Stocks are up on Wednesday morning, with the Dow Jones Industrial Average (^DJI 0.68%) and the broader S&P 500 (^GSPC 1.21%) gaining 1.4% and 1.2%, respectively, as of 11:45 a.m. EDT. With the S&P 500 fluctuating in a very tight range this year, the index is within 2% of its record high, set on May 21. Broad market valuations look expensive, but are there pockets of value left in this market? Yes, says outspoken banking analyst Dick Bove, in the [drum roll] banking sector. Analysts say all sorts of things for any number of reasons, but I think there is a reasonable investment case for the (un)holy triumvirate of Bank of America (BAC 1.48%), JPMorgan Chase (JPM 1.23%), and Citigroup (C 2.58%).

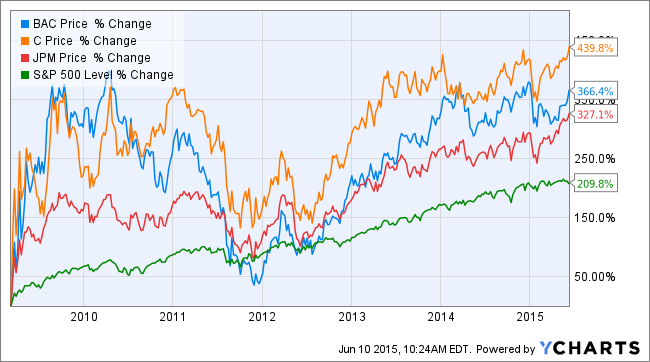

They don't call it a financial crisis for no reason. Banks were at the heart of the global financial crisis of 2007-2009, and pre-dilution shareholders paid an atrocious price for their misdeeds. However, bank stocks have rebounded sharply in the years since; starting from the market low on March 9, 2009, shares of Bank of America, Citigroup, and JPMorgan Chase have smashed the market (albeit with higher, stomach-churning volatility, too):

Following that thundering rally, can these three institutions continue to outperform over the next three to five years? The answer is yes, for multiple reasons.

Valuation

These megabanks look cheap. Here's how Bove framed the argument on CNBC yesterday:

Take a look at JPMorgan right now. The company's net cash per share is $148 and the stock price is under $70. If you take a look at its cash relative to its common equity, it has more cash than it does common equity, ... Citigroup's net cash is $70 a share and the stock is at $55. So there is tremendous amount of value that is not being recognized by the market.

Two catalysts: Interest rate and dividend hikes

A long-anticipated turn in the interest rate cycle could be a boon to bank loan profitability as the yield curve steepens, providing the opportunity to earn better loan margins. Bove isn't on board with the notion that interest rate increases will boost bank stock prices, however: "We looked at the interest rates going back to 1988 versus bank stock prices and what we found was there was zero correlation."

I'm not convinced. Note, for example, that the KBW Bank Index (DJINDICES: ^BKX) rose 1.8% last Friday, outperforming the S&P 500 by nearly 2 percentage points, which coincided with the release of a better than expected May employment report. The report raised the probability of the Federal Reserve implementing a first increase in its policy federal funds rate this year.

With regard to dividend increases: Not all of the "majors" have normalized their payouts. Traditionally, bank shares sport an above-market dividend yield, but of BofA, Citi, and JPMorgan, only the latter boasts a respectable 2.4% yield (Citi yields a nominal 0.1%). Once BofA and Citi become legitimate dividend stocks again, this could spur the market to rerate the shares.

Look forward, not backward

When it comes to analyzing the prospects for the shares of Bank of America, Citigroup, and JPMorgan, avoid looking in the rearview mirror. Even after a long period of blistering performance, the shares can continue to outperform -- though not by the same margin, assuredly -- based on improving fundamentals and valuations.