Electrical equipment is a pretty vague description of a really important industry. We aren't talking about a radio: We're talking power plants, wind turbines, factory automation, and industrial lighting, among other things. These are the types of products that, quite literally, make our modern lives possible. And if you want to own some of the best companies in the space, you'll need to look at General Electric Company (GE -1.75%), ABB Ltd. (ADR) (ABBN.Y 6.26%), and Emerson Electric Co. (EMR -0.46%).

A big stumble

If you're like me, the first thing you think of when you hear GE is the steep price decline, dividend cut, and financial bailout from Uncle Sam. All of that took place because of an overweighting in finance when the financially led 2007-to-2009 recession hit. But GE's history is really in the industrial space, and it's been getting back to its roots since that not so minor "near-death" experience.

When it comes to industrial applications, GE is a real powerhouse (pardon the pun). Its product offerings run the gamut from jet engines to smart meters. However, a large portion of its business involves energy, such as making power converters, wind turbines, and nuclear power plants.

What makes GE so interesting right now, however, is that it's getting to the end of its efforts to trim the size of its finance arm. This shift, along with other streamlining moves such as selling the television network it owned, have helped the company become more focused and a cleaner play for anyone interested in an industrial company with a focus on electrical equipment.

And that core business is doing pretty well, with the third quarter of 2015 marking the ninth consecutive quarter or organic revenue growth. Operating margins, meanwhile, were up 1.2 percentage points year over year in the quarter. So it's efforts to refocus on its core seems to be baring fruit.

Moreover, it remains something of a turnaround situation, so there could be more upside as the housecleaning comes to an end. With a current yield of around 3.1%, it's worth a look for income investors, too. Note that the dividend has now been increased every year since 2010, which is solid evidence that management is really trying to win back the investor confidence it lost.

Foreign power

ABB isn't as diversified as GE, which operates on the consumer level as well as the industrial level. In fact, The vast majority of its customers are corporations and governments. Also, it's based overseas. But don't let that put you off. In fact, it could be a net benefit.

For example, GE is a global giant, but it gets around half of its revenues from just one country -- the United States. ABB is a global company, too, but it gets only about a third of its revenues from the Americas. For reference, the Americas includes the United States, Canada, Mexico, and all of South America. If you want global exposure, ABB is an option you should strongly consider.

ABB's global reach. Source ABB.

That said, just to highlight ABB's electrical equipment chops, it considers itself a power and automation company. Electrical equipment is at the core of both. About a third of its business comes from utilities, around 45% from industrial customers (think things like factory robots), and about 20% or so from the infrastructure space.

Like most industrial companies ABB's top- and bottom-lines will ebb and flow the global economy. They are ebbing right now. However, with roughly 45% of its top line coming from emerging markets it's focused on the areas of the world that are likely to drive global growth over the long haul.

Right now as news of a Chinese economic slow down is captivating investors that doesn't look like a great thing, but with countries like India just starting to build out their electric grids, ABB already has boots on the ground in high demand areas. I mention India because order growth in that giant nation advanced roughly 50% year over year in the third quarter. In China order growth was up 5%. That isn't to suggest that the company is bucking the industry's weakness, only that there's a reason, as an investor, to like the global opportunity ABB is reaching for.

The other "Electric" company

Emerson is the other big U.S. industrial company with "electric" in its name. Both it and GE have long and storied histories. Both companies are broadly diversified global giants. And both companies play a big role in electrical equipment. Emerson, for example, has its fingers in automation, process management, network power, climate control, and commercial and residential products. Or at least it will until its splits itself in two.

A decade or so ago, the company pushed hard into providing power for data centers. That hasn't turned out as well as hoped. And, now, the company is using a spinoff to reinvent itself. That's something that this company, at more than 125 years old, has done successfully before. This time around, Emerson will be left focused on its process and industrial business and its commercial and residential arm. Electrical equipment will be a big part of what it continues to do.

But why care or take the risk of a corporate makeover effort that's just getting under way? First, Emerson has successfully navigated change before. Second, although the company's revenues will drop by a third after the proposed spinoff, underlying sales growth at the remaining businesses has historically been around 50% faster than the overall company's growth. Earnings before interest and taxes would have been nearly 20% higher, too. In other words, Emerson looks like it's keeping the crown jewels. At the very least, this is one company to put on your watch list in the electrical equipment space.

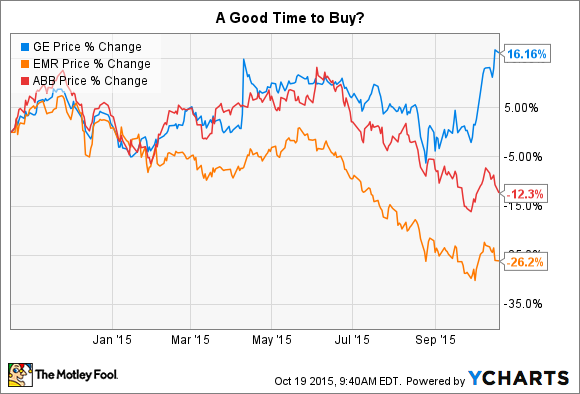

Tough time

It's been a tough year for this trio of electrical equipment powerhouses, with GE's shares only jumping more recently because of its continuing efforts to reduce its finance exposure. So now might actually be a really good time to take a look at this sector. And if you are, GE, ABB, and Emerson should all be on your short list.