Image source: Caterpillar.

Unfortunately, it seems that the only use for Caterpillar's (CAT -0.55%) earth-moving equipment is to dig itself a deeper hole for its stock price to fall into. While it's tempting to jump on board Caterpillar hoping its cyclical business is at or near the bottom, thereby offering value investors upside when the global economy finally gains momentum, that development may be years away. And the remoteness of that recovery has become more evident in recent weeks as analysts continue to line up and take their shots at Caterpillar's gloomy future. Plus, the most recent admission from Caterpillar's own management about China's prospects is even more depressing for investors.

Here's a look at what analysts are saying -- and what the company's own financials are showing -- about Caterpillar's business. And I'll discuss an alternative stock for investors to consider instead.

What analysts are saying

As the calendar was flipping from August to September, R.W. Baird analyst Mircea Dobre downgraded Caterpillar to neutral as his prediction of commodity prices stabilizing failed to take place. Additionally, Dobre moved his price target from $89 to $77.

Raymond James analyst Ben Cherniavsky was rather blunt when explaining his pessimism for Caterpillar's business: "[W]e believe that the worldwide machinery market remains in a difficult state of disequilibrium with over-production and excess dealer inventories plaguing supply while slower global GDP and a massive commodity rout crimps demand."

Even worse, at a time when Caterpillar had just announced it planned to fire as many as 10,000 employees, Axiom Capital's Gordon Johnson explained that the risk for Caterpillar's downside isn't fully understood by investors, and put a frighteningly low 2017 price target of $28 per share -- a predicted downside of roughly 60%.

Unfortunately for Caterpillar investors, the analysts' lack of enthusiasm was echoed by the company's own Tom Pellette, Caterpillar's group president for construction industry equipment. Pellette explained to Financial Times that industry-wide sales of hydraulic excavators between 10-90 tonnes will reach about 23,000 this year in China. That's a far cry from 2010, when the industry sold more than 112,000 units in China.

"My expectation is within China and globally that the market will pick up to a level above where we are in 2015. But for China specifically, our expectation is that the market will rebound but we are not planning [for it to] get back to 2011/2012 levels." Tom Pellette told Financial Times in an interview.

What sales are saying

Furthermore, Caterpillar's woes extend beyond hydraulic excavators and China. Take a look at Caterpillar's sliding global revenues.

Chart by author. Information source: Caterpillar SEC filings.

Caterpillar's bottom line has suffered declines as well.

Chart by author. Information source: Caterpillar's SEC filings.

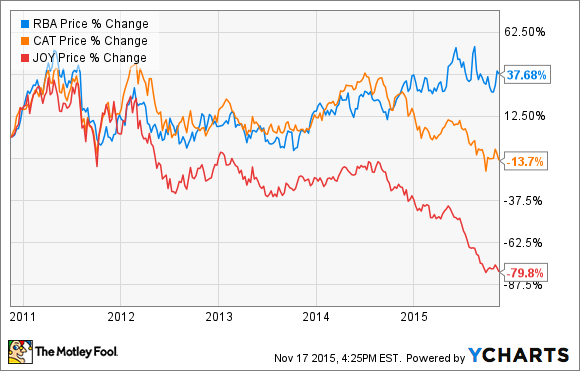

Caterpillar isn't the only heavy machinery manufacturer to feel the pain; Joy Global finds itself in a similarly gloomy scenario.

However, investors looking to invest in heavy machinery in anticipation of a global recovery in the medium term should take a closer look at Ritchie Bros. Auctioneers (RBA 0.17%).

Ritchie Bros. Auctioneers is the world's largest seller of used heavy equipment and generates almost all of its revenue from unreserved auctions. The company charges commission to sellers and a small fee to buyers and it provides investors with a network effect that expands in value as each new seller and/or buyer comes into the fold.

While Ritchie Bros. Auctioneers has produced higher return on invested capital (ROIC) than Caterpillar over the past five years, it should move even higher in the coming years as it grows its online auction business through RitchieBros.com and EquipmentOne.com. The company's websites have enabled buyers to use the Internet to place bids anywhere and anytime, and that online business generated more than 40% of auction proceeds last year.

Ultimately, investors looking to invest in heavy equipment manufacturers like Caterpillar or Joy Global should think twice for now. While those large companies aren't going away by any means, and they will eventually see better days for their business, they also offer little upside given management projects sales to remain flat globally over the near term. Instead, investors should search for out-of-the-box ideas like Ritchie Bros. Auctioneers: Companies that can generate strong ROIC and increase their competitive advantage -- a network effect, in this case -- as their business grows.