If you think college is expensive now, it will only get worse. Tuition rises at more than twice the overall inflation rate, doubling every nine years. If you're a parent, you have several ways to save for your child's college education. Two popular options are 529 plans and Roth IRAs.

A 529 plan is specifically designed to save for college costs and graduate school. Annual distributions of up to $10,000 for K-12 tuition are also allowed under 2017 Tax Cuts and Jobs Act rules.

529 plans are administered by individual states, although you don't have to stick with your state's plan. A Florida resident can invest in a California plan or vice versa. Most 529 plans are investment accounts, but a few states also offer prepaid tuition plans. We'll focus on 529 investment accounts in this article because they're much more common.

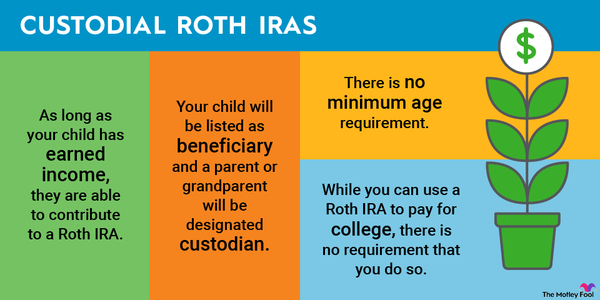

A Roth IRA is technically a retirement account. However, there are some benefits that make it a great vehicle for college savings, particularly if your family wants flexibility in how it uses the money.

If you're not sure which type of college savings account is best for you, here's an in-depth look at how the two compare in terms of investment options, contribution limits, withdrawal rules, and more.

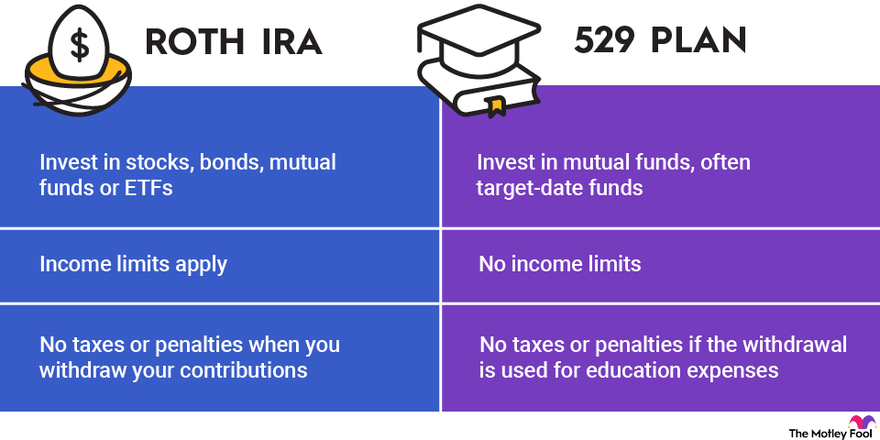

Roth IRA vs. 529 plan: How they stack up

Roth IRAs and 529 college savings plan contributions won't give you a tax deduction this year, although some states offer incentives to residents who invest in their 529 plans. One of the biggest differences between the two accounts is how distributions work.

With a 529 plan, you must use distributions for qualified college expenses as defined by the IRS. Otherwise, you'll owe a 10% penalty plus income taxes on withdrawals. Qualified expenses include the following:

- Tuition and fees

- Room and board

- Textbooks

- Electronics, such as computers or tablets

Some costs related to attending college don't qualify, including the following:

- Transportation and travel costs

- Insurance

- Extracurricular activities

You can withdraw your Roth IRA contributions for any reason whenever you want with no taxes or penalties. But the account earnings are usually subject to income tax plus a 10% penalty if you withdraw them before age 59 1/2 or before you've had the account for five years. You can avoid the 10% penalty, but not the tax bill, if you use the earnings toward qualified education expenses.

Now that you understand the basics of using a Roth IRA and a 529 plan for higher education, let's take a more in-depth look at the pros and cons of each.

Roth IRA pros and cons

Saving for college in a Roth IRA may make sense if:

- You aren't sure if your child will go to college, and there's no one else in the family who plans to attend.

- You want the flexibility to use the money for your retirement if you choose.

- You want more control over the investments.

- You can limit your withdrawals to the final two years of college if your child will need financial aid.

Using a Roth IRA for higher education expenses has its drawbacks, including:

- Mixing your savings for your child's college and your own retirement can make it difficult to track your progress.

- Withdrawing money in the first two years of college can significantly reduce the financial aid award.

- You'll still owe income taxes on the earnings you withdraw for college.

- Your savings potential is constrained by contribution and income limits.

529 plan pros and cons

A 529 plan is a better option than a Roth IRA if:

- You have limited retirement savings.

- You have more than one child, or there's another family member you'd consider naming the beneficiary if your child opts not to go to college.

- Your child will need financial aid for all four years of college.

- You want to contribute more than a Roth IRA allows in a single year.

- Your income is too high for you to contribute to a Roth IRA.

- Family members or friends want to contribute.

The downsides to a 529 plan include:

- You'll pay a 10% penalty and income taxes if you don't use the money for IRS-approved education expenses.

- Your investment options are often limited to mutual funds.

- Significant 529 assets could reduce financial aid.

