Getting a pile of Schedule K-1 forms at tax time can be daunting. Here are three non-MLP dividend stocks. Source: IRS.

Master limited partnerships, or MLPs, can be great income investments. MLPs benefit from a specific structure that's very tax efficient, since they pay no income tax at all. This is very different from a more traditional corporation, which pays tax on its earnings, leaving it with less cash to use for things such as dividends and corporate investment. In other words, the MLP structure can leave significantly more cash available to return to shareholders.

But there are downsides for MLPs, particularly related to some added complexity when tax season rolls around and you start getting those Schedule K-1 forms. Because of the tax implications of MLPs compared to regular corporations, some investors -- especially those who are actively investing in a retirement account that may not allow ownership of MLPs -- are better off avoiding master limited partnerships completely. At least for now.

But that doesn't mean dividend-seeking investors are out of luck. Here are three companies that some of our top contributors offered up as great dividend-paying alternatives to MLPs.

Matt DiLallo

In my opinion, Kinder Morgan (KMI 2.53%) is flat out one of the best dividend stocks around. It has a very generous dividend that at the moment is yielding just over 6%. It's a dividend that's as solid as one will find in any sector, as it's primarily backed by fee-based cash flow. Furthermore, not only is the current payout rate safe, but Kinder Morgan is also planning to grow that payout by 10% per year through 2020. That's a recipe for a great energy dividend stock, if you ask me.

Obviously, the foundation of any great dividend stock is the stability of its payout. For Kinder Morgan, that foundation begins with its focus on owning assets that generate fee-based cash flows. In fact, as the following slide notes, 87% of its cash flow is fee-based.

Source: Kinder Morgan investor presentation.

What's key here is the solid foundation of Kinder Morgan's cash flow, as 65% of its cash flow is coming from highly secured take-or-pay contracts. In other words, its customers pay the company whether they use its assets (such as takeaway capacity on a pipeline or in a storage terminal) or not. Overall, 96% of the company's cash flow this year is either hedged or fee-based, leaving very little variability, as the company expects commodity prices to lead to a roughly $300 million swing in its cash flow this year on an $8.2 billion budgeted number. Even with that swing, the company is expecting to generate more than $300 million in excess cash flow, and that's after growing the dividend 15% over last year's rate.

The company expects its cash flow to grow over the next few years, even if commodity prices remain weak. That's based on the fact that it has a $22 billion project backlog that it plans to build over the next few years, 90% of which consists of fee-based pipeline or terminal assets. Furthermore, a growing portion of those projects is driven by demand for lower-price energy and not predicated on supply growth.

The bottom line here is that Kinder Morgan's dividend is not only generous, but it's also secure and expected to grow 10% per year through 2020.

Tyler Crowe

The real stalwarts of the energy industry aren't known for putting up gaudy growth numbers on a regular basis. What they all do very well, though, is pay dividends. If you're looking for a company that's going to pay a growing dividend for years to come, you'll be hard pressed to find one with a better track record than ExxonMobil (XOM -0.09%).

For 75 years in a row, ExxonMobil has raised its dividend (split adjusted, of course). Thanks to its vertically integrated model in the oil and gas business, its profitability doesn't suffer through commodity price swings like a company that's a pure play in one segment of the value chain. It also helps that ExxonMobil has enormous benefits from economy of scale and a credit rating better than the United States Treasury. Combined, these elements allow the company to take on big projects that have the potential to generate high rates of return and can throw more cash back to dividend payments and share repurchases.

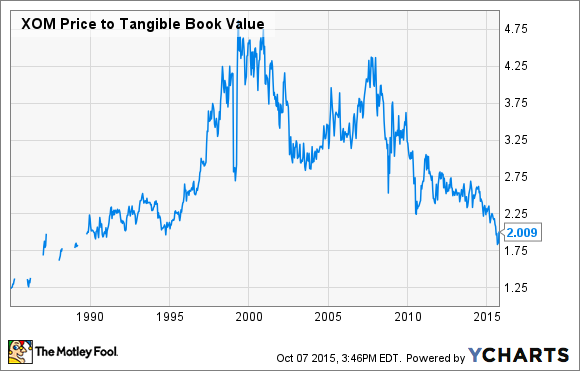

It doesn't always make sense for investors to buy a company like ExxonMobil. Since it doesn't grow earnings at a high clip, investors need to be very patient to find a time when shares of ExxonMobil are cheap. Thanks to the decline in oil prices, it looks like today is one of those times. Today, Exxon's stock trades at a price-to-tangible book value ratio -- a better gauge of value for a cyclical business than earnings -- that's at its lowest in 20 years.

XOM Price to Tangible Book Value data by YCharts.

Today, buying shares of ExxonMobil gets you a rock-solid company that will pay you a decent dividend yield of 3.7%, which will very likely grow year in and year out. That's a pretty tempting offer for almost any investor.

Jason Hall

Phillips 66 (PSX -2.51%) is an interesting company in that many of its businesses are ideal for MLPs. This is why the company formed Phillips 66 Partners, and why its joint venture with Spectra Energy, DCP Midstream, formed DCP Midstream Partners. Since these assets are held inside MLPs, Phillips 66 is able to benefit from the tax-advantaged structure while still operating a more diversified operating business that also contains many assets that aren't ideal MLP assets -- such as its fast-growing chemical manufacturing business and its super-profitable refined products marketing business. In short, the company uses a mix of MLPs and operating units to best leverage its assets, and to generate significant cash flows. And management has chosen to return huge amounts of that cash back to long-term shareholders:

PSX Shares Outstanding data by YCharts.

Even with a near-tripling of the quarterly dividend since the company was spun out of ConocoPhillips in 2012, the 14% reduction in shares outstanding has reduced the total impact of the dividend increases significantly. For long-term investors, this means that continued dividend increases should be more affordable for the company. All things considered, Phillips 66 should continue to be a great dividend growth stock that gets a lot of benefit from the MLPs it partly owns and runs, but without the tax complication for investors that comes with owning MLP shares directly.