The latest saga at Twitter (TWTR) over the company's direction and investors' disappointment in its growth highlights the conundrum companies and investors face in the tech space. Given the culture of innovation and the funding from venture capital in Silicon Valley, start-ups have an incentive to find a way to develop cool apps, attract users, and grow quickly. But they don't necessarily have an incentive to make money.

Just look at Facebook's (META -4.13%) acquisition of WhatsApp for $19 billion in 2014. The company had no revenue, yet it was (apparently) worth more than Under Armour. Twitter, like WhatsApp, wasn't built with revenue in mind -- it was built to be a communication tool. So, we shouldn't be surprised when it struggles to make a communication platform into a profit machine. Companies are either built on a concept that will make money, or they're not.

Not every tech company is Google

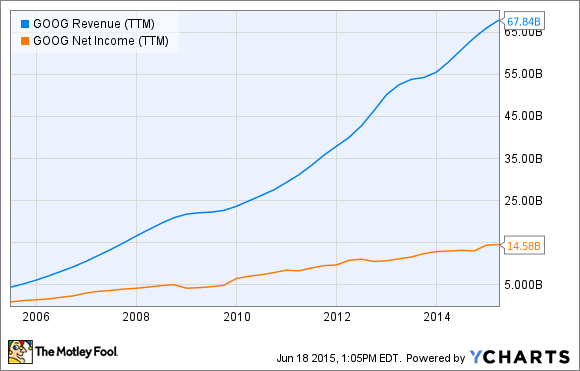

The biggest example of an Internet company turning into a cash generating machine is Google (GOOG -1.10%) (GOOGL -1.23%). You can see below that the company has been incredibly successful in growing revenue and net income over the past decade, which is why its stock is now trading for $538 per share, well above its split-adjusted $42.50 IPO price.

GOOG Revenue (TTM), data by YCharts

But not every Internet company is Google. It just so happens that Google's business -- search -- matches perfectly with making money. When I search for something it means I want to find out more about it or buy something. Google provides those results and also matches me with advertisers willing to pay a pretty penny for what is likely a very motivated buyer. Multiply this by billions of searches per day and you have a lot of potential revenue without forcing an unnatural revenue model on the business.

Even the ancillary services Google offers, like Android, Mail, Maps, and Drive, feed into learning more about what you're looking for and matching you with the highest value advertisement. In that respect, Google is naturally a money making machine. But if you try to force revenue generation on a business that's not built for it you can turn off your more important users.

Some businesses just aren't built to make money

Have you ever seen an ad on Facebook, Twitter, Instagram, or any other app and thought "that's useful"?

Probably not: at least not in the way that Google ads are useful, because you don't go on Facebook, Twitter, Instagram, Snapchat, or any other social media app to find things you'd like to buy. You go on those social networks to see what people are doing or what they're talking about.

The same goes for older Internet companies that provide content, like Yahoo (NASDAQ: YHOO) and AOL (NYSE: AOL) (which was just acquired by Verizon). People don't visit their sites seeking specific things that would feed into advertising, they go to read articles or communicate with others. So, it's difficult to turn the dissemination of content into revenue naturally.

YHOO Revenue (TTM), data by YCharts

The point isn't that most Internet companies can't make money. Facebook has $13.5 billion in revenue over the past year, so it's doing fine. The point is that not every Internet company is built to make money. Just because you have users doesn't mean you'll be profitable and Twitter's investors are having a hard time adjusting to that reality.

Investors need to keep long-term potential in mind

When looking at Internet stocks, I think investors need to ask whether or not each company's business model is built to make money. I don't think Twitter's model is built to make money at all and that's something its management is fighting against, given Wall Street's expectations for growth and the company's $24 billion market cap.

Not every company is a natural revenue generator like Google, which is why it's such a rare company. It's also a reminder that how a company transitions from growth start-up to profit machine is important. To keep these lofty valuations, companies will have to make money. After all, that's the point of businesses, even in Silicon Valley.