The thought of learning and understanding a bunch of seemingly complicated accounting concepts can strike fear into the hearts of small business owners.

However, if you take a little time to familiarize yourself with the basics of accounting, you’ll likely find it’s not as difficult as you may have imagined. We’re here to show you some important accounting basics every small business owner should know and understand.

At a glance: The accounting basics small business owners should know

- Bookkeepers record financial transactions, while accountants provide analysis of what those transactions mean. As a business owner, you’ll likely be doing a bit of both.

- Double-entry accounting is the best way to ensure that your accounts remain in balance.

- Debits and credits are the heart of accounting. These entries can both either increase or decrease an account balance, depending on the type of account.

- Financial statements provide you with the information needed to make both short-term and long-term decisions about your business.

Accounting definition and glossary

While accounting may appear to be intimidating to business owners, just about anyone can easily understand bookkeeping basics.

Familiarizing yourself with common accounting terms can go a long way towards making you much more comfortable with the entire accounting process.

1. Double-entry accounting

Double-entry accounting means every transaction entered into your accounting system or ledger will affect at least two accounts. For every debit entry you make, you will need to make a corresponding credit entry.

Likewise, if you’re making a credit entry, you will have to make a corresponding debit entry. This ensures that your accounts remain in balance. While sole proprietors and freelancers may not need to employ double-entry accounting, small and growing businesses will be better served by doing so.

2. Debits and credits

Debits and credits are used to record all of your small business bookkeeping and accounting transactions. The effect that a debit or credit has on a particular account is largely dependent on the account type being affected.

| Types of account | Increases balance | Decreases balance |

|---|---|---|

| Assets | Debit | Credit |

| Liabilities | Credit | Debit |

| Revenue | Credit | Debit |

| Expenses | Debit | Credit |

| Equity | Credit | Debit |

For instance, if you post a debit transaction to an asset account, it will increase the balance of that account, while if you post a debit to a liability account, the balance of that account will be decreased.

A debit is always on the left side of any accounting transaction, while a credit is always on the right side of the transaction.

3. Chart of accounts

Your chart of accounts is the heart of any accounting system and lists all of the accounts found in your general ledger, which is where all of your accounting entries reside.

You should create the chart of accounts prior to recording any financial transactions. Fortunately, most small business accounting programs include a default chart of accounts that the majority of small businesses can use, with the ability to add more accounts if necessary.

4. Cash accounting method

After setting up your chart of accounts, you will need to decide what type of accounting method you will use. Many freelancers and sole proprietors use the cash accounting method, which records cash when it is received and expenses when they are paid, and it does not keep track of accounts payable or receivable balances.

5. Accrual accounting method

If you have employees or you sell products, you should be using the accrual accounting method. This method records all revenue/income and expenses as they occur, not when your customer pays or you write a check for a bill.

Accrual accounting provides a much clearer picture of both income and expenses for a specific period of time, but it can make it more difficult to manage cash flow properly.

6. Assets

An asset is anything of value that your business owns. Assets can include the cash in your bank account, your accounts receivable balance, the building you own, inventory, supplies, computer equipment, and furniture. Assets can also be intangible, such as intellectual property.

7. Liabilities

Liabilities are anything your business owes. Your accounts payable balances are considered liabilities because that’s what you currently owe your vendors. Loans are also considered a liability.

8. Revenue and income

Revenue, or income, is any monies received during the course of conducting business, whether that’s selling products or services.

9. Expenses

Everything from paying your employees to paying your electric bill is considered an expense. For instance, when you enter an electric bill to be paid next month, that’s recorded as an expense. An expense report helps you track your business expenses so you can know where your money is going

10. Equity

Equity represents your current financial interest in your business and is derived from subtracting your total liabilities from your total assets.

11. Accounts payable (A/P)

Accounts payable is a record of bills that have been entered into ledger or accounting software, but have not yet been paid. Once a vendor has been paid, the A/P balance is reduced by that amount.

| Date | Account | Debit | Credit |

|---|---|---|---|

| 10-25-19 | Utility Expense | 200 | |

| 10-25-19 | Accounts Payable | 200 |

When the electric bill is paid the following month, the entry would be:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 10-25-19 | Accounts Payable | 200 | |

| 10-25-19 | Cash Account | 200 |

You can see that the initial entry in A/P is a credit, which increases the balance of that account. Once that bill has been paid, A/P is reduced by the amount of the payment, while your cash account is reduced as well.

12. Accounts receivable (A/R)

Accounts receivable is where all of the funds currently owed to your business are recorded until paid by your customers. Once a customer pays their bill, the A/R balance is reduced. You can use A/R to acquire insight into your business operations by calculating the accounts receivable turnover ratio.

13. Aging

Both A/P and A/R accounts include aging, which is simply a way to manage monies coming in or monies going out. A/P aging displays a list of all bills currently owed vendors and suppliers, tracking due dates and advising you when a payment is due, or when it is late.

A/R provides the same information for outstanding customer payments, again advising you when a customer payment is late. Once you have multiple customers or vendors, aging reports can become invaluable to your business.

14. Journal entries

While your accounting software will likely handle the majority of the entries needed for your business, there may be occasions when you will need to enter a journal entry.