Key rules for Roth IRAs and 529 plans

The following table provides a brief summary of some of the key rules relating to Roth IRAs and 529 plans for college education.

| Rules | Roth IRA | 529 Plan |

|---|---|---|

| Investment options | Whatever stocks, bonds, mutual funds, or ETFs you choose. | Mutual funds, often target-date funds. |

| Contribution limits |

$7,000 a year in 2024 ($6,500 in 2023) if you're younger than 50. Additional $1,000 catch-up contribution allowed if you're 50 or older. |

No contribution limits. Aggregate limits range from $235,000 to $553,098, depending on the state. |

| Income limits | Income limits apply. | No income limits. |

| Withdrawal rules |

No taxes or penalties when you withdraw your contributions at any age. No 10% penalty when you withdraw the earnings for educational expenses before you're 59 1/2, but you'll owe income taxes. |

No taxes or penalties if the withdrawal is used for qualified education expenses. 10% penalty plus income taxes if the withdrawal is for non-education expenses, although some exceptions apply. |

| FAFSA rules |

Parent-owned assets don't count against financial aid. Distributions count as income, even if you limit them to your contributions, and could reduce aid by up to 47%. |

Parent-owned 529 plan assets count against financial aid and can reduce aid by up to 5.64%. Distributions don't count as income on the FAFSA. |

Roth IRA vs. 529 plan: Investment options

Your investment options in a 529 plan are limited to a selection of mutual funds. While some plans allow you to craft your own investment strategy by choosing the funds you'd like to invest in, most families opt for target-date funds, which gradually shift to more conservative assets as your child gets closer to college.

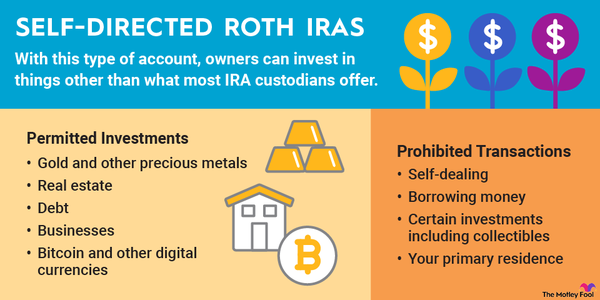

A Roth IRA gives you the freedom to invest however you choose. You can invest in any stocks, bonds, exchange-traded funds (ETFs), and mutual funds that appeal to you. However, if your child will need that money for college in the next few years, it's essential that you avoid high-risk investments. Exposing yourself to too much risk could leave you without enough money to cover the full cost of a college education.

Roth IRA vs. 529 plan: Contributors

You are the only person who can fund your own Roth IRA (with the exception of spousal IRAs).

However, anyone can contribute to a 529 plan: grandparents, aunts and uncles, family friends, etc. Many plans have gifting platforms that make it easy to ask for contributions. For example, you could give friends and family the option of giving to your child's 529 plan as a birthday gift.

Roth IRA vs. 529 plan: Income and contribution limits

You can contribute as much as you like to a 529 plan, regardless of your income. These plans do have aggregate limits, but they're high, ranging from $235,000 to $553,098, depending on the state.

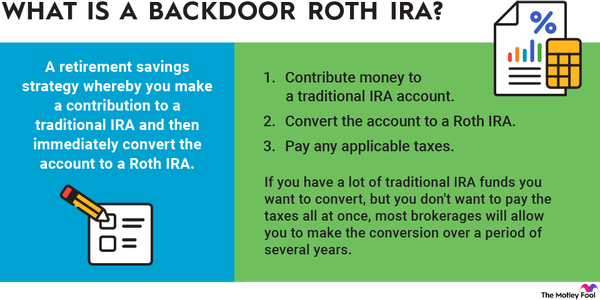

For the 2024 tax year, Roth IRA contributions are limited to $7,000 per year, or $8,000 for savers older than 50, plus income limits apply. (There is a complicated "backdoor" method of contributing for higher-income people, though.)

Roth IRA vs. 529 plan: Effects on financial aid

Your 529 savings will count as parent-owned assets if your child fills out the FAFSA to get financial aid. That means they could lower the amount of aid your child receives, although the impact is minimal. At most, parent-owned assets reduce the award by 5.64%.

Roth IRA savings don't count as assets on the FAFSA, so they won't affect your child's financial aid. However, Roth IRA withdrawals do count as income, even if you limit them to your contributions. Income is weighted much more heavily than assets for financial aid. Roth IRA distributions could reduce your child's award by as much as 47%.

However, the FAFSA looks back on tax returns from two years prior to calculate financial aid. For instance, aid for the 2024-2025 school year is based on 2022 tax returns. If you can wait until the last two years of your child's college career to take a Roth distribution, it won't affect any potential financial aid arrangements.

Roth IRA vs. 529 plan: When kids don't attend college

At first glance, Roth IRAs seem to win on flexibility. After all, if your child doesn't go to college or needs less money than you expected, you can always use the funds for your own retirement.

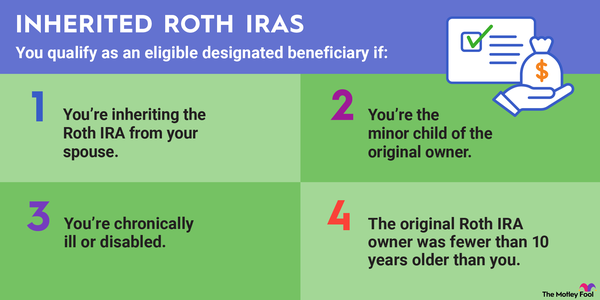

But 529 plans offer some flexibility, too. You can change the account beneficiary to another family member if your child doesn't need the money. The 10% penalty also may not apply if your child earns a scholarship, attends a military academy, becomes disabled, or dies.

Roth IRA vs. 529 plan: Why not both?

If you're still not sure whether a Roth IRA or a 529 plan is a better choice for you, you can always use a combination of the two.

One strategy financial planners often recommend: Max out Roth IRA contributions first, and then invest additional funds in 529 plans for your kids. If you have the resources, there's no reason not to contribute to both a Roth IRA and a 529 plan. Your kids will thank you when they graduate without the crushing weight of excess student loans.