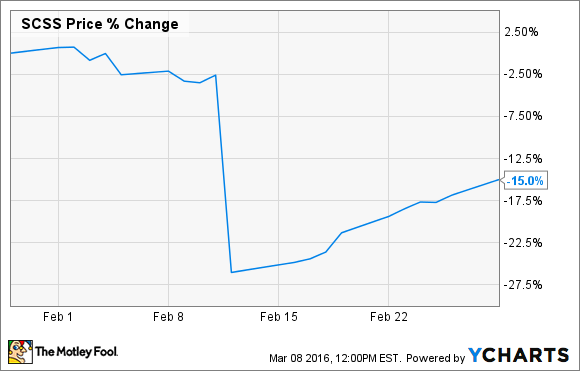

What: Select Comfort Corporation (SNBR 0.53%) investors were getting a poor night's sleep last month as shares dropped 15% according to data from S&P Global Market Intelligence. A disappointing earnings report sent shares down 19% in a single day though the stock recovered most of the losses afterwards.

So what: The maker of the Sleep Number bed posted a per-share loss of $0.42 in the quarter, blaming the shortfall on the transition to a new Enterprise Resource Planning system. CEO Shelly Ibach said the switch was "far more challenging with far greater customer and financial impacts that we anticipated." However, she added, "We have made major progress resolving technical and operational issues," and the company expects the new system to be accretive to profits by the second half of 2016.

As a result of the ERP implementation disruption, sales in the quarter fell 33% and comparable sales were down 30%. Almost all of the sales slide was the result of the ERP implementation and an extra week in the calendar last year. Adjusting for lost sales to the ERP transition, earnings per share was a penny. Analysts had expected a loss of $0.05.

Now what: Looking ahead to 2016, management expects a full-year EPS of $1.25-$1.45, within the range of what 2015's earnings would have been without the ERP situation. However, the 2016 outlook also includes a reduction of $0.25 to $0.30 in earnings per share due to the continued transition in the first quarter.

Investors seems to be giving the company a reprieve as the stock has recovered nearly all its losses since the report. Management is sticking with its goal of $2.75 in earnings per share by 2019. As long as consumer spending, the stock steadily increase if the company can deliver on that target.