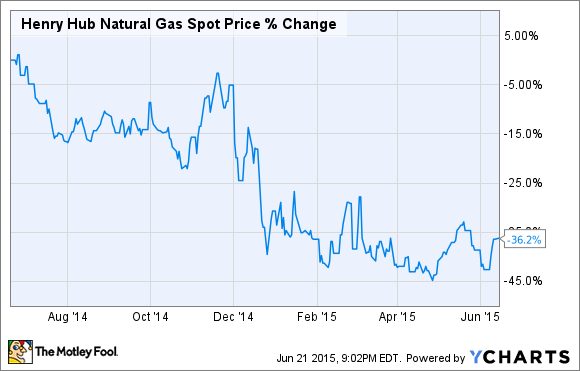

Over the past year natural gas prices have plunged almost as much as oil.

Henry Hub Natural Gas Spot Price data by YCharts

While this has certainly hurt gas producers, other companies potentially stand to benefit from an abundance of cheap gas, especially those involved with LNG exports. That's because natural gas can't easily be traded around the world except in liquid form, and gas prices in Europe and Asia remain 150% to 320% higher than those in the US, creating enormous import demand for America's cheap gas.

European Union Natural Gas Import Price data by YCharts

This creates potential investment opportunities for investors in Cheniere Energy (LNG 2.31%), natural gas transport giant Kinder Morgan Inc (KMI 2.53%), and LNG tanker companies such as Gaslog (NYSE: GLOG). Learn why these three stocks in particular might be among the best way to cash in on cheap gas prices, and secure market beating returns in the years to come.

Cheniere Energy: the LNG export pure play

Most US LNG export projects are still years away from completion but Cheniere Energy's Sabine Pass export facility -- which will eventually have a capacity of 27 million tons per annum (mtpa) -- is scheduled to commence operations by the end of 2015.

Cheniere already has 81% of Sabine Pass's eventual capacity locked up under 20 year fixed fee contracts that are expected to bring in $2.9 billion in annual revenue, with plans for selling the remaining capacity on the spot market via its marketing arm.

In fact, by the time Sabine Pass's 6 export trains are fully online Cheniere estimates that it will bring in a total of $4.4 billion in revenue at the partnership level.

Source: Cheniere Energy Parters investor presentation.

Better yet, the company just announced major expansion plans at a second facility in Corpus Christi, Texas, that along with potential investments in two new Louisiana facilities owned by Parallax Enterprises could bring the company's total LNG production capacity up to 60 MTPA by 2025.

Source: Cheniere Investor presentation.

Once this new capacity is completed Cheniere Energy Inc will have the option of either retaining ownership -- as it does with its Corpus Christi facility -- or dropping it down to Cheniere Energy Partners in exchange for cash, debt assumption and possible additional limited units. Either way, as general partner, incentive distribution rights owner, and holder of 49% of the MLP's limited units, Cheniere Energy Inc investors are sure to profit handsomely from the enormous stream of stable and predictable cash flow represented by Cheniere's growing LNG trading empire.

Kinder Morgan: the diversified, high-yield dividend growth option

Kinder Morgan is the largest transporter of natural gas in America and seeking to become a dominant player in LNG exports as well, having applied for a permit for its $8 billion Gulf LNG Liquefaction Project in June of 2015. This would represent Kinder's second LNG export facility, joining its joint venture with Shell, which Kinder is planning to build on Elba Island off the coast of Savannah, Georgia.

Even for a midstream giant such as Kinder Morgan, Gulf LNG would be a real needle mover. For instance, if approved, the project would become one of the largest undertakings in the company's history and grow Kinder's already enormous project backlog by 44%.

However, potential Kinder investors will need to be patient to reap the benefits from Gulf LNG, as the project isn't expected to begin operating until the end of 2020 and won't be fully complete until the end of 2021.

LNG tankers: toll takers of LNG's future

Gaslog owns a fast growing fleet of LNG tankers designed to take advantage of the enormous amount of LNG export capacity that is currently under construction around the world.

Source: Gaslog investor presentation.

In fact by the end of 2017 management has plans to double the company's LNG tanker fleet to 40 vessels, both through acquisitions, and new tanker construction.

Gaslog Partners, the company's MLP, is a great way of financing this aggressive growth plan because management can sell, or "drop down" tankers to the MLP in exchange for cash, additional limited units, and debt assumption -- which can finance further fleet expansion. Since Gaslog owns 43% of Gaslog Partners as well as 100% of the IDRs it will still be able to retain a large proportion of the long-term contracted future cash flow of these tankers.

Meanwhile any drop downs will likely help fuel strong distribution growth for investors in Gaslog Partners, an added bonus for an already generous payout.

Takeaway: cheap gas could mean a bigger future for LNG exports

While natural gas prices can be highly volatile, America's shale gas boom is likely to continue for several decades and potentially usher in a long-term era of cheap US natural gas prices. This could accelerate future US LNG exports and makes the three companies mentioned here worthy of consideration for your diversified, long-term portfolio.