Today, we're doing a dividend-stock smackdown. A grudge match. A fight to the finish. Two bank stocks enter, but only one will leave.

It's SunTrust Banks' (STI) 2.2% dividend yield versus Regions Financial's (RF 1.46%) 2.3%. Each bank has its own strengths and weaknesses, and the only way to find a winner is to pit them head to head. Enough talking: Let's get it on!

Round 1: Are either of these banks paying out too much of their earnings as dividends?

Dividend stocks work only if the dividend keeps coming, so it's important to understand how thinly a company is spreading itself to make these quarterly payments.

In this case, neither SunTrust nor Regions is paying out an excessive portion of its earnings as dividends. SunTrust has a dividend payout ratio of 26% on a trailing-12-month basis, and Regions has a 33% ratio. Both of those are perfectly acceptable.

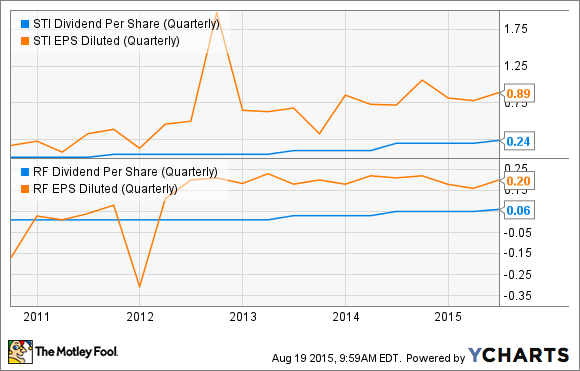

Another way to examine this question is by contrasting the bank's diluted earnings per share against the dividend per share. As the following chart shows, both banks have a healthy cushion of stability and margin between earnings and the dividend. Regions does take a half-ding for its troubles back in 2012, when the bank took a one-time, non-cash charge related to an acquisition and reorganization in its investment banking and brokerage division.

STI Dividend Per Share (Quarterly) data by YCharts

Round 1 score: Draw.

Round 2: Are there any issues with earnings or capital to worry about?

When a bank earns a profit, it must decide what to do with it. It can be reinvested into the company. It can be held to boost capital. It can buy back shares. Or it could be paid out as a dividend. Usually it's some combination of them all.

This allocation decision is particularly important for banks because of the regulatory capital requirements from both the Basel III accords and the Dodd-Frank legislation. If earnings or capital are weak, investors may not be able to count on the dividend much longer.

Neither SunTrust nor Regions is kicking the door down with earnings, but both are at least profitable. SunTrust reported return on equity of 8.3% in the second quarter. Regions' performance was a little worse, returning 6.8% on equity. Both banks are at or just below the 8.4% average ROE for regional banks of comparable size, based on a peer set of 60 other U.S. banks. Bank's across the board are struggling to achieve traditional return on equity numbers in the 10% to 15% range due to the current low interest rate environment. In that context, neither bank's performance stands out as excellent, but neither are their numbers so bad as to create an immediate concern.

On the capital side of the bank, SunTrust had an assets-to-shareholder equity ratio of 8.1 and a common-equity tier 1 ratio of 9.8% as of June 30. Regions' capital position was slightly stronger, with a leverage ratio of 7.2 and a common-equity tier 1 capital ratio of 11%.

Round 2: Draw.

Round 3: What about loan losses just around the corner that could ruin everything?

The biggest threat over the long term to both earnings and capital is loan losses. When loans start going sour, all bets are off.

The easiest way to gauge a bank's current potential for loan losses is by comparing its non-performing assets -- loans that are severely past due plus foreclosures -- to its total assets. Among comparable regional banks, the industry average is a ratio of 0.66%.

SunTrust reported its non-performing assets-to-total assets at 0.3%, handily beating Regions' slightly above average 0.7%.

After three grueling rounds, Regions' knees may have just buckled.

Going to the judges' scorecards

With three rounds in the books and no knockout, this battle will be settled by the judges' scoring.

Both banks are pretty cheaply valued: SunTrust at 1.5 times tangible book value, and Regions at 1.3. For context, the average price to tangible book value of the larger regional bank peer set is 1.85 times. Some banks with exceptional results presently trade as high as 2.8 to 3 times tangible book value.

These cheap valuations are not altogether surprisingly, given each banks' similar returns, leverage, and capital ratios. SunTrust does have slightly better returns, but Regions countered by edging out a better capital position.

Neither bank was perfect, but neither was terrible, either. It's a close call. At the end of the day, though, SunTrust walks away with the win because of its much better credit quality metrics. Long term, bank performance always comes back to credit quality, so that's enough to tip this judge's scale to SunTrust.