Two of the most popular retirement accounts are the Roth IRA and the 401(k). The biggest difference between a Roth IRA and a 401(k) is that anyone with earned income can open and fund a Roth IRA, but a 401(k) is available only through your workplace. This article will help you weigh the pros and cons of each and determine which plan is best for you.

401(k) vs. Roth IRA: Choosing the best plan for you

Deciding between a Roth IRA and a 401(k) comes down to personal circumstances.

A 401(k) is a good option for those with an employer match, low fees in their plan, and who expect their effective income tax rate in retirement to be less than their marginal tax rate today. The 401(k) contribution limit can't be beat either. Be sure to review your investment options in the 401(k) plan to ensure you're not paying too much in fees and that you're investing in the funds that will work best for you.

If your employer doesn't offer a 401(k) plan, a Roth IRA is an excellent alternative. You may consider a Roth IRA even if your employer offers a 401(k) because of the minimal fees and greater investment and withdrawal flexibility.

Importantly, you don't have to choose between the two. You can contribute to both a 401(k) and a Roth IRA. Even if the fees on your 401(k) are high, it's worth contributing at least enough to get the full employer match, which will more than offset the additional costs of a 401(k).

Contributing to both will also diversify the tax treatment of your withdrawals in retirement since 401(k) withdrawals incur taxes but Roth IRA withdrawals don't. That gives you additional control over your tax rate in retirement, allowing you to minimize how much you pay the government.

Understanding the benefits and drawbacks of each retirement account can help you make the best decision for your future.

Pros and cons of 401(k) plans

With a 401(k) plan, retirement savings are taken straight from an employee's paycheck and put into a 401(k) account. A 401(k) offers several advantages:

- Employer matching: An employer match can increase your savings by 50% or 100% right off the bat. Each employer will have a different policy about how much of an employee's compensation it will match, but it's free money just for saving for retirement.

- High contribution limits: 401(k) accounts allow you to save more for retirement than any other retirement savings account. For 2024, the contribution limit for employees is $23,000, or $30,500 if you're older than 50. (In 2023, the limits were $22,500, or $30,000 if you're older than 50.) The employer match can put even more savings into your account. The total combined limit for all contributions is $69,000, or $76,500 for ages 50 and older in 2024 (up from $66,000 (or $73,500 for ages 50 and up in 2023).

- Tax savings: If you plan things properly, you can save on taxes by contributing to a 401(k). You won't pay income tax on your contributions in the year you make them. You'll also avoid paying capital gains taxes when you sell your investments. You'll owe taxes only when you withdraw funds from the account, and that gives you greater control over your tax rate.

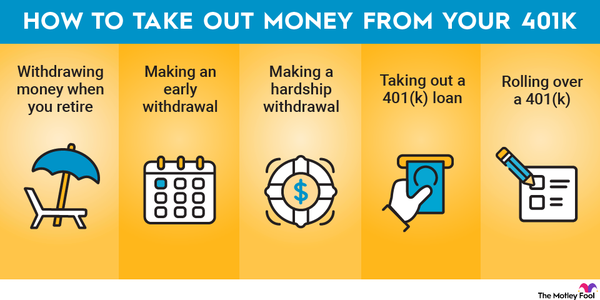

- Loan option: Many 401(k) plans offer a loan option. Taking a loan from your 401(k) can be a good option when you need cash for a big purchase (like a new home) and prevailing interest rates are high. You'll be able to pay yourself back (with interest) and avoid penalties for early withdrawal.

But 401(k) plans often come with a few drawbacks as well:

- High fees: 401(k) plans might charge a plan administration fee, which is often charged as a percentage of assets. Additionally, participants may see relatively high fees on their investment options. Some 401(k) plans will also nickel-and-dime you with individual service fees when you want to take advantage of certain plan features like the loan option.

