However, the oil business isn't disappearing overnight, and many of the biggest and best companies have managed to weather the storm, and will continue to do so. Savvy and patient investors willing to, as the saying goes, "buy when there's blood on the streets," stand to gain market-crushing returns when oil prices do eventually recover.

The problem is picking the right companies to invest in. Instead of choosing a few companies and maybe making a wrong choice, you could be better off going with an oil ETF. Let's take a closer look at the top three oil ETFs on the market.

1. Energy Select Sector SPDR (ETF) (XLE -0.29%)

The Energy Select Sector SPDR (ETF) is the biggest oil ETF, with around $12.3 billion in net assets.

XLE Total Return Price data by YCharts,

This oil ETF is a great, low-cost way to invest in the energy sector of the S&P 500, currently comprised of America's 42 largest publicly traded oil and gas companies. Because the fund is weighted by market cap, the top two companies, ExxonMobil and Chevron, account for more than 30% of the fund's value.

This means that much of the fund's performance will be dictated by these two behemoths. There's good in that, as well, because they're two of the best-run oil companies on the planet, and well positioned to ride out the downturn and benefit from a recovery.

From a cost perspective, this is a cheap fund to invest in, with an expense ratio of 0.14%. In other words, you'll only pay $14 this year to the fund managers for every $1,000 you invest in the fund.

2. Alerian MLP ETF (AMLP 0.94%)

The Alerian MLP is the second-largest ETF by assets, with more than $7 billion at recent count.

AMLP Total Return Price data by YCharts.

However, it's a very different animal, with an entirely different kind of focus: MLPs. MLPs are master limited partnerships, which is a kind of legal structure that many oil and gas businesses use because it can increase the amount of cash flows the company is able to return to investors.

An MLP isn't a corporation, so doesn't pay corporate income tax. The flip side is that the unitholders -- MLP-speak for shareholders -- are often exposed to paying higher taxes on income and capital returns paid out as distributions. Distributions from MLPs may even be subject to income tax if you hold them in an IRA. In other words, these great income-producing investments often come with extra complexity that makes them less-than-ideal choices.

The Alerian MLP ETF is supposed to address some of this, structured as a regular corporation, meaning that shareholders of the fund aren't subject to the rules of investing in MLPs directly. If you're looking to invest in the income-producing power of MLPs, but you want to keep things simpler, or invest in your retirement accounts, the Alerian MLP ETF is an answer.

However, doing so comes at a big cost, as the fund charges 5.43% per year in fees -- 0.85% in management fees, and another 4.58% in deferred income-tax expense. In other words, this isn't a loophole way to invest in MLPs and avoid the tax. The tax man cometh. He just goeth to Alerian, which owns the MLP units, and therefore, the tax liability.

Think about it this way: The Alerian MLP ETF pays a huge 9.5% dividend yield today, more than triple the 3% yield of the Energy Select Sector SPDR. But you'll give half that back to Alerian because it holds the deferred tax liability from the MLP distributions.

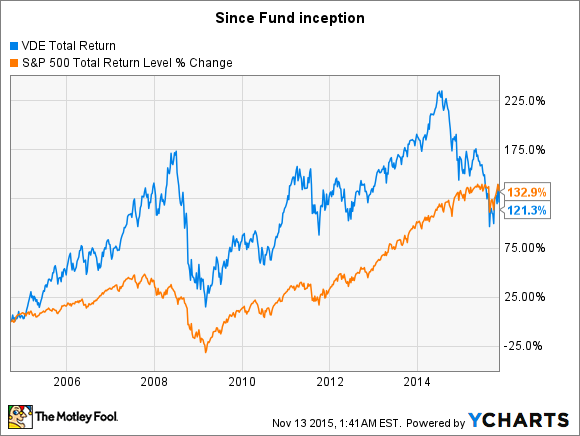

3. Vanguard Energy ETF (VDE -0.46%)

The Vanguard Energy ETF is closer to the Energy Select Sector SPDR, with a low expense ratio of 0.12%, but is made up of a broader swath of companies -- 150 at last count -- in the MSCI US Investable Market Index (IMI)/Energy 25/50.

VDE Total Return Price data by YCharts.

In other words, it has exposure to a larger mix of companies involved in the oil and gas business in the U.S. However, ExxonMobil and Chevron still make up a huge chunk -- more than 34% at last count -- of the fund's holdings.

Which top three oil ETF is right for you?

The Alerian MLP ETF is an interesting choice, and it does pay a big dividend, but the impact of deferred tax fees takes half of that away. Further, the 0.85% management fee, in addition to the tax fee, seems exorbitant for this kind of fund. It may seem small, but over time, it really adds up. If you were to invest $1,000 per year into this fund for 20 years, and get 8% annual returns on average, you'd pay $3,375 in fees, at 0.85%.

That works out to giving fund managers more than 11% of your total returns in fees. I'm just not convinced that the extra cost will lead to better long-term returns.

That leaves us with the Vanguard and SPDR funds. Their historical performances are quite similar, and both are low cost. Chances are their returns will look very similar going forward, considering that the top-10 holdings for each fund are nearly identical, and make up about two-thirds of their holdings. In other words, the makeup of the rest of the funds seems like a distinction without much of a difference.

Any way you slice it, I'd expect to see better long-term returns from these two than the Alerian MLP ETF, largely because of the higher cost of doing business.