Flickr source

The recovery in the U.S. economy and the stock market over the past six years couldn't have come at a better time, as millions of retirement savers have recovered from the dire financial straits they found themselves in following the financial crisis and market meltdown. Yet as retirement savings levels have climbed, many investors find themselves in unfamiliar territory as they try to decide how to defend their hard-fought gains from the next bear market. In particular, one red flag shows just how uncertain investors are about the future of the stock market, and it could leave them especially vulnerable if recent market volatility keeps building.

On the fence

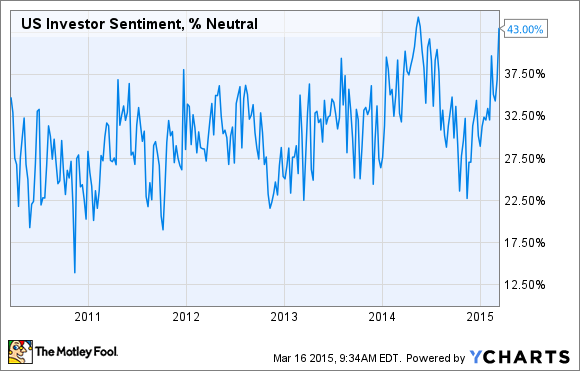

Every week, the American Association of Individual Investors conducts a survey of investor sentiment. The AAII Investor Sentiment Survey asks members whether they are bullish, bearish, or neutral on the direction of the stock market over the next six months.

Typically, the stock market's historic upward bias shows up in the results, with long-term average survey findings being roughly 40% bullish, 30% neutral, and 30% bearish. It's relatively common for those numbers to oscillate back and forth, though, with bullish readings giving way to bearish results when the market gets choppy.

Whether they're bullish or bearish, most investors have some strong opinion of the market's future direction. It's unusual to see the survey's respondents not really know which way the market will move.

Yet recently there has been a big rise in the number of people expecting neutral results in the coming months. In the most recent week, neutral sentiment climbed to 43%. That might not sound all that remarkable, but the reading approaches levels not seen in more than a decade, with only a few isolated readings last year exceeding the latest figure.

US Investor Sentiment, % Neutral data by YCharts.

Why neutrality is a danger

At first glance, neutral investor sentiment figures might seem to be less of a threat than overly bearish sentiment. After all, neutral sentiment suggests investors are willing to stay the course and see what's coming next.

Yet there are a couple problems with high levels of neutral sentiment. On one hand, they tend to reflect the uncertainties that investors have about current conditions. For instance, in the most recent survey, AAII members expressed concerns about the possibility of geopolitical disruptions, sluggish economic growth in many parts of the world, and fairly high stock market valuations. Moreover, some of their bullishness resulted from favorable U.S. monetary policy, which the Federal Reserve might start reversing within the next several months. Those concerns could lead investors to revise their retirement savings allocations, reducing their exposure to stocks in order to protect against these perceived risks.

Image: Ireneogrizek.com.

On the other hand, the AAII has found that high levels of neutral sentiment are actually one of the best indicators of future performance, at least in the short run. According to the AAII, "the best contrarian signal occurred not when investors were unusually optimistic or pessimistic but rather when they described themselves as being neutral." Stocks tend to rise sharply following high levels of neutral sentiment, with a typical gain in the S&P 500 (^GSPC -0.88%) of nearly 9% over the subsequent six months and almost 18% over the ensuing year.

This combination of nervous investors who are ready to flee and the likelihood of future positive returns poses a red flag for retirement savings. Given the difficulties in timing the market, it can be fatal to your retirement savings prospects to miss out on what proves to be the best-performing periods for stocks. Particularly for the many Americans who have saved relatively little for retirement, making the most of investment returns is crucial -- and falling into the trap of thinking you can avoid a temporary market setback runs the real risk of jeopardizing your longer-term financial prospects.

As markets climb, keeping an eye on your portfolio's risk level makes sense, with occasional rebalancing helping to ensure you aren't overly vulnerable to a market setback. But going overboard by reacting emotionally to the fear of a long-overdue market correction can do far more harm than good. Retirement savers must overcome those fears and stay on course with their long-term investing strategy.