What: After rallying big-time earlier this year, shares of natural gas refueling leader Clean Energy Fuels Corp (CLNE -0.87%) fell more than 25% in June. Since May 1, the company's stock has fallen almost 50%:

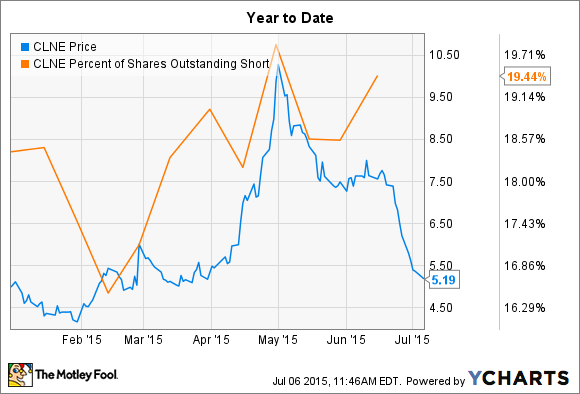

So what: Clean Energy has reported two relatively positive quarters so far this year, and it's looking like those positive earnings reports corresponded with a bit of a short squeeze:

In other words, there's a high likelihood that the price of the stock was bid up as short sellers exited their positions on the good news earlier in the year, and the lack of any material news has led to the stock price dropping closer to pre-earnings levels.

Now what: While the data in the charts above can help explain why Clean Energy's stock price fell, I would caution against thinking there's any predictive power in it. Yes: shares sold short are rising again, and there's the chance that another positive earnings report could lead to another short squeeze, but it's important to remember the big-picture risks and opportunities with Clean Energy. After all -- we're talking about a real company here, not just lines on a chart.

With that in mind, now could be a great time to buy shares of Clean Energy Fuels. Even with oil prices still down significantly -- this is a risk because it makes diesel and gas, which are the competing fuels against natural gas, cheaper -- the company has managed to grow its fuel sales volume more than 20% nearly every quarter for the past two years, and it's looking like its cash burn -- which remains a concern -- is stabilizing as the company's capital expansion decelerates.

There remains risk that adoption of natural gas could slow if oil prices stay down for a protracted period, but so far that hasn't happened. There's also some debt risk with almost $150 million in debt due in about a year, but management is adamant that it has a lot of flexibility to handle this without putting the business at risk. This could be partly paid through a share offering which would dilute shareholders, but it's looking like management is holding this as a last resort option.

At any rate, the business looks to be stable and growing, and long-term investors could make out big if they're patient, and willing to ride out the ups and downs.