This can happen for things such as bank charges that you may find when you reconcile your bank account at the end of the month. Or, it can be for depreciation entries if you’re recording depreciation for big-ticket items (such as building purchases, expensive computer systems, or the purchase of a company vehicle).

All of these transactions will need to be entered into your accounting software by making a journal entry.

How to set up an accounting system for your small business

Fortunately, today’s small business accounting software applications such as QuickBooks Online, Xero, and FreshBooks are designed to make it easy to set up your business.

While small business owners can use spreadsheet software, it’s really in your best interest to find accounting software that you’re comfortable using, and begin setting up your business.

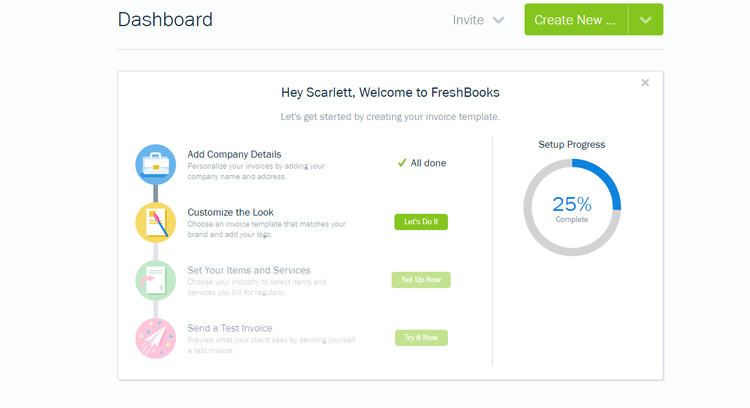

Many accounting software applications such as FreshBooks offer expedited setup. Image source: Author

Step 1: Create a chart of accounts

Again, using accounting software, this process is usually automated and quite painless, with most small business owners able to use the default chart of accounts provided in the software.

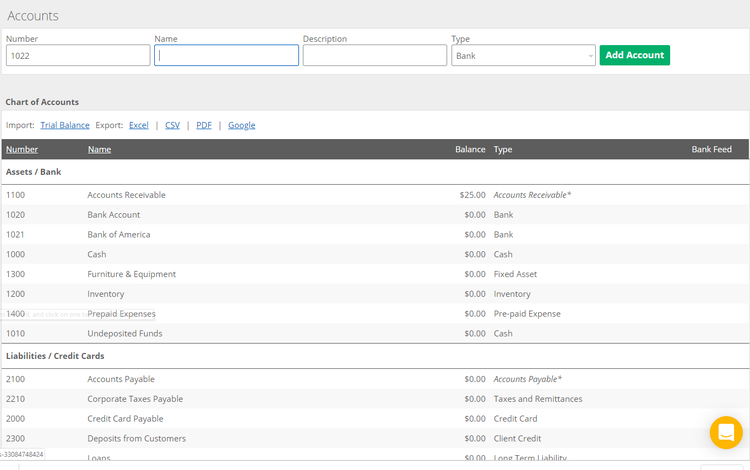

Accounting software applications like Image source: Author

Kashoo offer a default chart of accounts to use. Source: Kashoo software.

Step 2: Determine your accounting method

Prior to entering transactions, you will need to determine if you want to use the simplified cash accounting method or the more comprehensive accrual method. Remember, if you have employees or manage a lot of inventory, accrual should be your preferred method.

Step 3: Set up beginning balances, if any

If you’re a new business owner, you won’t have beginning balances, but those transitioning from spreadsheet software or another accounting application will need to enter their beginning balances into the appropriate general ledger accounts.

Step 4: Begin entering transactions

Once you’ve created your chart of accounts, chosen your accounting method, and entered your beginning balances into your current software application, then you can begin to enter your financial transactions.

Ways accounting software can help with your financials

Years ago, small business owners often found themselves completely lost when it came to understanding and navigating accounting software.

Today, these applications have made the entire process much easier, using intuitive data-entry screens while replacing outdated terms with familiar vocabulary that most of us are already familiar with.

In fact, using accounting software can result in the following:

- A reduction in errors: Accounting software is designed to accurately capture your financial transactions, such as expenses and writing invoices, and reduce input errors. While it’s easy to forget to enter the second part of a transaction in a spreadsheet, using accounting software, you’ll be immediately prompted should you forget.

- More free time: Inputting all of your transactions in a spreadsheet can be time-consuming. Entering this information manually in separate ledgers can be even worse. When using accounting software, you’ll find that you actually have more free time to spend on your business, instead of doing accounting work.

- Access to comprehensive financial reports: Creating financial statements from spreadsheets is a recipe for disaster. Instead, it takes about 30 seconds to create a comprehensive set of financial statements such as a balance sheet, income statement, and cash flow statement using accounting software.

Finding the right accounting solution for you

With the help of accounting software, you can have your business on solid financial footing in no time.

If you’re still struggling to find the software that’s right for you, or decide between two options, such as FreshBooks vs. Quickbooks, be sure to check out our accounting software reviews.

Many of the applications offer a free demo that allows you to test-drive the software prior to purchasing.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.