Roth 401(k)s have become increasingly common and can be a good option for retirement savers. Unlike with traditional 401(k)s, which allow pre-tax contributions but have taxable withdrawals, you contribute to a Roth 401(k) with after-tax funds but can make tax-free withdrawals as a retiree.

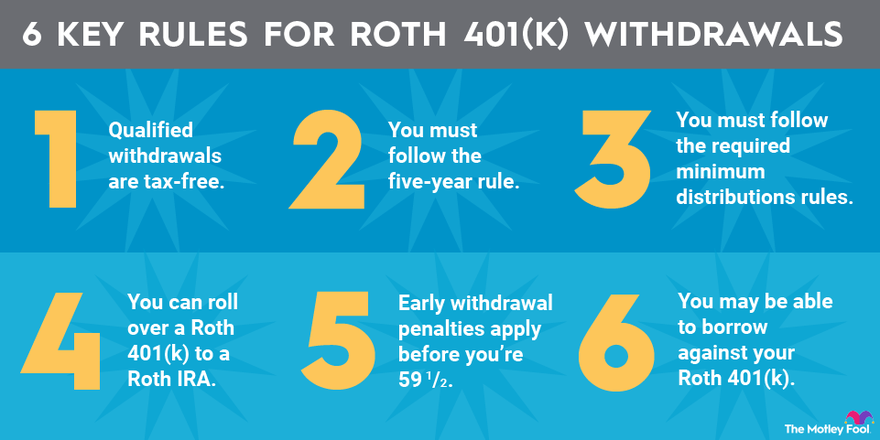

There are, however, strict rules, both to qualify for those tax-free withdrawals and to avoid penalties for early distributions. In general:

- Roth 401(k) rules allow you to make "qualified," or penalty-free, withdrawals of both contributions and gains any time after age 59 1/2 as long as your first contribution to your account was at least five tax years earlier.

- While you are still required to take required minimum distributions (RMDs) from a Roth 401(k) in 2023, you may be able to get around this rule by doing a rollover from a Roth 401(k) to a Roth IRA. Beginning in 2024, Roth 401(k)s will no longer have RMDs.

While this may sound complicated, we'll look at six key rules for Roth 401(k) withdrawals below to help you make sense of it.

1. Qualified withdrawals are tax-free.

According to the IRS, "qualified withdrawals" from a Roth 401(k) can be made tax-free. A withdrawal is considered qualified if:

- It occurs at least five years after the tax year in which you first made a Roth 401(k) contribution.

- It's made after you turn 59 1/2.

A qualified withdrawal is not included in your gross income. You also won't owe any penalties on it.

2. You must follow the five-year rule.

On the list above, you'll notice the IRS allows tax-free withdrawals only if you made the first contribution to your account at least five years earlier. This is called the five-year rule.

Many Roth 401(k) account holders are confused about this because they assume they can start withdrawals without penalty after 59 1/2, as with a traditional 401(k). However, the five-year rule supersedes that rule. If you open your account in the tax year you turn 58, you must wait until you are 63 to take a penalty-free withdrawal.

The five-year rule can also cause problems if you roll over your Roth 401(k) into a Roth IRA. If you move your money into a newly opened Roth IRA, you will have to wait five years from the first Roth IRA contribution regardless of how long ago you first contributed to the 401(k).

3. Required minimum distributions are necessary for Roth 401(k)s in 2023, but not 2024.

There's another tricky rule to be aware of with Roth 401(k) accounts. Unlike Roth IRAs, Roth 401(k)s are subject to required minimum distribution rules, however, starting in 2024, Roth-designated workplace accounts will no longer have RMDs.

RMDs now start at age 73 due to Secure Act 2.0 rules, which pushed back the RMD age from 72 to 73 in late 2022. You must use IRS tables to determine the minimum amount to withdraw from your account and are subject to a 25% penalty for any missed RMDs, though the amount may be lowered to 10% if you swiftly correct your mistake.

4. You can roll over a Roth 401(k) to a Roth IRA.

If you are leaving the job that provides you with a Roth 401(k) account, your account can be rolled over to another Roth 401(k) or to a Roth IRA without incurring taxes.

You should try to do a direct rollover, which means the funds are transferred directly from your current Roth account to your new one since this reduces the potential for tax complications.

In most cases, it's best to roll over your Roth 401(k) to a Roth IRA rather than to another Roth 401(k). By doing so, you should also have a broader choice of investment options available to you.

5. Early withdrawal penalties apply.

If you take money out of your account before age 59 1/2 or before you've held the account for five years, this is generally considered an unqualified or "early" withdrawal. If you take an unqualified withdrawal, you will be taxed on investment earnings and owe a 10% penalty.

Any early withdrawals you take are prorated between after-tax contributions and taxable gains. If your account has a value of $10,000 -- $9,400 from contributions and $600 from investment gains -- and you take a $5,000 unqualified withdrawal, $4,700 is considered contributions and is not taxable, but that $300 of earnings is included in your income, and you are subject to taxes and penalties on that amount.

This is a key distinction between a Roth 401(k) vs. a Roth IRA. With a Roth IRA, you can access your contributions at any time without paying taxes or a penalty. Any money you withdraw is treated as contributions until you've withdrawn more than you contributed.

Related retirement topics

6. You may be able to borrow against your Roth 401(k).

Some 401(k) plan administrators allow you to borrow funds from your 401(k) -- and that includes from a Roth 401(k). Loans do not trigger taxes or an early withdrawal penalty. However, if you default on your loan, it is treated as an early withdrawal.

Normally you may borrow up to $50,000 or 50% of your vested account balance, whichever is less, if your plan administrator allows it. Loans allow you to access the money in your Roth 401(k) without serious tax consequences, but they are risky because of the penalties if you become unable to pay back what you borrowed.

And while you pay interest to yourself when paying back your loan, the interest will likely be below the return on investment you could have earned had you left your funds invested for your future.

The bottom line is that you need to understand the rules while considering your personal situation. Everyone has different needs and wants, so make sure you understand the implications of any withdrawals.