Image source: FedEx Corporation.

When you need to send a package, your choice is often between United Parcel Service (UPS 2.42%) and FedEx Corporation (FDX 0.59%). It's no different in the stock market, where these fierce competitors commonly vie for the same investors. Let's take a look at both to see how the two stocks stack up.

Company profiles

Before diving into market metrics, let's look at the corporations themselves. Founded in 1907 as a private messenger and delivery service, United Parcel Service is now based out of Atlanta and operates across three major segments: U.S. packages, international packages, and supply chain and freight. Its U.S. packages division brought in $37 billion in sales last year, three times that of international packages and more than four times the revenue of its supply chain and freight business. In 2015, UPS delivered an average of 18.3 million packages per day, and has also continued to focus on expanding its capabilities to include "more than package delivery." Last year, for example, UPS purchased a truckload freight brokerage company for $1.8 billion to help improve its freight efficiency.

While UPS may disagree, FedEx claims it "invented express distribution" in 1973. Headquartered in Memphis, Tennessee, the company divides its package services by speed (express versus ground) instead of geography. The company's hallmark express services accounted for $27.2 billion in 2015 sales, compared to just $12.9 billion for ground delivery and an additional $6.2 billion for freight. In 2015, FedEx delivered around 11 million packages per day, just 60% of UPS' delivery quota.

Sales, profits, and margins

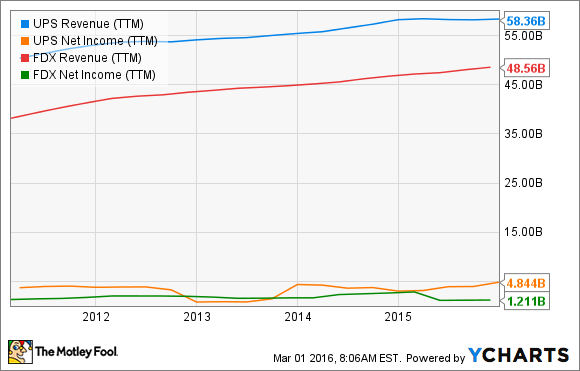

Now let's dive into some financial figures. On all accounts, UPS is simply bigger than FedEx. The company's overall revenue clocks in around $10 billion higher and its net income is four times that of FedEx.

UPS Revenue (TTM) data by YCharts.

That means that, at least currently, UPS also enjoys much fatter margins than FedEx. But each company's margins have been up and down over the past five years, and it's unclear whether one corporation has a consistently clear lead over the other.

UPS Operating Margin (TTM) data by YCharts.

The future of these metrics is made even more unclear by FedEx's $4.9 billion proposed acquisition of European shipping company TNT Express. The move would rev FedEx's revenue up to UPS levels, but the purchase isn't cheap and FedEx could see its bottom line shrink as it absorbs acquisition costs in the years to come.

Stock prices, valuations, and dividends

While UPS may be a bigger corporation, the past five years haven't been better for its stock. FedEx shareholders have enjoyed an S&P 500-beating 52% gain in the last half-decade, compared to a lagging 31% increase for UPS investors. That boost, combined with FedEx's relatively smaller earnings, also means that investors are paying more for FedEx shares: Its 32.6 P/E ratio is nearly double UPS' 18.2.

But while UPS and FedEx are similar businesses, their shareholder value creation models differ significantly. As its TNT Express acquisition suggests, FedEx is focused on aggressive growth. UPS, meanwhile, is more interested in steadily improving sales. These differing strategies are primarily reflected in each company's dividend decisions: While FedEx currently offers a token 0.7% yield, UPS shareholders can enjoy a consistently higher 3.1% rate.

FDX Dividend Yield (TTM) data by YCharts.

Which is a better buy?

When considering whether UPS or FedEx Corporation is a better stock buy, the answer depends on the investor. For income investors looking for a more conservative investment, UPS offers size and stability that FedEx currently doesn't have. But for investors interested in getting in on growth potential, FedEx is firing on all cylinders. Its relatively expensive stock price could turn out to be well warranted if it's able to topple UPS from its profitable perch, causing a double-whammy jump in FedEx stock and drop in UPS shares. But that future is far from certain, and thus carries its own risks.