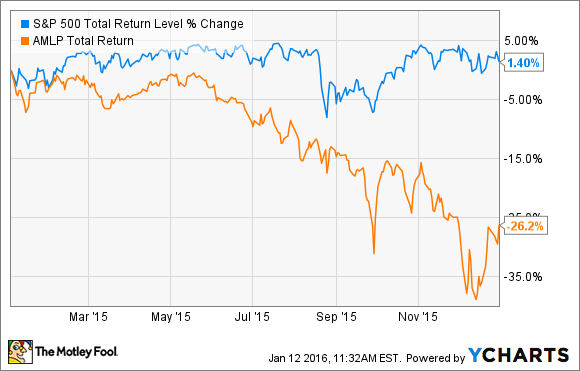

After seeing so many energy companies hit the skids in 2015, it's pretty understandable if investors are a little shy about wanting to add energy companies to their portfolios in 2016. One place many investors thought they could finds shelter in the energy market was master limited partnerships and pipeline companies that were much less reliant on prices to make a living. Based on the Alerian MLP index, though, that didn't turn out so great.

Despite the pain the market doled out to MLP investors, there are three MLPs investors should consider adding to their portfolios in 2016: Enterprise Products Partners (EPD 0.18%), Magellan Midstream Partners (MMP), and Holly Energy Partners (HEP). Let's take a look at what sets these three partnerships apart from their peers -- and why now may be the best time to add them to your portfolio.

What these MLPs have in common

The boom in oil and gas production in the United States has translated into the need for a massive revamping of our nation's energy infrastructure. New shale basins in places like Pennsylvania and North Dakota were basically starting from scrach with oil and gas pipeline networks. This need for loads of new transportation infrastructure sent several pipeline companies on huge spending sprees that were supported by taking on a bunch of new debt and raising equity while throwing back as much available cash as they could to investors through generous payouts.

It seemed like a model that could work at the time -- after all, demand for pipe was booming, debt was cheap, and share prices were attractive enough to justify using it as currency in the capital markets. As oil and gas production has started to dry up, though, companies are finding it harder and harder to find new capital at attractive rates. So, the companies that weren't paying for some of their growth through internally generated cash flows are now looking like they will need to cut their payouts for that very purpose.

That is what makes Enterprise Products Partners, Magellan Midstream Partners, and Holly Energy Partners so unique. The management teams at these three partnerships took a much more conservative approach to how they paid their investors and grew the business.

There are two ways that best show this conservative approach: their distribution coverage ratios, and their change in share count over the past five years.

| Company | Distribution Coverage Ratio |

| Enterprise Products Partners | 1.30x |

| Magellan Midstream Partners | 1.35x |

| Holly Energy Partners | 1.54x |

Source: Company earnings call transcripts and earnings releases.

The distribution coverage ratio is how much cash the company brings in on a quarterly basis compared to the amount paid out in distributions. The higher the number, the more cash being retained by the business to be reinvested in growth. Most other MLPs have coverage ratios in the 1.00x-1.10x range, meaning very little is left over to reinvest. By contrast, Enterprise, Magellan, and Holly's management teams all actively keep payouts lower in relation to cash coming in the door to ensure it can pay its investors when business is less robust and give them some extra cash to reinvest.

It's no coincidence, then, that with the cash each company has generated internally, they have kept their debt levels much more manageable than their peers...

EPD Financial Debt to EBITDA (TTM) data by YCharts.

...and have not needed to issue many new shares to fuel growth.

EPD Average Diluted Shares Outstanding (Quarterly) data by YCharts.

Why buy now?

While the investment thesis on all three of these companies has remained strong throughout the downturn in energy stocks, the sheer fact that they are associated with others in this space has put a decent discount on shares over the past year or so.

Still, none of these companies have indicated they plan to cut distributions any time soon. Rather, all three see some pretty ample opportunities to keep their decade-long streaks of distribution raises alive.

EPD Dividend data by YCharts.

With yields as high as they are today, and the very low chance that distributions will be cut, shares of Enterprise Products, Magellan Midstream Partners, and Holly Energy Partners all look pretty compelling.

What a Fool believes

The energy market is a lot of things; "predictable" isn't one of them. There are simply too many factors that can impact the price of oil and gas on any given day, and many of them are things we never see coming. For master limited partnerships, this means those with aggressive growth plans and dependence on the capital markets to fuel growth are likely to suffer when times get rough. So, investors should focus more of their attention on those MLPs that have a more conservative approach, like Enterprise, Magellan, and Holly. They may not look as compelling in the good times, when others around them are pushing payouts to the limit, but long-term investors will be grateful for the conservative approach when times get tough.