Source: Lions Gate..

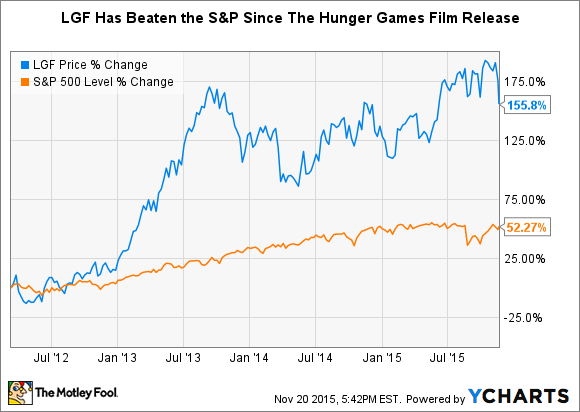

Building a multifaceted production studio from scratch is hard work. Lions Gate Entertainment (LGF-A 2.22%) has done it about as well as one can imagine. The company first got on my radar back in early 2012. I saw how wildly popular the Hunger Games books were and knew what a blockbuster film series could do for such a relatively small film studio. It was the equivalent of having a smaller biotech company hit on a new drug versus having one of the giants add another piece to its portfolio. Since the release of the first Hunger Games film, and three follow-up productions, the stock has been on a tear.

While the success of this film series gave the company opportunities, it also could have acted like a noose. Instead of solely trying to replicate the success of this type of tentpole movie franchise, which it did to some degree with The Divergent Series, Lions Gate focused on diversifying its portfolio of offerings to great success.

Scripted tv, game shows, and lower-budget films

ABC's Nashville. Produced by Lions Gate. Source: Lions Gate.

Lions Gate has produced Orange Is the New Black for Netflix, Nashville for ABC, and Casual for Hulu. It is medium- and network-agnostic, and this stance has allowed the company to create a smoother growth trajectory than would be available by focusing exclusively on boom-and-bust big-budget movies.

Lions Gate's Family Feud, a nearly 40-year-old property, had recently risen to No. 1 on the syndication ratings chart for the first time, before falling slightly behind stalwarts such as Jeopardy! and Wheel of Fortune.

Success with lower-budget horror films such Ouija, Tyler Perry Films, and surprise hits such as John Wick, have further rounded out the company's portfolio of offerings. While Lions Gate is still reaping the benefits from the latest Hunger Games film -- The Hunger Games: Mockingjay -- Part 2 is in theaters now and its domestic total as of Nov. 25 was $136 million -- it has positioned itself to exist and prosper well after the final dollar from that franchise has been counted.

One glaring hole ... no more

Some of Pilgrim Studios television offerings. Source: Pilgrim.

The one piece missing from Lions Gate was a robust group of non-scripted shows. But Pilgrim Studios, which, according to Deadline, was "one of the most sought-after independent production companies in the space," has reportedly received a major investment from Lions Gate. While the terms haven't been released, it's rumored that Lions Gate recently paid around $200 million for a greater-than-50% stake in the company.

According to a Lions Gate press release, "Pilgrim's programming slate encompasses 47 unscripted and scripted series spanning 27 networks." Together, the combined entity will possess "nearly 80 television series across 40 networks." Unscripted shows such as Pilgrim's Ghost Hunters and Wicked Tuna have significantly smaller production budgets than scripted comedies and dramas. The appeal of buying access to a portfolio of already vetted and successful shows is clear, and Lions Gate has taken the dive.

Lions Gate's revenue has been on the decline since 2013. In that year it jumped over 70% to $2.7 billion, and it has declined to under $2.3 billion on a trailing-12-month basis.Incorporating the Pilgrim Studios shows should help to juice top-line growth while also strengthening gross margins because of the lower production costs.

Lions Gate has done a wonderful job of competing in difficult waters and using one successful franchise to help spawn a diversified production company. With a small dividend yield -- around 1% -- and plenty of investment in its future, I still see LGF as a market beater going forward. I plan to hold my shares for years to come.