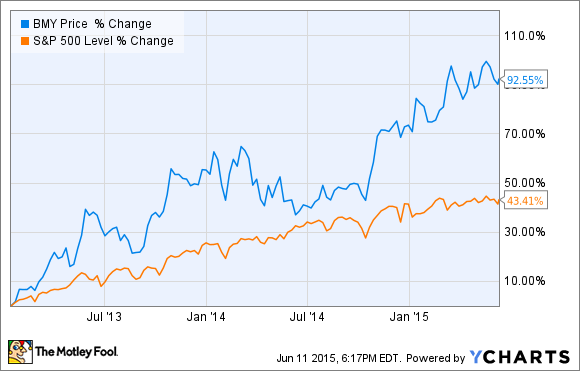

Since the start of 2013, Bristol-Myers Squibb's (BMY -0.27%) stock has been crushing the broader markets:

Despite its soaring share price, though, Bristol's underlying business has actually been going through a tumultuous period during this time span. The patent cliff has wreaked havoc on the pharma's revenue stream, precipitating a major downsizing of its global operations and a pivot toward immuno-oncology as the main focus of the company's clinical efforts.

Through this reorganization, Bristol has been able to steady its bottom-line, even while its revenues have plummeted:

Most importantly, the pharma giant has been successful at leading the charge in the emerging field of immuno-oncology with two regulatory approvals for its PD-1 inhibitor Opdivo. Specifically, the drug is now approved as later-line treatments for both advanced melanoma and metastatic squamous nonsmall cell lung cancer. And with additional clinical trials under way testing Opdivo across more than 20 tumor types, the Street is optimistic that this single drug could generate over $5 billion in sales by 2020.

The market's enthusiasm for Bristol's turnaround story may nevertheless be overdone at this point. Here's why.

Bristol's foray into immuno-oncology may not be as profitable as expected

Although it's still early days for Opdivo's commercial launch, the first-quarter's numbers revealed that Merck's (MRK 0.10%) competing PD-1 inhibitor, Keytruda, is dramatically outselling Opdivo. Specifically, Keytruda sales came in at $83 million, while Opdivo raked in less than half of that figure at $40 million.

Source: Bristol

With the two drugs mirroring each other in terms of approvals through the oncology landscape, Bristol needs to figure out a way to clearly differentiate its product in the minds of clinicians. Otherwise, Merck could end up eating Bristol's lunch.

Another area of concern is that immuno-oncology in general may fail to live up to its hype because cancer drug prices are now coming under fire from major payers like Express Scripts. As Opdivo's annual price tag hovers around $150,000, payers are almost certainly going to challenge this premium pricing structure at some point, especially as the drug's label garners more indications.

Finally, the Street could very well be grossly mistaken about the commercial potential of immuno-therapies as a whole. The emerging clinical profile of this first wave of immuno-oncology drugs is that they work great in about a quarter of patients with high levels of PD-L1 expression, but not so much in the remaining three-fourths.

To overcome this hurdle, Bristol, along with all the other major players in immuno-oncology, are exploring combination therapies that will hopefully be able to treat a wider swath of patients, or so-called "all-comers." But if history is any guide, most tumors will end up proving resistant to even these novel combo therapies. While that is a pessimistic outlook for sure, it is also realistic in light of the fact that over 90% of experimental cancer therapies fail in clinical trials. All told, immunotherapies may not be able to displace the current standards of care in many forms of cancer as currently predicted.

Key takeaways

With a 12-month, trailing P/E ratio of 48 and a forward ratio of 28, Bristol's stock is certainly not cheap at these levels. I would contend that the market has more than baked in Opdivo's regulatory success, but hasn't truly factored in the risks to its commercial potential moving forward. As the calls for lower drug prices -- especially among pricey new cancer treatments -- grow louder, Bristol's share price could come under significant pressure due to its reliance on this novel therapeutic platform for top-line growth.

There also isn't another major catalyst on the immediate horizon to propel the pharma's shares higher. In fact, the loss of exclusivity for another major revenue source, Abilify, should result in a 27%-plus drop in diluted earnings per share in the second-quarter, compared to a year ago. And this trend of declining overall revenues is expected to continue for the remainder of the year, and perhaps longer. That's why Bristol is ripe for a trend reversal, making now a good time to move to the sidelines with this big pharma.