What is a stock worth? You could simply go with the current stock price. But that price is subject to the market's whims. Another alternative is to determine the stock's intrinsic value. The intrinsic value of a stock is its true value. It refers to what a stock (or any asset, for that matter) is actually worth -- even if some investors think it's worth a lot more or less than that amount.

You might think calculating intrinsic value would be difficult. That's not the case, though. Not only can you determine the intrinsic value of a stock, but you can also use it to search for the best bargains in the market. Knowing an investment's intrinsic value is useful, especially if you're a value investor with the goal of buying stocks or other investments at a discount.

Intrinsic value of stocks

Intrinsic value of stocks

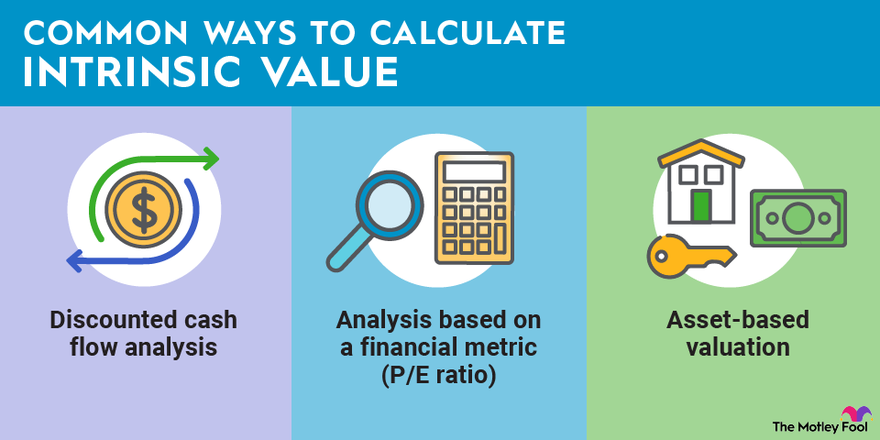

Just how easy is it to calculate the intrinsic value of a stock? It depends on which calculation method you use. Yep, there are multiple methods to pick from. We'll look at three of the most popular approaches.

Discounted cash flow analysis

Discounted cash flow analysis

Some economists think that discounted cash flow (DCF) analysis is the best way to calculate the intrinsic value of a stock. To perform a DCF analysis, you'll need to follow three steps:

- Estimate all of a company's future cash flows.

- Calculate the present value of each of these future cash flows.

- Sum up the present values to obtain the intrinsic value of the stock.

The first step is the toughest, by far. Estimating a company's future cash flows requires you to combine the skills of Warren Buffett and Nostradamus. You'll probably need to delve into the financial statements of the business (unsurprisingly, previous cash flow statements would be a good place to start). You'll also need to gain a decent understanding of the company's growth prospects to make educated guesses about how cash flows could change in the future.

Here's the formula you can use to calculate an intrinsic value using discounted cash flow analysis:

Intrinsic value = (CF1)/(1 + r)^1 + (CF2)/(1 + r)^2 + (CF3)/(1 + r)^3 + ... + (CFn)/(1 + r)^n

where:

- CF1 is cash flow in year 1, CF2 is cash flow in year 2, etc.

- r is the rate of return you could get by investing money elsewhere

Let's say you want to perform a discounted cash flow analysis for the stock of RoboBasketball, a fictional company that makes a remote-controlled drone that looks like a basketball. You look at its current cash flow statement and see that it generated cash flow of $100 million over the last 12 months. Based on the company's growth prospects, you estimate that RoboBasketball's cash flow will grow by 5% annually. If you use a rate of return of 4%, the intrinsic value of RoboBasketball would be a little over $2.8 billion using discounted cash flows going out for 25 years.

Analysis based on a financial metric

Analysis based on a financial metric

A quick and easy way of determining the intrinsic value of a stock is to use a financial metric such as the price-to-earnings (P/E) ratio. Here's the formula for this approach using the P/E ratio of a stock:

Intrinsic value = Earnings per share (EPS) x (1 + r) x P/E ratio

where r = the expected earnings growth rate

Let's say that RoboBasketball generated earnings per share of $3.30 over the last 12 months. Assume that the company will be able to grow its earnings by around 12.5% over the next five years. Finally, let's suppose the stock currently has a P/E multiple of 35.5. Using these figures, RoboBasketball's intrinsic value is:

($3.30 per share) x (1 + 0.125) x 35.5 = $131.79 per share

Asset-based valuation

Asset-based valuation

The simplest way of calculating the intrinsic value of a stock is to use an asset-based valuation. The formula for this calculation is straightforward:

Intrinsic value = (Sum of a company's assets, both tangible and intangible) – (Sum of a company's liabilities)

What is RoboBasketball's intrinsic value using this approach? Let's assume the company's assets totaled $500 million. Its liabilities totaled $200 million. Subtracting the liabilities from the assets would give an intrinsic value of $300 million for the stock.

There is a downside to using asset-based valuation, though: It doesn't incorporate any growth prospects for a company. Asset-based valuation can often yield much lower intrinsic values than the other approaches.

Calculating the intrinsic value of options

Calculating the intrinsic value of options

There's a rock-solid way of calculating the intrinsic value of stock options that doesn't require any guesswork. Here's the formula you'll need to use:

Intrinsic value = (Stock price-option strike price) x (Number of options)

Suppose a given stock trades for $35 per share. You own four call options that entitle you to buy 100 shares per call option for $30. What's the intrinsic value of your options? The calculation is simple:

($35 – $30) x (400) = $2,000

Options that are not "in the money," meaning that the strike price is greater than the current share price, have no intrinsic value and are trading only for time value (i.e., the potential that the stock price could increase and drive the option price higher).

Related investing topics

Why calculating intrinsic value is useful

Why calculating intrinsic value is useful

The goal of value investing is to seek out stocks that are trading for less than their intrinsic value. There are several methods of evaluating a stock's intrinsic value, and two investors can form two completely different (and equally valid) opinions on the intrinsic value of the same stock. However, the general idea is to buy a stock for less than its worth, and evaluating intrinsic value can help you do just that.

If you're ready to begin your investing journey, check out the best online brokerages to get started today.