There are many ways to measure a company's profitability. One key metric is net profit margin, which quantifies how much revenue a company keeps after paying all its expenses.

We'll take a closer look at this profitability measure by exploring:

- What is net profit margin?

- How to calculate net profit margin.

- How to evaluate a company using net profit margin.

- What are the limitations to net profit margin?

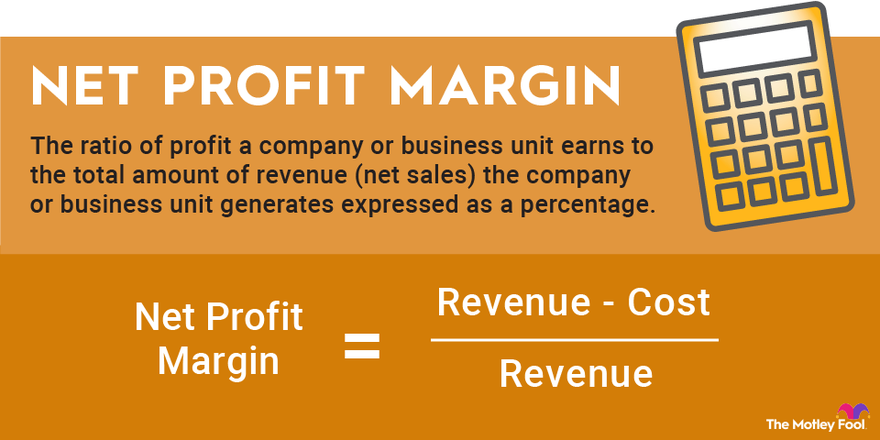

What is net profit margin?

What is net profit margin?

Net profit margin, also known as net income margin or net margin, is the ratio of profit a company or business unit earns to the total amount of revenue (net sales) the company or business unit generates. Net profit margin is expressed as a percentage. Net profit is what remains after accounting for all expenses, including operating costs, interest, and taxes. In a nutshell, net margin is the percentage of a company's revenue that it keeps as profit.

Calculating a company's net profit margin helps investors evaluate the relative amount of profit the company produces from its revenue. A key indicator of overall financial health, net margin is also an excellent metric to use to compare a company with its competitors. This metric can signal whether a business is doing a comparatively better or worse job of controlling its expenses.

How to calculate net profit margin

How to calculate net profit margin

The calculation of a company's net profit margin for any given reporting period is relatively straightforward. Net profit margin equals a company's net income -- either listed as such in its financial statement or can be calculated as revenue minus the cost of goods sold, operating and other expenses, interest, and taxes -- divided by revenue. That result is multiplied by 100 to convert the net margin ratio into a percentage.

Here's the formula for net profit margin:

Let's say a company generates $1 billion of revenue and $225 million of net income during a reporting period. The company's net margin equals its net income ($225 million) divided by its revenue ($1 billion). Multiplying that result by 100 yields the value of 22.5% for the company's net profit margin.

It's worth noting that net margin can be positive or negative. A negative net profit margin means the company or business unit was unprofitable during the reporting period.

How to evaluate a company using net profit margin

How to evaluate a company using net profit margin

Net margin can help investors compare a company's performance across reporting periods and among its competitors. If a company undertakes a strategic initiative to increase its profitability, then investors can calculate net profit margin to evaluate whether that initiative is delivering results. If the company's net margin is in decline, then investors can use that information to recognize deteriorating financial health.

A company with a higher net profit margin than those of its peers is more efficiently converting revenue into profit. If a company's net margin is lower than those of its industry peers, then that could be a sign it is financially weaker or less efficient than its rivals.

What are the limitations to net profit margin?

What are the limitations to net profit margin?

While net profit margin is a useful metric, it has some limitations. For example, it is not a good gauge for comparing companies in different sectors. That's because in some industries, low-single-digit net profit margins are considered quite good, while in other sectors, double-digit net profit margins are the norm.

Another limitation of the net margin metric is that it can vary greatly across reporting periods due to the potentially outsized effects of one-time events. Asset sales can temporarily boost income, inflating the net margin. Likewise, one-time expenses can weigh heavily on a company's profitability for a reporting period. Because of this, it's important to understand the factors that influence net profit during any given period to determine whether calculating net margin is appropriate to evaluate the company.

Net profit margin is just one of many metrics that investors can use to analyze a company, and it is certainly not the sole metric that determines the worthiness of a stock investment.

The bottom line

Investors can calculate net profit margin to understand how well a company converts revenue into net income. Further, despite its limitations, net profit margin is a good comparative metric to measure whether a strategic initiative is improving profitability or if a company is better at generating net income than its peers.