This past year has been brutal on the oil industry, after the price of crude plunged from north of $100 a barrel to less than $40 in recent weeks. It's a plunge that many in the industry weren't prepared to handle, forcing several producers to make drastic changes just to stay afloat. And then we have EOG Resources (EOG 0.59%), which had one focus during the downturn: Prepare for the eventual recovery. That's what makes it the one oil stock to own for the looming recovery in oil prices.

Applying the brakes

When EOG Resources set its 2015 plan, the company noted that its "primary goal for 2015 is to position the company to resume long-term growth once crude oil prices recover" and added, "The company is not interested in accelerating crude oil production in a low-price environment."

This plan resulted had the company slashing its spending by 40% and only completing enough wells to keep its production roughly flat. It was a plan quite outside the norm, with many of its peers growing oil production by double digits in 2015, even though the oil market was vastly oversupplied.

Instead of growing its production, EOG Resources spent its time and money on improving its operations, with a particular focus on drilling better wells at lower costs so that it could improve its drilling returns. The results have been nothing short of remarkable:

Source: EOG Resources investor presentation.

What's clear from that chart is that EOG Resources can now drill wells that are just as profitable, if not more so, than when oil was much higher.

A gusher awaits

Aside from a focus on improving its returns, one other thing EOG Resources did this year that set itself apart from its peers was to drill but not complete a large number of wells. This decision had the company building an inventory of wells that it can quickly complete when conditions improve. It expects to end this year with 320 wells awaiting completion, which for perspective is three times its normal level and about three-quarters of the wells it completed last year. These unfinished wells give the company a big resource to unleash once oil prices improve.

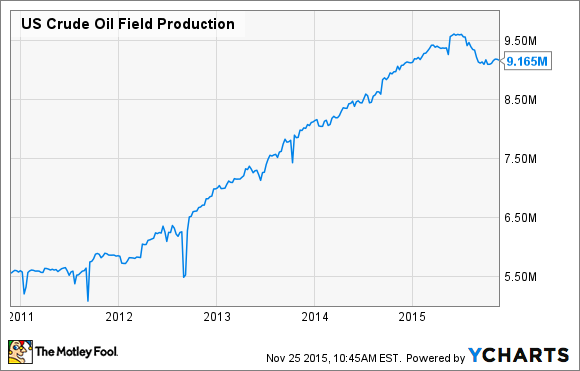

It's an improvement that could come as early as next year. While producers delivered a lot of production growth in 2015, most of that growth occurred earlier this year. In fact, U.S. oil production peaked in April and has been on a steady decline.

US Crude Oil Field Production data by YCharts

Additional declines are likely, with oil reservoir specialist Core Labs (CLB) projecting that production in the U.S. could fall by more than 700,000 barrels per day from the peak by the end of this year, which is above Core Labs' prior estimate of 500,000 barrels. Further, Core Labs expects year-over-year declines in North American production to top 900,000 barrels per day in 2016. When combined with demand growth that's expected at 1.8 million barrels this year, and 1.2 million barrels in 2016, the oversupply of oil could quickly dissipate in 2016, which, according to Core Labs, "should precipitate higher commodity prices."

Investor takeaway

It would appear that higher oil prices are just around the corner, which is something EOG Resources has been preparing for all year. Thanks to its huge inventory of uncompleted wells, the company is among the best positioned to fully capture an improvement in the oil price, making it the one stock to own if you want to profit from what appears to be an impending rally in crude prices in 2016.