When the market is falling, many stocks look "cheap," but certain types of businesses are particularly great to load up on during a correction. One of my favorites is real estate investment trust Health Care REIT (WELL 0.32%). The company has a fantastic long-term business model, excellent risk management, and plentiful access to cheap financing to take advantage of future opportunities -- not to mention a rock-solid 5.1% dividend yield. Here's what you need to know about Health Care REIT and why it deserves a look when the market falls.

Health Care REIT's business

Health Care REIT owns 1441 properties focused on healthcare operations, most of which are oriented toward the needs of senior citizens. Sixty-two percent of the portfolio is made up of senior housing facilities, 21% long-term care (LTC) properties, and 15% outpatient facilities. Most of the company's properties (85%) are based in the United States, but it also has substantial operations in Canada and the U.K.

Why Health Care REIT's future is bright

There are a few reasons I have a positive view of Health Care REIT's future, and perhaps the most compelling is the favorable demographic trends.

I mentioned earlier that most of the company's properties are geared toward caring for senior citizens, and this portion of the population is expected to increase dramatically over the coming decades. Between now and 2035, the 75-and-older population is expected to increase five times faster than the overall growth rate.

Source: Health Care REIT company presentation.

And the 85-and-older segment is expected to grow even more rapidly. In fact, this segment of the population is expected to grow by more than 200% by the year 2050. To put this in perspective, consider that the 20-34 age group is expected to grow by just 10% during that time.

Source: Health Care REIT company presentation.

In other words, Health Care REIT's addressable market is going to expand rapidly no matter what the overall economy does.

Another reason is the company's reasonable use of debt, which should allow it to ride out any recession or crash that occurs. Since the end of 2013, Health Care REIT has significantly reduced its debt relative to the value of its portfolio, and as a result, its debt payments eat up less of its earnings.

|

Ratio |

2013 Year End |

Q2 2015 |

|---|---|---|

|

Net debt/enterprise value |

38.3% |

31.5% |

|

Net debt/ adjusted EBITDA |

6.1x |

5.5x |

|

Adjusted interest coverage |

3.4x |

4.2x |

|

Fixed charge coverage |

2.7x |

3.3x |

In other words, the company now earns $3.30 for every dollar in fixed charges it is responsible for. And, it is continuously trying to improve the debt situation. For example, the company recently discharged all $300 million of its 6.2% senior notes that were due in June 2016 -- choosing to take advantage of the current low-interest environment to finance debt instead. And both Moody's and S&P upgraded Health Care REIT's credit outlook from stable to positive during the second quarter, which could make it easier to obtain low-cost financing in the future.

Health Care REIT operates in a fragmented industry, meaning that no companies have a dominant position. In fact, Health Care REIT is the largest REIT with a focus on healthcare real estate and only commands a 2.4% market share. This implies that there will always be attractive acquisition opportunities to take advantage of, and this would be particularly true if the economy turns sour.

Finally, another reason Health Care REIT is a long-term winner is because it recognizes the value of quality partnerships and quality assets. A large portion of its properties are operated by some of the most well-respected healthcare operators in the industry, and 80% of its current investments are made alongside existing partners.

As far as quality assets go, the company firmly believes that above-average assets will produce above-average results. For example, Health Care REIT's average U.S. senior housing property is 12 years old and in an area where the median household income is $77,750. In contrast, the average property in its peers' portfolios is 18 years old and located in an area where the median income is $53,996. It appears the strategy is a successful one, as Health Care REIT generates $22,586 in annual net operating income per unit – 54% more than peers -- and grows its revenue at a faster pace.

Why buy it now?

Perhaps the most compelling reason to buy Health Care REIT in this market correction is because of its extremely attractive valuation.

The best measurement of a REIT's "earnings" is its funds from operations, or FFO. Health Care REIT is anticipating 2015's FFO to fall in the range of $4.25 and $4.35 for the year. Using the midpoint of that range, the stock is trading for just 15.1 times this year's FFO -- much cheaper than the S&P 500's average P/E multiple of 20. For a more direct comparison, consider that peer HCP, trades for 18.9 times its 2015 FFO projection, and popular retail REIT Realty Income trades for 16.8 times FFO.

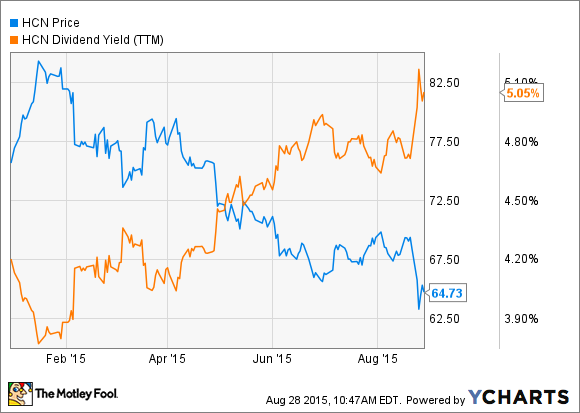

Since Health Care REIT's share price has dropped considerably this year -- down 23% from its January high -- its dividend yield has soared to 5.1%. This should make the stock rather attractive to income investors, as the company has paid dividends for 177 consecutive quarters (more than 44 years), and the dividend has grown at an average rate of 4% per year throughout that time period.

The bottom line

Not only is Health Care REIT well positioned to grow and profit no matter what the economy does, its stock is on sale. Of course, just like any other stock in the market, Health Care REIT has risks. For example, if interest rates rise rapidly, it will cost the company more to borrow -- cutting into its profit margins. Despite the few risks involved, HealthCare REIT looks like an attractive addition to the portfolio of income investors and growth investors alike, and could be an excellent way to protect your long-term financial health during volatile times.