Musk standing in front of a Tesla Model S. Source: Maurizio Pesce via Wikimedia Commons.

What is Elon Musk's net worth? And where did it come from?

Elon Musk has an estimated net worth of $13.2 billion, making him the 87th richest person in the world, according to Forbes' real-time ranking on June 15. Microsoft founder Bill Gates currently reigns as the wealthiest person on this planet, with a net worth of $79.1 billion.

Forbes doesn't break down the sources of Musk's net worth, but we're going to pop the hood and look at the components of the serial entrepreneur's wealth by digging into his filings with the Security and Exchange Commission. The bulk of the 43-year-old's net worth consists of the stock he owns in three companies he founded or co-founded: Tesla Motors (TSLA -3.78%), SpaceX, and SolarCity (SCTY.DL).

Musk's net worth is accelerating as fast as a Tesla Model S

Musk's net worth has been on turbocharge thanks largely to the soaring stock price of the electric-vehicle maker he co-founded and steers as CEO and chief product architect. His net worth clocked in at $11.9 billion this February, up from $8.4 billion in February 2014, and $2.7 billion in February 2013, according to Forbes.

Data by YCharts.

Tesla's stock has soared more than 1,400% from its IPO price of $17 per share in June 2010 to its current (as of June 15) price of $250. That's taken Musk's net worth on a joyride, as the South African native owns a 26.7% stake of the $31.7-billion market-cap company, according to SEC filings. Thus, Tesla accounts for about $8.5 billion of Musk's net worth.

Musk's wealth skyrocketing with SpaceX

CRS-6 cargo resupply mission to International Space Station for NASA in April 2015. SpaceX's Falcon 9 rocket launched the Dragon spacecraft. Source: SpaceX.

Musk's soaring net worth has also defied gravity in recent years because of the rising value of privately held spacecraft maker SpaceX, which he founded in 2002 and leads as CEO. SpaceX announced in January that it had raised $1 billion from new investors Google and Fidelity, which the company said collectively now "own just under 10% of the company." Some sources have reported that the exact stake is 8.333%. These numbers value SpaceX at just over $10 billion-$12 billion.

Since SpaceX is a private company, we don't know exactly how many shares of its stock Musk owns. However, some have speculated that he probably controls a portion in the same general ballpark as he does of SolarCity and Tesla, or about 20% to 30%. That seems a solid assumption. If accurate, then the spacecraft maker adds approximately $2 billion-$3.6 billion to Musk's net worth.

Notably, SpaceX has a $1.6 billion contract with NASA to resupply the International Space Station. Even more notably, SpaceX is reportedly profitable. That makes it the only one of Musk's three companies that has a positive bottom line on a GAAP basis. If SpaceX ever goes public, interest should be phenomenal, and should boost Musk's net worth significantly as well.

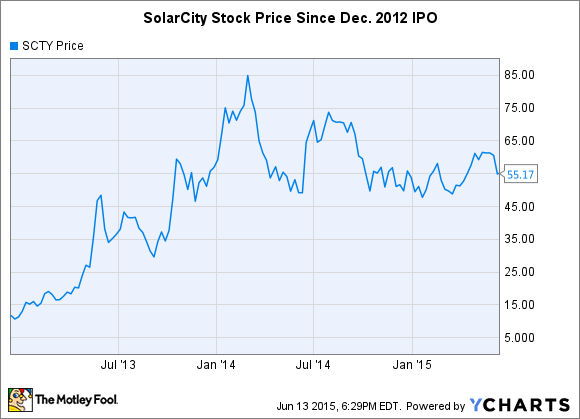

Musk's fortune, along with SolarCity, has enjoyed sunny days

The last component of Musk's current hat trick of winning businesses is solar-panel maker and installer SolarCity, run by his cousins Lyndon and Peter Rive. While Musk isn't usually considered an official founder, he reportedly suggested the business idea to his kin and serves as the company's chairman.

Data by YCharts.

SolarCity's stock rose nearly 600% from its IPO price of $8 per share in December 2012 to its current (as of June 15) price of $55. Musk owns 20,681,485 shares of the company's stock, according to his most recent SEC filing -- a 21.4% stake. The solar-power company sports a $5.4 billion market cap, so it adds almost $1.6 billion to Musk's net worth.

What can investors learn from this?

In investing it usually pays to bet on the jockey -- and Musk has a been a winning jockey to date. Musk's explosion of wealth in recent years also demonstrates the amazing power of compounding over time. Investors can't expect most of their holdings to skyrocket like Tesla and SolarCity -- two Motley Fool recommendations -- but the same phenomenon holds true for, say, annual stock-price gains of 5%. Over many years, relatively small annual gains will compound to very large sums.