IRAs have a very clear purpose: to help you save for retirement. Individual retirement accounts can be a great supplement to your employer-sponsored plan, or you can use them to house all your retirement funds.

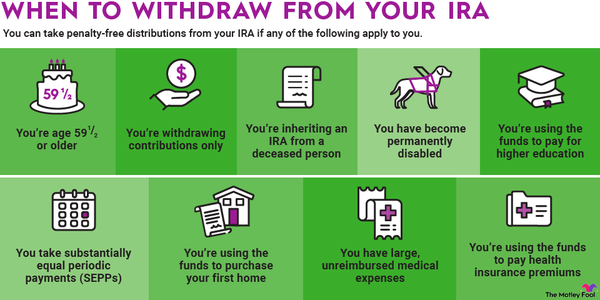

However, in certain circumstances, you can access your IRA early. In other cases, you may even be able to work within the IRS rules to borrow from your IRA. This all depends on your personal circumstances, so be sure to know the IRA rules before taking a distribution.

Type-based borrowing

Q: Can you borrow from an IRA?

While you can't borrow from an IRA in the traditional sense, there is a way to remove money from an IRA and then replace it within a specified period without incurring a penalty.

Under the 60-day rule, an IRA account owner may take money out as long as it is returned in full within 60 days, beginning from the original withdrawal date (more on that below). While this isn't technically borrowing in a principal-plus-interest sense, it serves a similar function -- with caveats.

Q: Can you borrow against a Roth IRA?

Not really. Like a traditional IRA, a Roth IRA is meant for long-term saving and investing and is specifically intended to fund retirement expenses. But there are ways to circumvent this intent. You're permitted to withdraw Roth IRA contributions at any time, regardless of your age, so there is a way to access some Roth money early.

Q: Can you borrow from an inherited IRA?

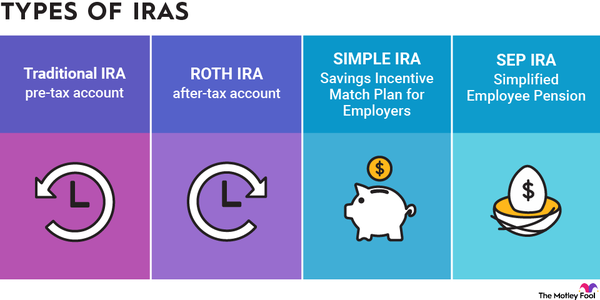

No. An inherited IRA is the one type that doesn't allow contributions or 60-day rule transactions. Once the money's out, it's out. The IRS wants you to liquidate these accounts as soon as possible. This way, you will pay income tax sooner, but you also have access to the funds sooner. With the recent elimination of the stretch IRA under the new inherited IRA rules, in most cases you'll now need to liquidate these accounts within 10 years of inheriting one if you're a nonspouse beneficiary.

Q: Can you borrow against a SEP-IRA?

Again, not really, but you are able to remove money and then replace it within 60 days. The IRS makes it difficult to do this because a SEP-IRA, much like the other IRAs on this list, is intended to help cover your retirement expenses, not fund short-term goals. If you do choose to remove money, you'll need to ensure all of it is paid back within a 60-day period to avoid taxes and penalties.

Q: Can you borrow against a traditional IRA?

Not in the true sense, but there are many ways to access IRA funds in the event of an emergency (if you were to become disabled) or a milestone life event (purchasing a home for the first time or having a child). The amounts tend to be on the smaller end, so tapping your retirement to fund these expenses is generally not recommended as a first option.

Circumstance-based borrowing

Q: Can you borrow from an IRA to buy a house or do home improvements?

You are able to access certain IRA funds to help you buy your first home. In the case of a traditional or Roth IRA, you're able to withdraw up to $10,000 without penalty to assist in your first home purchase. Under the Roth IRA rules, you can access your contributions (but not your earnings) at any time without tax or penalty.

The same provision does not exist for home improvements. You could, in theory, remove money from a traditional IRA, pay for home improvements, and then return the full withdrawal amount to your account within 60 days without taxes or penalty. However, it would be rather unusual for this to be a recommended personal finance option.

Q: Can you borrow from an IRA to buy a car?

There isn't any specific provision that would allow for this, but, as with the above example, it would be technically permissible for you to remove money from your IRA, buy a car, and then return the full proceeds to your IRA within 60 days. This might work if you're expecting a large cash inflow during that 60-day period. This is all to say that using IRA funds to buy a car -- unless you're already retired -- is not the best idea.

Borrowing rules

Q: Can I borrow from my IRA for 60 days?

As mentioned above, many IRA types (specifically excluding the inherited IRA) allow for the 60-day rule. This means you can take money out of your IRA as long as it is returned in full within 60 days of the original withdrawal.

For example, if you take $10,000 from your IRA and 10% is withheld for federal tax, you'll receive $9,000 in cash, but you still must return $10,000 to your IRA by the end of 60 days.

One wrinkle here is that you can only do this once within a 12-month period. It is also not "borrowing" in the traditional sense. It's really meant to allow for IRA rollovers, but it can accomplish the desired result.

Q: Can you borrow from an IRA without penalty?

Yes, but you'll need to follow the 60-day rule described above. In general, whenever the IRS says you can do something and then provides a list of stipulations for avoiding a penalty, it's best to consider the action a last resort.

Q: How much does it cost to borrow from your IRA?

While you won't pay any taxes, penalty, or interest if you borrow from your IRA and then return the money in full within 60 days, you need to be extremely careful. If you fail to comply with any aspect of the 60-day rule, it can cost you quite a bit, including the opportunity cost of tax-advantaged growth in your retirement account. It also costs peace of mind to know that you're up against so many restrictive rules.

Q: How much can I borrow from an IRA?

You can borrow the entire balance if you want, but that means you'll need to return the entire amount (pre-tax) to avoid unnecessary costs.

Related retirement topics

Key takeaways

Borrowing from your IRA is possible, but it is not recommended. There are also ways to qualify for an early distribution for qualified expenses such as buying a home, but these IRA distributions fall under an exception and do not need to be returned to your IRA. Keep in mind that they call it an individual retirement account for a reason. Your IRA is meant for retirement, and it's by far the best idea to use it for its intended purpose.