Lowe's (LOW 1.56%) stock has trailed competitor Home Depot's (HD 1.00%) this year as its key operating metrics lag just behind those of its larger rival. Yet Lowe's is still benefiting from the rising economic tide that's lifting the home improvement market to new highs. That trend was evident in the company's third-quarter earnings results, which it released on Nov. 18.

Here's a big picture look at how Lowe's numbers stacked up against the prior-year period :

Lowe's results: The raw numbers

|

Q3 2015 Actuals |

Q3 2014 Actuals |

Growth (YOY) | |

|---|---|---|---|

|

Revenue |

$14.4 billion |

$13.7 billion |

5% |

|

Net Income |

$736 million |

$585 million |

26% |

|

EPS |

$0.80 |

$0.59 |

36% |

Source: Lowe's financial filings.

What happened with Lowe's this quarter?

As Home Depot did earlier in the week, Lowe's posted substantial quarterly revenue and earnings gains as shoppers across the country boosted their spending on home improvements. Comparable-store sales growth accelerated from the prior quarter -- and profitability spiked as well.

The key highlights of the third quarter:

- Revenue jumped 5% to $14.4 billion.

- Comps rose 5% -- an improvement from the 4.3% pace that Lowe's set in the second quarter. Yet that result trailed Home Depot's 7.3% comps jump.

- Gross margin ticked higher to 34.75% of sales, on pace with Home Depot's gross profitability.

- Operating margin improved to 8%, but remained well below Home Depot's 14% margin.

- Lowe's returned $1.01 billion of cash to shareholders through $750 million in stock buyback spending and $260 million in dividend payments.

- It affirmed its full-year sales and profit outlook.

- Reiterated plans to open as many as 20 new stores this year.

What management had to say

"This is an exciting time for Lowe's as we continue to execute our strategic priorities alongside a favorable macroeconomic backdrop," said CEO Robert A. Niblock. That happy backdrop involves a home improvement industry that's growing sharply: Spending has jumped to a $600 billion annual pace, up from less than $400 billion three years ago.

Source: Federal Reserve Economic Data.

Management credited a healthy mix of increased shopper traffic and higher average spending for powering the solid results. "Growth was driven by gains in both transactions and average ticket, while our focus on productivity and profitability also allowed us to deliver strong earnings-per-share growth," Niblock said.

Lowe's didn't provide details on its customer traffic and average ticket results, but we know that they trailed Home Depot's figures. The home improvement giant posted 4.4% customer traffic gains along with a 0.8% uptick in average customer spending, to $58 per trip.

Looking forward

Niblock and his executive team reaffirmed their full-year sales growth outlook that targets comps gains of 4.25% at the midpoint of guidance. Earnings are expected to weigh in at $3.29 per share (up 21% over 2014). Those targets haven't changed since Lowe's first articulated them in February.

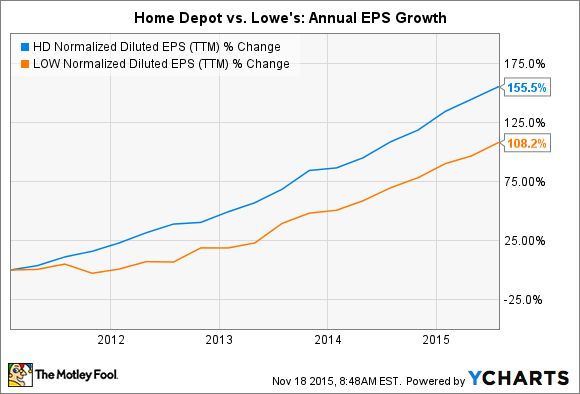

HD Normalized Diluted EPS (TTM) data by YCharts

In contrast, Home Depot earlier in the week raised its comps forecast for the third consecutive time, saying it believes it will grow by 4.9% in 2015. Its profit outlook has improved as well, rising to a projected $5.36 per share (up 14% from 2014) from the $5.14 per share that it had originally forecast.