If you’ve been a follower of The Motley Fool for long, you’ve probably heard all kinds of terms that are ours alone. They may get a little confusing for people who are new to communities like Rule Breakers, but we’re here to help.

Spiffy pop defined

Spiffy pop defined

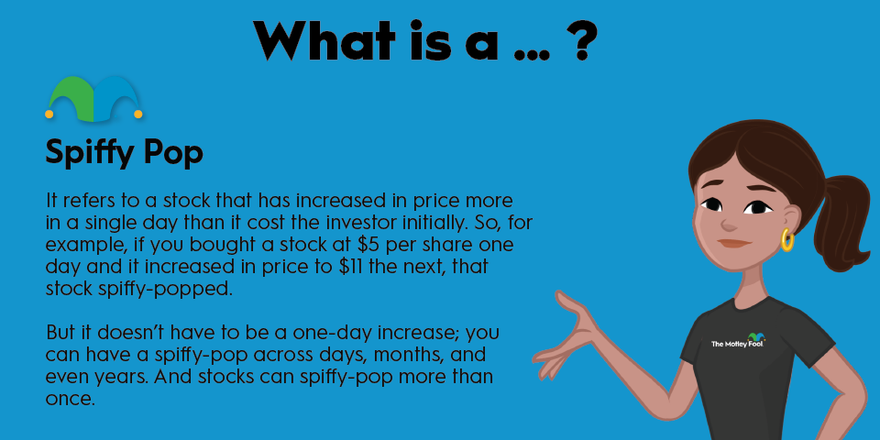

Spiffy pop is a term coined by The Motley Fool’s Rule Breakers community all the way back in 2007. It refers to a stock that has increased in price more in a single day than it cost the investor initially. So, for example, if you bought a stock at $5 per share one day and it increased in price to $11 the next, that stock spiffy-popped.

But it doesn’t have to be a one-day increase; you can have a spiffy-pop across days, months, and even years. And stocks can spiffy-pop more than once. The only hard and fast rule is that “spiffy is for closers,” according to Motley Fool co-founder David Gardner. Which is to say, your spiffy pop isn’t official unless the price you’re basing it on was the closing price for the market day (no spiffy pops allowed on morning highs or midday spikes).

Spiffy is for closers.David Gardner, co-founder of The Motley Fool

Spiffy pop versus daybagger

Spiffy pop versus daybagger

A lot of Motley Fool investing lingo comes about because the words we need simply don’t exist yet. There is a term for a stock that spiffy pops: It’s a daybagger. That means its price has increased by more than your cost-adjusted investment in your shares.

When Netflix (NFLX -0.53%) is a daybagger, it spiffy-pops. Spiffy pop is the verb that goes with daybagger. Rather than “daybaggering,” which sounds a little bit untoward, your stock spiffy-popped. It’s that simple -- no reason to make it any harder than it is. Spiffy pop is the verb, daybagger is the noun.

Day Bagger

Other types of spiffys

Other types of spiffys

There’s a small constellation of related terms. These have been created from the need to better describe what’s happening with an investment within Motley Fool communities. A few terms you might run into are:

Spiffy-drop: A spiffy-drop is when your stock value drops in price more in a single day than you paid for it. It’s kind of the antithesis of things that are spiffy. Most of the time, this doesn’t happen until the stock has already seen large gains, so it’s still in a net positive position.

Spiffy multipop: You might also see this referred to as something like a “spiffy three-pop.” Spiffy multipops happen when your stock not only spiffy-pops but does so several times over. If your stock increases by three times its original value in a single day, that’s a spiffy three-pop. (Very spiffy.)

Forget-me-pop: The spiffy-pop train can’t ride on forever; at some point, those daybaggers are predictable and not that much fun anymore. That’s why David Gardner decided that after big number 13 on any given stock, it’s time to start looking for new spiffy pops and stop counting the one that just keeps giving and giving. Number 13 is your forget-me-pop. (Of course, you can keep counting spiffy pops. We’re not your mom.)

Supernova: This is a rare type of spiffy pop involving any of the stocks most widely held by our Motley Fool Stock Advisor members. Generally, “widely held” means a stock is among the top 20 holdings in aggregate. When one of these stocks spiffy pops, it brings the whole community up, and we honor it with the moniker of supernova.

Examples of spiffy pops

Examples of spiffy pops

We have been keeping extensive records of the spiffy pops that have happened on our watch. One of the best known of our daybaggers has been Netflix. Netflix hasn’t just spiffy popped for longtime Stock Advisor members, it’s also gone supernova multiple times.

For example, Netflix first went supernova (remember, this is when a widely held Stock Advisor stock spiffy pops, which we absolutely love) on April 22, 2010, when it closed at $14.32. It had been trading for about (or less than) $7 in October 2009, so a lot of our members quickly saw a spiffy pop there.

Amazon (AMZN -1.0%) was another early spiffy pop, all the way back on July 25, 2007, when it traded for $4.31, having traded around $2 for the previous 12 months, including the previous day. This was a dramatic spiffy pop that really never stopped popping for those early Amazon investors.