You can find information about a company's debt and how much interest it pays to service its debt, but the actual interest rate it pays is generally not included in its financial statements. While many companies carry different types of debt (long-term, short-term, etc.) with different interest rates, it's possible to calculate a company's overall interest rate from information found on its income statement and balance sheet.

How to calculate

Calculating an interest rate

To calculate an interest rate, you'll need a few pieces of information:

- The interest expense, which you can find on a company's income statement.

- The time period the income statement covers, usually one quarter or a full year.

- The principal balance of the company's debt, which can be found on its balance sheet. Make sure you add up long-term, short-term, and current long-term debt.

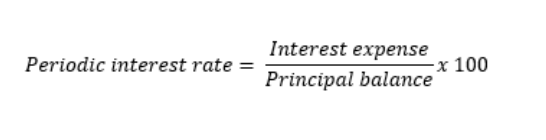

Once you have this information, the calculation is pretty straightforward. Simply divide the interest expense by the principal balance and multiply by 100 to convert it to a percentage. This will give you the periodic interest rate, or the interest rate for the time period covered by the income statement.

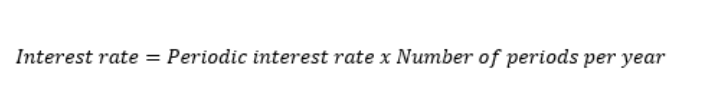

If the information came from the company's annual income statement, you're done. In this case, the periodic rate is the interest rate paid on the debt. On the other hand, if the income statement covers a shorter period of time, such as a quarterly or monthly income statement, multiply this result by the number of time periods in a year. For example, if you're using a quarterly income statement, multiply the periodic interest rate by four.

Related investing topics

Related investing topics

Example

An example

To illustrate this point, let's look at some data from Procter & Gamble's (PG -2.75%) financial statements from the first quarter of 2016. During the quarter, the company paid $146 million in interest expenses and had debt of $32.8 billion on its balance sheet.

Using the formulas listed, we can determine the periodic interest rate to be 0.45%. Since this data came from quarterly financial statements, multiplying this result by four implies that Procter & Gamble paid an overall interest rate of 1.9% on its debts during the first quarter.

If you're reading this because you want to learn more about stocks and how to invest, check out The Motley Fool's Broker Center and get started today.

This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Your input will help us help the world invest, better! Email us at [email protected] . Thanks -- and Fool on!