Starbucks (SBUX 0.29%) delivered impressive returns in 2015, with its stock up over 50%. Competitor Dunkin' Brands (DNKN), on the other hand, gained a much more modest 2.4% over the same stretch. However, past performance is no guarantee of future returns, and investment decisions need to be based on forward-looking considerations. Given this, which coffee stock is positioned for better returns in the future, Starbucks or Dunkin' Brands?

Starbucks is beating Dunkin' Brands

Dunkin' Brands is much smaller than Starbucks in terms of revenue. Wall Street analysts are on average forecasting that Dunkin' Brands will make $810 million in sales during 2015, a small fraction of the $19.2 billion in revenue produced by Starbucks during the fiscal year ended in September 2015.

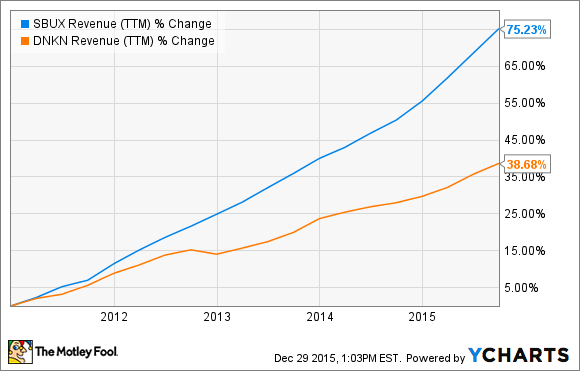

A smaller size can make a company more volatile and unstable, but it also provides more room for expansion. It's easier to sustain rapid growth from a smaller revenue base, and this could be an important advantage for investors in Dunkin' Brands versus Starbucks.

IMAGE SOURCE: THE MOTLEY FOOL.

However, as Yogi Berra once said, "In theory, there is no difference between theory and practice. In practice, there is." Starbucks has dramatically outperformed Dunkin' Brands in terms of revenue expansion over the last several years.

SBUX Revenue (TTM) data by YCharts.

Looking at the latest financial reports, Starbucks continues to be well ahead of Dunkin' Brands when it comes to sales growth. The Seattle-based coffee giant reported a record $4.9 billion in revenue during the September quarter, a big increase of 18% from the same period last year. Global comparable sales grew 8%, with traffic increasing 4% year over year. This shows that Starbucks continues enjoying vibrant demand, as new store openings are not hurting sales at previously existing locations.

Dunkin' Brands, on the other hand, announced a smaller increase in revenue of 8.9% last quarter. Baskin-Robbins is doing quite well: Comparable sales in the U.S. increased 7.5% for this division. However, comparable sales for Dunkin' Donuts in the U.S. increased by a disappointing 1.1%.

Growth is about much more than the mathematics of speed versus size. Starbucks is far superior to Dunkin' Brands in areas such as global brand recognition and management's ability to drive growth via product innovation, and this is allowing the company to sustain truly exceptional financial performance in spite of its relatively big size.

On value versus quality

The biggest drawback when analyzing an investment in Starbucks is arguably valuation. The coffee emporium trades at a steaming-hot price-to-earnings ratio of around 34 times earnings over the last 12 months, a substantial premium versus the overall market. As a comparison, the average company on the S&P 500 trades at a P/E ratio near 19.

IMAGE SOURCE: THE MOTLEY FOOL.

Starbucks certainly deserves an above-average valuation based on the company's brand power and successful track record over the years. Still, elevated valuation levels are reflecting high expectations, and this is always an important risk to watch. When a company such as Starbucks is aggressively valued, there is little room for disappointment in case the business hits any bumps down the road.

Dunkin' Brands is not particularly cheap, but the stock is still cheaper than Starbucks at a P/E ratio near 26. Valuation needs to be compared against business quality, though, and Dunkin' Brands is no match to Starbucks in that area.

Starbucks or Dunkin' Brands?

Starbucks is a world-class business that investors can free comfortable holding for years to come. The stock has always looked expensive, yet Starbucks has delivered amazing returns for investors over the long term, gaining over 300% in the last five years. Dunkin' Brands, on the other hand, is a reasonably good business trading at a moderate premium to the overall market.

It all depends on your own investing style and your vision about the future for the two companies. However, investing in extraordinary companies tends to pay big rewards over the years, and Starbucks fits the definition of extraordinary much better than Dunkin' Brands.