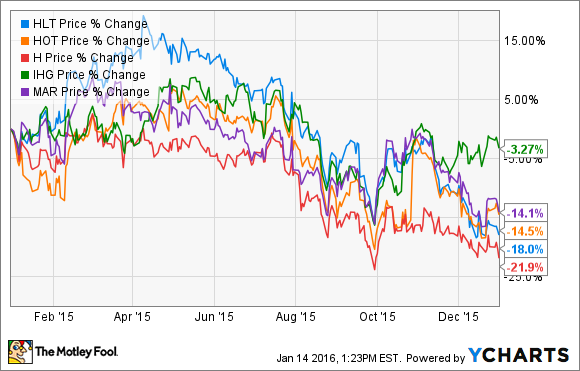

What: Shares of Hilton Worldwide Holdings (HLT -1.00%) took a dive last year, falling 18%, according to data from S&P Capital IQ. The decline came amdist a broader sell-off in the hotel industry as concerns about slowing growth and the threat of Airbnb and other such services looms. As you can see from the chart below, Hilton's decline tracked with many of its peers.

So what: Reports of room overcapacity and falling room rates dotted the industry landscape last year. In New York, the biggest hotel market in the country, room capacity has grown 21% in the last five years, with falling room rates as a consequence. The city already has 100,000 hotel rooms and 27,000 more are under construction.

In major international markets like the U.K. and Dubai, rates were also down.

Hilton started off the year on a high note as it moved higher after its fourth-quarter earnings report -- earnings per share for 2014 improved 30% over the previous year. The stock dipped in May when private equity giant Blackstone Group announced it would sell 90 million shares in the hotel chain, a stake worth close to $3 billion at the time, reducing its stake in the company from 55% to 46%.

Despite a strong second-quarter earnings report in July, the stock continued to sell off in the subsequent weeks, and a downgrade in August pushed the stock below $26 for the first time since the beginning of the year. On Sept. 18, the stock lost 6% as peer La Quinta lowered its revenue-per-room growth forecast. The stock continued to slide throughout the duration of the year, though it was briefly propped up by a plan to spin off some of its properties into a REIT.

Now what: Hilton shares have continued to slide in 2016, down 15% already. Despite a dive of more than 40% since its peak last year, the stock still isn't cheap at a P/E of 24, and the hotel industry continues to face many of the same challenges it confronted last year. Rising minimum wages also adds a new hurdle as those companies depend on low-wage workers. With the market in turmoil, Hilton shares could have further to fall.