Taxable Wages: What They Are and How to Calculate Them

Every business with employees must address payroll taxes. It’s the employer’s role to understand how payroll works and to withhold the applicable taxes before providing paychecks. But as anyone who’s filed taxes knows, the U.S. government’s federal tax codes are anything but straightforward.

For those who are responsible to run payroll, here’s a guide to help you comprehend the concept of federal taxable wages. This is key to understanding the kinds of income that are taxed as well as to be able to report an employee’s taxable wages on form W-2, which can impact your company’s qualified business income deduction (QBI).

Overview: What are taxable wages?

Any income earned by an individual is subject to taxation by the government. This includes earnings in the form of hourly pay, overtime wages, a salary, commissions, bonuses, and even tips and severance pay.

The portion of an employee’s earnings that are subject to taxation are called taxable wages. It doesn’t matter if we’re talking about an exempt employee or non-exempt staff. However, the catch is that not all the income earned is taxable. That’s why the W-2 form has a separate box for reporting taxable wages.

The amount of wages to be taxed is based on the total income earned minus certain deductions allowed under the Internal Revenue Service (IRS) tax code as outlined in IRS publication 15, the employer’s tax guide.

Examples of these pre-tax deductions are contributions to a 401(k) retirement plan as well as health insurance and other payments to benefits under what’s referred to as a Section 125 cafeteria plan. Note that these deductions factor into reducing the amount of Federal Income Tax (FIT) withheld, but not all apply to Social Security and Medicare taxes.

Once deductions are subtracted, the remaining income is what’s referred to as taxable wages. This is the amount used by the federal government to determine the amount of FIT withheld. Additional taxes are also deducted based on the tax rules at the state and local levels of government.

Are taxable wages the same as gross wages?

The IRS uses separate terms to distinguish between the total income earned and the amount subject to taxation. This is the difference between gross wages and taxable wages.

The amount of income earned before tax deductions is referred to as gross wages, gross income, or gross pay. This is not the same as pretax income, which applies to businesses, not individual workers.

After all qualified deductions are subtracted from gross wages, the remainder is the taxable wage amount. If an employee has no deductions, then gross wages equate to the taxable wage amount.

How to calculate taxable wages

Because FIT taxable wages can be tricky to calculate, let’s walk through the process in detail.

1. Gross wages

Gross wages are the starting point from which the IRS calculates an individual’s tax liability. The total amount of money paid to an employee equals their gross wages, so add up all payments such as a salary and overtime as well as reimbursements for items like tuition and business expenses. This amount needs to be reported to the IRS even though some amounts will be deducted in the next step.

2. Non-taxable wages

Certain employer payments are flagged as non-taxable income. These are deducted from gross wages to arrive at the taxable wages total. Examples here are reimbursement for mileage, certain business expense reimbursements, and educational assistance. Many of these also have a cap to the amount that’s considered non-taxable.

3. Deductions

Now it’s time to remove pre-tax deductions from the gross wages. Subtract out employee contributions to qualified retirement programs, flexible spend accounts (FSA), small business health insurance, and other pre-tax contributions.

For many employees, this is the point where we’ve arrived at their taxable wages. However, if an employer furnished other taxable benefits, then move on to the next step.

4. Employer-provided fringe benefits

Some employers also provide benefits that are considered taxable, and are added to the income amount. For example, if payments for moving expenses were provided, that amount would be added into the taxable wages in order to calculate the final tax amount. Another example is use of a company car.

5. Taxable wages total

After all the additions and deductions to gross wages have been calculated, we now have the amount used for determining tax liability, the employee’s taxable wages. The actual amount of tax taken from an employee’s paycheck is also dependent on their filing status (single or married) and number of allowances, both of which are reported on the employee’s W-4.

Here is the formula for calculating taxable wages:

(Gross wages) - (Non-taxable wages) - (Pre-tax deductions) + (Taxable benefits) = Taxable wages

The best payroll software tools that calculate taxable wages for you

As you can see, the federal tax rules are complex. Layer on the rules at the state and local levels as well as the fact that each employee’s tax situation is different, and it can be a nightmare trying to determine how much tax to withhold for every employee.

That’s why payroll software is a must for any business with employees. Here are some of the best.

1. OnPay

OnPay payroll software offers an excellent balance between robust features and a reasonable cost. It will not only handle your payroll taxes, including year-end W2 and 1099 forms, it delivers a plethora of capabilities.

