BHP Billiton Limited (ADR) (NYSE: BHP) is shedding some lesser operations to become a smaller, more-focused mining company. But it has pledged to keep raising its dividend just the same. In fact, it's kept raising its dividend while competitors like Rio Tino plc (ADR) and Vale SA (ADR) have cut back their dividends to save cash during a deep commodity downturn.

How has BHP managing to buck this trend? And how can it keep doing it?

Pain at the mine

The big problem across the mining industry is broadly falling commodity prices. BHP, for example, focuses on:

- iron ore, 32% of revenues and 53% of underlying earnings before interest and taxes in fiscal 2014

- copper, 21% and 22%, respectively

- coal, 14% and 0.2%, respectively

- oil, 22% and 23%, respectively

- smaller operations that are set to be broken off as South32 account for the remainder

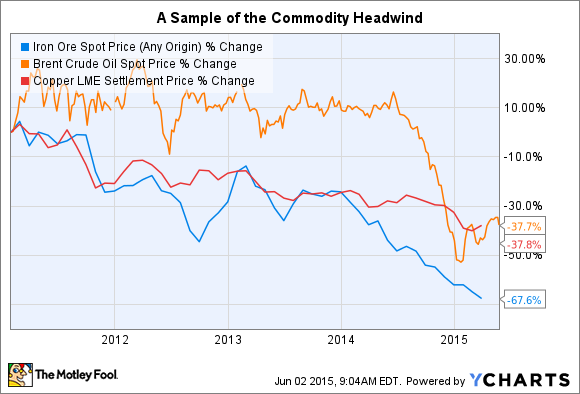

All of these commodities have seen prices drop since 2011, with the biggest impact coming in the iron ore business.

Iron Ore Spot Price (Any Origin) data by YCharts.

It's no surprise, then, that BHP's revenue peaked in fiscal 2011 at a touch more than $71.7 billion, or that the top line has fallen each year since, hitting $67.2 billion in fiscal 2014, which ended in June of that year.

Revenues fell another 12% or so in the first six months of fiscal 2015 compared to the year-ago period. That follows along with the continuing downward trend for most commodity prices, and the sudden drop in oil prices in that span.

Earnings have declined, too. Underlying earnings were $3.94 a share in 2011, and $2.53 a share last year. Through the first six months of fiscal 2015, underlying earnings were around $1.00 a share -- a run rate of about $2.00 for the year, roughly in line with analyst estimates. (GAAP earnings were around $0.80 a share.)

Things are still going the wrong way for BHP, but there's a silver lining: BHP is turning a profit. Many competitors are not.

That's one reason why BHP has been able to increase its dividend each year when competitors have been trimming theirs to save money. But it's not the end of the story.

Follow the cash

Like its competitors, BHP has been pulling back on capital spending to conserve cash. Case in point: The cash used in investing activities fell by more than 50% between fiscal 2012 and fiscal 2014.

That's a trend that's kept going, with cash used in investing activities falling roughly 25% year over year in the first half of fiscal year 2015. Although BHP is still investing in its best ideas, it simply isn't spending as much as it was, which helps to keep cash available for dividends.

Keep a closer eye on things

Also helping was debt, which actually allowed the company to increase its cash balance during the last couple of fiscal years. However, through the first six months of fiscal 2015, the company repaid debt, reducing its cash hoard by around 30%. At the end of the day, the mixture of profitability, stricter management of investing activities, and deft cash management has allowed BHP to keep increasing its dividend while others have gone in the opposite direction.

The unfortunate thing is that BHP is likely to have a harder time raising the distribution in the future if commodity prices don't rebound. For example, it paid out nearly 80% of its GAAP earnings as dividends in the first six months of fiscal 2015. That compares to about 40% in the first half of fiscal 2014.

While the ongoing spinoff of its smaller assets will shift some things around, BHP's margin for error, and room to keep increasing the dividend, is narrowing. In order to live up to its pledge to keep increasing the dividend through the downturn, BHP may have to start making greater use of debt.

This, in and of itself, isn't a bad thing. However, it does mean you'll want to keep a close eye on leverage. If it uses too much, BHP could put itself in a bind that results in a dividend cut.

That said, at the end of December, debt made up around a quarter of the miner's capital structure, so it looks like it has plenty of breathing room for now. Just double check what the balance sheet looks like after it's completed the South32 spinoff, and keep a close eye on its cash and debt until commodity prices turn higher again.