If you invest in bonds, you probably do so for the interest income, also known as coupon payments. You may expect the interest payments to continue until the bond reaches its maturity date. But if the bond is callable, those coupon payments could end sooner than you expected.

What is a callable bond?

What is a callable bond?

A callable bond is a bond that the issuing corporation or municipality can “call” or redeem before it reaches its maturity date. Callable bonds are also known as redeemable bonds.

Bonds are typically called when interest rates drop. Issuers typically include a call provision that allows them to redeem their bonds early, which allows them to refinance the debt at a lower interest rate.

Investors who depend on bonds for fixed income face what’s known as call risk with callable bonds compared to non-callable bonds. If the issuer redeems the bond early, the interest payments will end early. Investors who seek to re-invest their money in the bond market will have to do so at lower interest rates. Because of call risk, bond investors require a higher yield for a callable bond vs. a non-callable bond.

How callable bonds work

How callable bonds work

Suppose you buy a bond from Company XYZ that has a 10-year maturity date and pays a 6% annual coupon. The bond’s face value is $1,000, which means Company XYZ agrees to repay you $1,000 when the bond matures in 10 years. In each of the 10 years, you’ll receive $60 in interest since the bond’s annual coupon is 6%.

But suppose the bond is callable and interest rates drop to 3%. Just as you might want to refinance your 6% mortgage if interest rates dropped to 3%, Company XYZ will want to refinance its debt to save money on interest.

If Company XYZ redeems the bond before its maturity date, it will repay your principal early. In some cases, you'll get a bonus payment. Or the bond may be callable at a price higher than par. For example, if the bond purchase agreement states that the bond is callable at 103, you'd receive $1.03 for every $1 of the bond's face value.

Types of callable bonds

Different types of callable bonds

There are several different types of callable bonds that vary based on when the issuer is allowed to redeem the bond.

- American calls: The issuer can redeem the bond at any time until its maturity date.

- European calls: A one-time only call, i.e., the issuer can only redeem it once on a predetermined date.

- Bermuda calls: The issuer can redeem the bond at predetermined dates on a schedule. Bonds may be redeemed monthly, quarterly, or annually, for example.

- Canary calls: The bond is callable up to a certain date, after which the issuer can't redeem it early.

- Verde calls: The issuer can redeem the bond on predetermined dates, but the dates on which the bond is callable become less frequent over time.

Bonds

Bond interest rates

Interest rates and callable bonds

In general, bonds and interest rates have an inverse relationship. When interest rates rise, the prices of existing bonds drop because investors can buy newly issued bonds that pay a better coupon rate. If interest rates drop, you can sell bonds at a premium because new issues will pay less interest.

Understanding the general relationship between interest rates and bonds is helpful in understanding how callable bonds work. If interest rates rise, a bond issuer is unlikely to redeem its bonds. Just as you wouldn't want to refinance your mortgage after interests raise rise, companies and municipalities typically don't want to redeem their bonds in a higher-interest-rate environment. Issuing new bonds at prevailing interest rates would cost them more money.

However, issuers are likely to exercise a call provision after interest rates have fallen. When that happens, they can pay back the principal of existing bonds, then issue new ones at lower interest rates.

Pros and cons of callable bonds

Pros and cons of callable bonds

As with any investment, there are pros and cons to consider with callable bonds. Here are a few important considerations:

Advantages of callable bonds

- Investors can receive a higher yield for investing in callable bonds vs. noncallable bonds.

- Callable bonds could be a compelling investment if you believe interest rates will hold steady or rise.

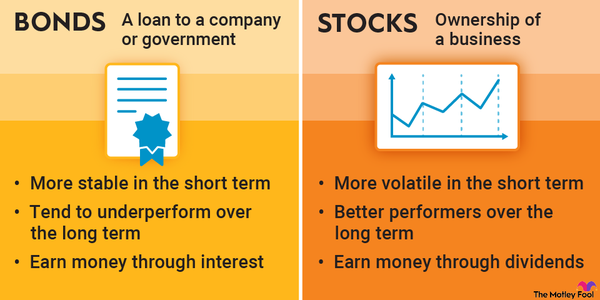

- Although riskier than noncallable bonds, a callable bond is still typically less risky than investing in stocks.

Disadvantages of callable bonds

- If interest rates fall and a callable bond is redeemed, investors lose a source of fixed income.

- Investors may be forced to put their money in lower-yielding bonds if interest rates drop.

- Whenever you invest in bonds vs. stocks, your potential returns are lower.

Example of callable bond issuances

Example of callable bond issuances in the real world

In 2015, U.S. corporations issued about four times the amount of callable debt they issued in 2005. While the bond market can be extraordinarily complex, the financial crisis was likely a key culprit. As central banks slashed interest rates to stimulate economic recovery, corporations issued more callable bonds to give themselves an opportunity to refinance their debt at a lower rate.

Also, many corporations saw their credit ratings tumble during the financial crisis. When a company is less creditworthy, it pays higher interest rates. Corporations whose creditworthiness took a hit likely issued callable bonds in hopes of improving their creditworthiness and eventually issuing new debt at a lower rate.

Related investing topics

Should you buy callable bonds?

To determine whether to invest in callable bonds, you need to consider the right mix of stocks vs. bonds in your portfolio. Even though callable bonds offer a slightly higher yield than noncallable bonds, stocks are typically a much bigger driver of growth in your portfolio. For most investors, particularly those who have a long time until retirement, stocks should make up the bulk of their investment portfolio.

From there, consider the purpose of bonds in your portfolio. If you're relying on a steady income, you may be better off taking a slightly lower yield and sticking with noncallable bonds. If you opt for callable bonds, consider how you'd reinvest your money if interest rates drop and your bonds are redeemed.

Callable bond FAQs

Why do investors like callable bonds?

Investors like callable bonds because they offer a slightly higher yield than noncallable bonds. Investors who believe interest rates will rise may prefer to take that higher yield despite the call risk since issuers are less likely to redeem bonds when interest rates rise.

What happens to callable bonds when interest rates rise?

Callable bonds are less likely to be redeemed when interest rates rise because the issuing corporation or government would need to refinance debt at a higher rate. As with other bonds, callable bond prices usually drop when interest rates rise.

What are the disadvantages of investing in callable bonds?

If interest rates drop, the issuer of a callable bond is likely to exercise the call option and issue new bonds at lower interest rates. Fixed-income investors will lose the steady stream of income and will likely need to put their money in a lower-yielding investment unless they're willing to accept more risk.