Carl Icahn is an activist investor extraordinaire with a net worth of $22.1 billion, according to Forbes' 2015 billionaires list. The 79-year-old thus comes in at No. 31 among the world's richest people, making him the 20th richest American and the 5th richest hedge-fund manager. He is presently the majority shareholder and Chairman of the Board of the publicly-traded diversified holding company, Icahn Enterprises, L.P. (IEP), that bears his name.

Starting in 1978, Icahn began to truly build his immense wealth by buying up large chunks of companies with the goal of breaking them up and/or selling off key assets. The overarching theme throughout his career has been to maximize shareholder value over exceedingly short time periods -- usually a few months. To do so, he pushes to gain multiple seats on the boards of directors of companies he buys into, giving him a voice in day-to-day operations.

Source: Wikimedia Commons.

His penchant for breaking companies apart or selling them off to larger peers, though, hasn't always been to the benefit of everyday retail investors. In the healthcare arena, for instance, his activist approach has probably short-circuited investors' abilities to maximize their returns over the long haul, at least in some cases.

Icahn's focus on short-term profits isn't always in shareholders' best interests

Icahn's short-term investing horizon has drawn the ire of biotech investors and insiders alike over the years, with many claiming that his often combative efforts to sell smaller companies to big pharmas stifles innovation and significantly curtails shareholder value. A look at his track record suggests that there is something to these claims.

From 2007 to 2011, Icahn purchased over 8 million shares of Biogen (BIIB 0.24%), giving him a controlling stake in the biotech. He subsequently attempted to force the drugmaker to sell itself, on several occasions, to a larger pharmaceutical company. After failing to convince management that this was the best course of action and even accusing management of lying about its efforts to pursue a sale, the billionaire began aggressively dumping his stake in Biogen in 2011.

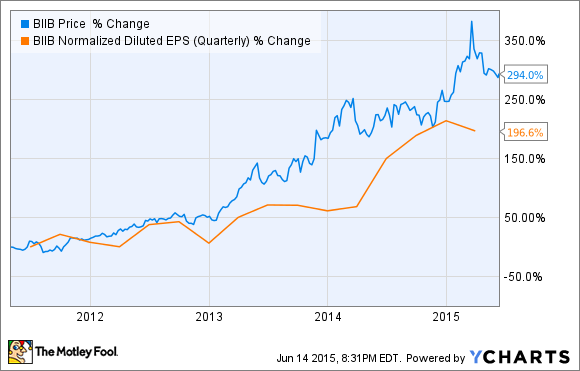

Since then, Biogen has been tremendously successful at building out its commercial product portfolio of biological-based drugs in the areas of neurology, hematology, and immunology, causing its share price to nearly triple and earnings per share to double:

If Biogen had been acquired between 2007 and 2011 for its multiple sclerosis drug Tecfidera, which was an experimental entity at that point, shareholders probably wouldn't have gotten anywhere near a 300% premium for their shares. And there's no guarantee that a larger pharma would have followed up on Biogen's other clinical assets.

In another cautionary tale, Icahn forced the vaccine maker and biologics company MedImmune to sell itself to AstraZeneca (AZN -0.61%) for $15 billion back in 2007, netting his hedge fund $300 million in profits in only a few months. MedImmune has since developed the anti-PD-L1 immune checkpoint inhibitor, MEDI4736, that's exhibiting potent anti-tumor properties across a host of cancers. This single drug is estimated to see peak sales of between $6 billion and $8 billion, and it was a focal point in Pfizer's attempted takeover of AstraZeneca in 2014. Put simply, Icahn's activist approach toward generating profits for his fund probably significantly short-changed MedImmune's investors with a longer-term outlook.

Key takeaways

Because of his enormous wealth and influence on the Street, Icahn is one of the most closely watched figures in the investing world today. That said, his aggressive approach to investing is far from perfect. Over the last few years, his holding company has outperformed broader indices such as the S&P 500, but it's gotten crushed by industry-specific funds like the iShares Nasdaq Biotechnology ETF (IBB -0.15%):

All told, Icahn's track record in biotech provides a compelling counterexample as to why it's important to take the long view when it comes to investing, instead of chasing short-term profits.