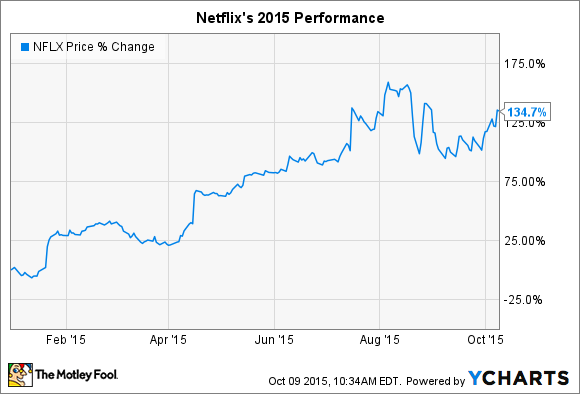

Mark your calendars: Netflix (NFLX -3.92%) posts its third quarter earnings results on the afternoon of Wednesday, Oct. 14. The streaming video giant is now the market's single best-performing stock of the year, and the seventh most heavily traded issue in the S&P 500.

Those two facts practically guarantee that we'll see a volatile stock price around the report this week.

And that's because Netflix is negotiating two risky shifts that are transforming its business. First, it's changing the streaming catalog from a wide offering of licensed content into a focused portfolio of exclusive TV shows and movies. Second, the company is aggressively adding markets in order to cover the globe by the end of next year. Thanks to these strategic advances, the only thing we know for sure is that the business will look very different in a few years.

Here are some key questions for CEO Reed Hastings ahead of the critical earnings release this week.

How fast can you grow the member base?

Three months ago, Netflix executives said they believed they would add 3.6 million new subscribers this quarter to reach a global base of 69 million members. That works out to 18% faster growth than in the year-ago period -- a strong result but still down from last quarter's 95% leap.

Management has pointed to the importance of an increasing pace of growth for Netflix's member base. "Running equal to, or slightly above, prior year net additions is a great outcome, because it implies that we're still in the middle section of the S curve of consumer adoption, with years of member growth ahead of us," they explained.

Source: Netflix

We'll get a partial answer to this question with Netflix's subscriber forecast for the coming quarter. The bar is set pretty low in that anything above 6% growth, or more than 4.3 million projected new members, would constitute accelerating growth.

What's the service really worth?

Last week, the company increased the price of its standard plan by $1, so new users now have to fork over $9 per month. But is that level still significantly underpricing the streaming service?

After all, Netflix is planning to spend $6 billion on content next year. That includes hundreds of hours of original series, along with exclusive access to blockbuster movies from Disney studios like Pixar, Disney Animation, and Marvel.

It's inevitable that subscription prices will have to rise to reflect the increasing value of the service -- and the fact that the average streamer spends more than two hours per day watching Netflix content.

Last quarter, Hastings called the then $8 monthly price "incredibly affordable", and that still holds true at today's slightly higher fee.

Is another large debt offering in the cards?

Partly thanks to that low-priced service, Netflix doesn't generate nearly enough profit to fund its international expansion while at the same time pouring money into producing original content. In fact, operating cash flow stayed negative last quarter despite record membership growth.

NFLX Free Cash Flow (Quarterly) data by YCharts

Chief Financial Officer David Wells warned investors that things will get worse on cash before they get better. "You should expect that [loss] to continue as we invest heavily in our original content," he said in a conference call.

Management has a habit of dipping into the credit markets in the first quarter of the year: Netflix took out loans of $500 million and $400 million in early 2013 and 2014, before borrowing $1.5 billion this year. That increasing burden is raising the risk profile of the business. And next year might require another large debt offering, depending on how aggressive executives choose to be with bulking up Netflix's original content portfolio.