According to the Bureau of Labor Statistics, only about 44% of workers participate in defined contribution plans such as 401(k)s. If you have a 401(k) retirement savings plan available at your workplace, you might be wondering how safe it is and whether you should participate.

The answers to those questions are yes, 401(k)s are rather safe, and yes, you should probably be making the most of one if it's available to you. Let's explore those answers in a bit more detail, though.

Image source: Getty Images.

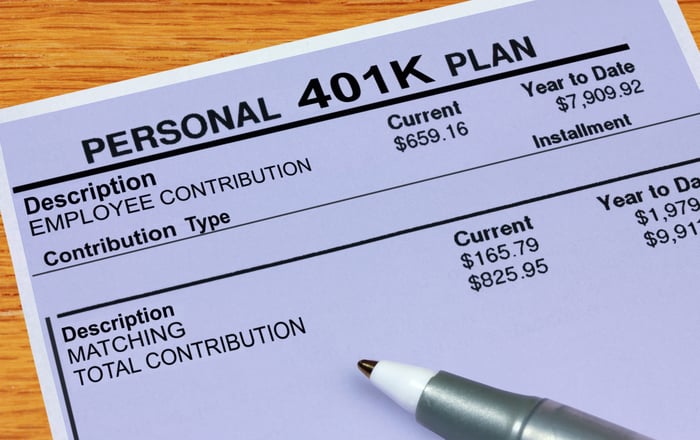

Should you participate in a 401(k) plan?

Most people should absolutely participate in a 401(k) plan. For one thing, 401(k) plans offer tax breaks while you save for retirement -- and saving for retirement is a rather critical and non-optional thing for most of us to do, since so few of us have pensions to look forward to.

With a traditional 401(k) plan (as with traditional IRAs), you contribute pre-tax money that reduces your taxable income and, therefore, your tax bill for the year. So if you earn $70,000 and contribute $10,000 to your account, your taxable earnings drop to $60,000, letting you avoid being taxed on the $10,000 contribution. If you're in the 25% tax bracket, you'll avoid paying $2,500 in taxes in the year of the contribution. When you withdraw the money in retirement, it will be taxed as ordinary income to you. (Another benefit: You may well be in a lower tax bracket in retirement.)

Image source: Getty Images.

Increasingly, 401(k) plans are offering Roth versions. With a Roth account, as with a Roth IRA, you contribute post-tax money that doesn't deliver any upfront tax break. (Earnings of $70,000 and a $10,000 contribution? Your earnings remain at $70,000.) But you eventually get a big tax break when you withdraw money from the account in retirement – because you get to take all the money out of the account tax-free if you follow the rules.

Meanwhile, 401(k) plans have relatively hefty contribution limits, allowing you to sock away a lot. The annual contribution limit for 2016 and 2017 is $18,000, plus an extra $6,000 for those 50 or older. That's much more than the limit for IRAs, which is $5,500 (plus $1,000 for those 50 and older) for both 2016 and 2017.

Check out how much money you can accumulate if you sock away the following sums annually and earn an average annual return of 8%:

|

Growing at 8% For: |

$5,000 Invested Annually |

$10,000 Invested Annually |

$15,000 Invested Annually |

|---|---|---|---|

|

15 years |

$146,621 |

$293,243 |

$439,864 |

|

20 years |

$247,115 |

$494,229 |

$741,344 |

|

25 years |

$394,772 |

$789,544 |

$1.2 million |

|

30 years |

$611,729 |

$1.2 million |

$1.8 million |

Data source: calculations by author.

If you accumulate a $500,000 nest egg and follow the flawed but helpful "4% rule," which is a way to plan on making your money last for about 30 years, you'll withdraw 4%, or $20,000, in the first year and then adjust future withdrawals for inflation. Clearly, that's significant retirement income. (Note that the average Social Security retirement benefit was recently only $1,360 per month, or about $16,000 per year.)

Image source: Getty Images.

How safe is your 401(k)?

So how safe is your 401(k)? The question can be answered in a few different ways.

Will your money in a 401(k) be safe from market downturns? If you've invested some or all of it in mutual funds that are invested in stocks, then no: If the market plunges in value, your investments in various stock mutual funds will also probably lose value. That's when inexperienced or naive investors might bail, not realizing that the market will always have occasional downturns before recovering and going on to reach new highs. You may be able to invest in less volatile, non-stock securities in your 401(k), but know that they may not grow your assets as quickly.

Next, is your 401(k) safe from your employer going out of business? Generally, yes -- because employers typically don't manage retirement accounts on their own. Instead, they employ third-party administrators such as Fidelity or Vanguard to do that work. (Fidelity, for example, recently managed about 14 million 401(k) accounts.) The money that's rerouted from your paycheck into your 401(k) goes to them, to manage in your 401(k) account. (Of course, if your plan administrator is Scruffy's Retirement Accounts and Fried Chicken, you might want to take a closer look into its trustworthiness.)

Here's how Fidelity offers assurance:

The assets of our customers -- whether in brokerage accounts, mutual funds or other investment vehicles -- belong to them. These assets cannot be handled in any manner that deviates from stated investment objectives or brokerage agreements. As a provider of record-keeping services for retirement plans, Fidelity's services are governed by federal law, which generally requires that defined contribution plan and other retirement plan assets be held in trust, segregated from an employer's or record keeper's assets. As a result, were a provider of record-keeping services, such as Fidelity, or your employer to face financial issues, your account would be protected from creditors of the employer and the record keeper.

Image source: Getty Images.

When "safe" isn't safe

Most 401(k)s plans will offer you a limited menu of investment options -- typically they will be a handful of mutual funds focused on stocks, bonds, or a combination of the two (such as in "target-date" funds).

It's possible to contribute a lot to your account each year but not see your nest egg grow very quickly, if you've parked your money in choices that are simply conservative and/or charge hefty fees. Bonds, for example, have tended to underperform stocks over long periods. You may think you're playing it safe, but if you don't build a cash war chest that's sufficient to meet your needs in retirement, it won't have been the safest route.

It's also possible to invest 401(k) money in a fixed annuity -- but know that you don't need a 401(k) to invest in one, and buying one outside a 401(k) plan can be more cost-effective. And other kinds of annuities, such as variable or indexed ones, can be quite problematic, charging steep fees that erode your gains and featuring restrictive terms and complicated fine print. Some can lose money, too, making them even less "safe."

401(k) plans can help you build a significant war chest for retirement, but they're not without possible problems. Learn more about the investment options within your plan and be sure to choose low-fee investments that are likely to deliver growth, such as stock market-based index funds. If you don't see low-cost stock index funds among your choices, ask your plan administrator about adding them.