- Limited investment options: Most 401(k) plans offer only a few mutual funds or ETFs in which to invest your retirement savings. That might mean your favorite investment vehicle isn't on the list. You can ask your plan administrator to add the investment choices you'd like, but there's no guarantee they'll get added to your plan.

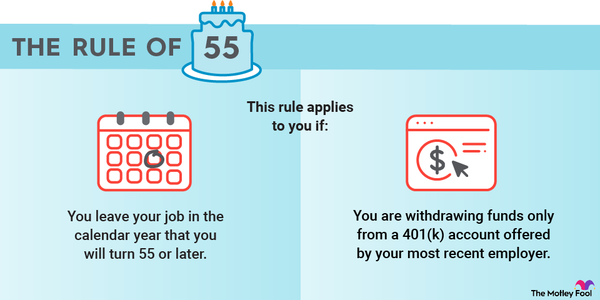

- Limited access to your funds before retirement: You likely won't be able to access your savings without paying a penalty before you turn 59 1/2 years old. There are only a few exceptions to that rule, such as early separation from service or making a withdrawal with a loan (which you'll need to repay). 401(k) accounts are meant for saving for retirement, so the government doesn't want you to withdraw funds early.

- Required minimum distributions: The year after you turn 73, you'll be forced to withdraw a minimum amount from your traditional 401(k) account every year. These required minimum distributions are based on your account balance and life expectancy, and they can throw a wrench into your tax planning. Note, however, that the Secure Act 2.0 eliminates RMDs for Roth 401(k)s in 2024 and subsequent tax years.

Pros and cons of Roth IRA plans

You don't need a special plan from your employer to save for retirement using a Roth IRA. The retirement savings account is available to anyone with earned income. You can simply open an account at any financial institution and contribute directly from your checking or savings account.

Here are some of the biggest advantages of a Roth IRA:

- Tax-free withdrawals: You pay income taxes up front on Roth IRA contributions. Your savings will grow tax-free, meaning you won't pay any tax on capital gains from your investments. You won't owe any income tax on your withdrawals either.

- No early withdrawal penalty on contributions: Unlike with a 401(k) or other traditional pre-tax retirement savings accounts, you can withdraw contributions to a Roth IRA at any point without paying a penalty. But be aware that earnings on your contributions aren't exempt from the penalty for withdrawals made before age 59 1/2.

- No required minimum distribution: The government won't force you to withdraw funds from your Roth IRA until you need them. That allows for more tax-free growth.

- More investment options: Your investment choices are limited only by what your financial institution offers. Since you get to choose which financial institution you open your IRA with, you should be able to find one that allows you to invest your Roth IRA funds however you see fit.

- Minimal fees: You should be able to find a financial institution that won't charge many, if any, fees on your Roth IRA.

There are some negatives to a Roth IRA as well:

- Income limitations: If your income exceeds the Roth IRA income limitation, you aren't eligible to contribute directly to a Roth IRA. To make the full contribution in 2024, your modified adjusted gross income (MAGI) can't exceed $146,000 for single taxpayers or $230,000 combined for married couples. Singles with incomes between $146,000 and $161,000 and married couples earning between $230,000 and $240,000 can contribute a reduced amount. Those with incomes above the upper limits of these thresholds are ineligible to contribute directly. In 2023, the phaseout ranges are $138,000 to $153,000 for single taxpayers and $218,000 to $228,000 for married couples. If your income exceeds those limits, you'll have to use the backdoor Roth IRA strategy, which involves several steps and adds a layer of complexity to your retirement savings.

- Lower contribution limits: The maximum contribution to a Roth IRA is $7,000 in 2024, up from $6,500 in 2024. You can contribute an extra $1,000 as a catch-up contribution if you're 50 or older in both 2023 and 2024. That's relatively little compared to other retirement savings vehicles like a 401(k).

- Paying taxes up front: If you're currently in a high income tax bracket, it might not make sense to pay such a high rate in taxes now. Deferring those taxes through another type of retirement account like a 401(k) or traditional IRA may result in a lower tax bill.