Over the past 18 months, Retail Opportunity Investment Corp. (ROIC 1.05%), which focuses on West Coast grocery and pharmacy anchored properties, has invested a huge amount of capital in growth. With third-quarter earnings set for release on Oct. 28, there are a few key things investors should pay close attention to.

Let's look at three that are at the top of the list.

1. Consistency in its property focus

While this is highly unlikely to change -- after all, CEO Stuart Tanz mentions it pretty much every chance he gets -- ROIC management should continue to focus on what it's proved itself to be good at: acquiring and managing retail properties that feature a few key things:

- High-traffic, highly desirable locations.

- Preferably distressed locations, or in some way available below market value.

- Sites that feature a grocery or pharmacy anchor tenant.

- West Coast location.

It may seem like a pigeonholed list, but the key for most successful companies is focus, and that's been the case for ROIC under Tanz. The CEO and his team have decades of experience operating on the West Coast, and their connections with literally hundreds of property owners puts the company in an enviable position when a property comes up for sale.

Expect to read about more of these kinds of properties, versus more residential- or business-oriented properties that management doesn't think will perform as well through all economic cycles.

2. How management uses capital

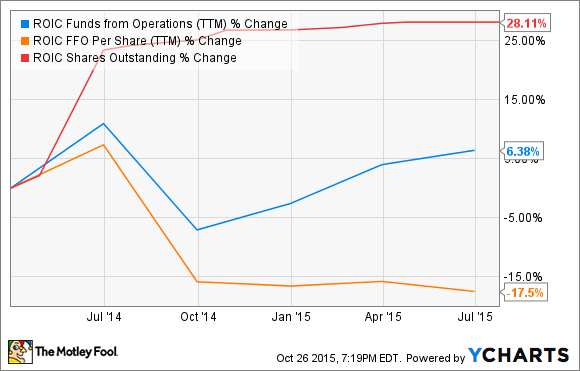

Last year, ROIC issued a huge number of shares -- increasing the count by nearly 30% -- to raise cash to fund acquisitions. While growth is important, per-share growth is key. Here's a look at some key metrics since the beginning of 2014:

ROIC Funds from Operations (TTM) data by YCharts

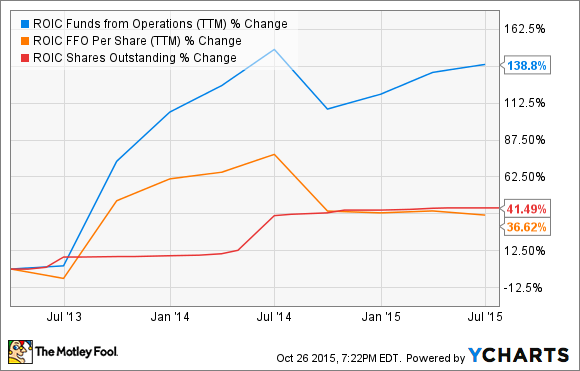

So far, funds from operations -- a core measure of profitability for REITs -- has only increased modestly, while FFO per share still lags behind the 12-month results through the end of 2014. But if we go back a little further, you'll see that FFO per share is well up from 2013 levels:

ROIC Funds from Operations (TTM) data by YCharts

The point? It takes time for new acquisitions to start affecting the bottom line fully. In many cases, the properties are in need of improvements to retain or attract tenants, and often the properties are charging rents substantially below market rates. Over time, ROIC will be able to increase rates to market, and this will lift profits.

But that's only part of the story with capital. ROIC has also taken on debt to fund growth. Through the second quarter, total long-term debt was $855 million, and the company closed on an additional $300 million in unsecured term debt at the end of September. And while the lion's share of that capital will be used for growth, the company also paid down $29 million in secured mortgage debt with the proceeds.

The bottom line is debt and the share count will trend up over time. Pay attention to how Tanz and his team are using the capital (Hint: Read point No. 1).

3. Growing payouts via per-share cash flow growth

As a real estate investment trust, ROIC is required to pay out at least 90% of taxable income to shareholders. For this reason, debt and share offerings are often primary growth funding mechanisms for this kind of corporate structure.

This makes it even more critical for management to execute well on capital allocation. ROIC's management has done an admirable job of doing that since the company went public, but at least some of its success is also due to the timing, as ROIC has been able to cherry-pick many great properties out of the ashes of the recession. Going forward, it may not be as easy to generate the same high returns as over the past six years or so.

With that in mind, investors need to keep a close eye on per-share FFO results over time, since this will provide some measure of how well management is able to use shares and debt to fund per-share returns growth. Again, as highlighted in point No. 2, it takes time for new properties to fully contribute, but new properties need to consistently add value at the bottom line over time.

This reality is highlighted by metrics such as portfolio leased rate, which measures the percentage of properties under a lease agreement, as well as same-center cash net operating income, which helps measure the health and income growth of assets held for at least one year.

There are more metrics to follow, but these two will help you keep an eye on how well the company does at keeping properties occupied, and at growing profits in its core assets.

Looking ahead

ROIC has been a great income growth stock since paying its first dividend in 2010:

ROIC Dividends Paid (TTM) data by YCharts

If you bought shares in 2011, when ROIC first began paying a dividend, you're getting about a 7% yield on your original investment. If you've recently bought, you're getting about 3.7%. For that dividend to continue growing, ROIC will need to keep growing its property portfolio, which means Tanz and team must continue to execute on their strategy, even if the environment gets a little more difficult.

Keep an eye on these things, and you'll get a better idea of how well they're doing.