a 56% gain while the S&P 500 only rose by 11%. Sales and free cash flow have just about doubled in four years, providing plenty of fuel for Red Hat's skyrocketing share price.

Those are impressive numbers for a company built on freely available and open-source software. Anyone can install Red Hat Enterprise Linux, the company's flagship product, for a free 30-day evaluation, and the system will remain fully functional (but unsupported) when the evaluation period or your last paid subscription license expires.

Red Hat also supports Fedora and CentOS, two totally free Linux distributions without professional support contracts. These systems serve as testing grounds and extended development platforms for RHEL. Their presence accelerates the enterprise product's development at a very low cost to Red Hat, and also broadens the company's community of users, developers, and system administrators.

The magic sauce that ties it all together, and also fills Red Hat's coffers, is the availability of top-shelf support contracts. Long-term contracts provide a wonderfully stable and predictable revenue flow. Linux in general, and Red Hat's premium products in particular, have finally gone mainstream.

At the same time, the company provides a plethora of tools that are proving popular in the emerging Internet of Things market. From lightweight operating systems to secure messaging tools, Red Hat can stick its fingers into that $19 trillion pie from many angles.

In short, Red Hat is perfectly positioned to continue growing quickly for a long time. Formerly known as an interesting cost-saving alternative, Linux has become a preferred computing platform. And Red Hat is locking its customers into multiyear relationships.

This growth story is just getting started.

The plucky upstart

Finally, let's talk about Amazon.com (AMZN -2.83%).

I know, the company is famous for its online retailing prowess above all else. Amazon built one of the first real e-commerce platforms, and still innovates in the retail space like nobody else. Seems like an odd choice for a discussion about IT products and services, right?

But for the purposes of this article, that online retail operation is only an additional bonus. Call it icing on the cake.

We're here to look at Amazon Web Services. The cloud computing platform grew out of Amazon's excess data center capacity in 2006, growing quietly under the radar for years. Nowadays, Amazon breaks this division out as a separate operating segment so we can track what's going on.

For example, in the recently reported Q1 2015, AWS sales jumped 49% higher year over year. The segment offers a $6 billion annual revenue run rate at the moment, and is growing fast.

The division might be small in the context of Amazon's $91 billion total sales run rate, but Web Services is tremendously profitable. In the third quarter, it provided more than one-third of Amazon's overall operating income.

Amazon wins AWS customers by offering a mighty flexible and low-cost computing environment. The company manages all the hardware you need, leaving your company to focus on the business-critical software that is running on these cloud servers. This approach, often known as platform-as-a-service or PaaS, is a new paradigm for information-technology management. Amazon remains a leader in this exploding market, surrounded by a host of big-name challengers.

If you're investing in Amazon to get hold of AWS' growth, you'll appreciate the financial stability that comes from the retail side. But I wouldn't be surprised if the Web Services division's profitability eclipsed that of Amazon's retailing operations sometime in the next three or four years. The retail segment's revenue will still dwarf its tech-minded sibling for decades, and perhaps forever.

Final words

I picked all three of these high-quality information technology stocks right out of my own real-money portfolio. Each of these companies is the best at what they do, with many years of predictable growth ahead.

Importantly, all three are poised to profit from the Internet of Things megatrend, which will take the IT market to a brand new place over the next five years or so. With trillions of dollars to be made, IBM, Red Hat, and Amazon stand ready to collect several billion each.

You don't want to miss that boom, which is happening as we speak.