Some of its features include multistate payroll if employees are based in more than one state, direct deposit or paper check options, administration of health benefits, and HR tools such as employee offer letters. It’s a well-rounded option for small businesses.

OnPay makes many payroll tasks, such as setting up state withholding taxes, easy to implement. Image source: Author

2. Patriot Payroll

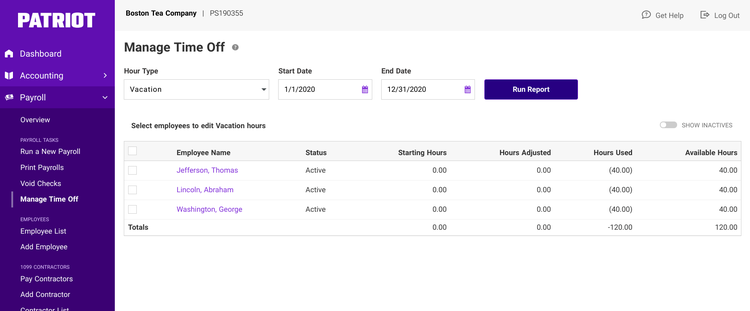

Small businesses new to payroll and looking for ease of use should consider Patriot Payroll. The software comes in two flavors, basic and full service, with the latter offering the filing and depositing of payroll taxes.

One of its key features is that Patriot Payroll handles all the initial setup, which includes entering complete historical payroll data for employees. It also automates the entire payroll process, and offers add-on modules that help you manage time cards, attendance, and HR components such as a company handbook and benefits information. The software covers the basics very well although it does not have a lot of bells and whistles, such as an option to pay contractors.

Patriot Payroll offers a solid set of features such as management of employee time off. Image source: Author

3. RUN Powered by ADP

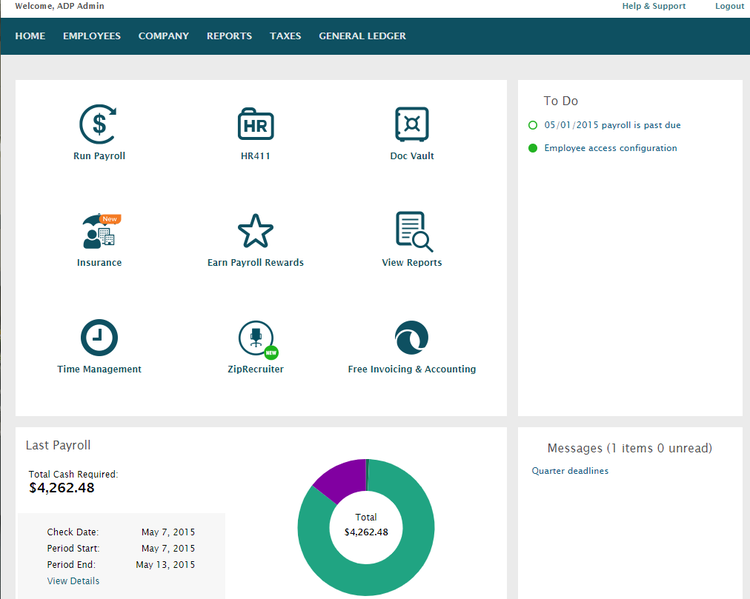

ADP is a powerhouse in the field of payroll, so it’s worth looking at its payroll software designed for small businesses up to 49 employees. Called RUN Powered by ADP, the tool delivers a comprehensive suite of capabilities.

It covers the basics of filing and paying payroll taxes, and also includes new employee onboarding, HR tools, and add-ons such as 401(k) retirement services. The software is on the expensive side, but it’s to be expected given the name recognition of the ADP brand and the extent of the software’s features.

RUN Powered by ADP’s dashboard is easy to navigate and offers a number of rich features. Image source: Author

Final considerations to calculate taxable wages

Note that employers are not responsible for withholding taxes from a contract employee. These contract workers are temporary staff who work independently, and since they are not full-time employees, it’s up to them to handle their own taxes.

In addition, some types of taxes have a taxable wage base. This means there’s a limit to how much an individual can be taxed for certain taxes. An example of a tax that caps the amount taken out of an employee’s pay is Social Security tax.

For more help, you can look online for a federal taxable wages calculator, which assists in calculating taxable wages. However, depending on the number of employees in the business, it’s usually better to talk to an accountant to prepare business taxes, and to invest in payroll software to let technology do the heavy lifting while you attend to driving the success of your business.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles