The 403(b) and 457(b) plans are special types of employer-sponsored retirement accounts that are available only to employees of certain types of organizations. The two accounts have several things in common, but they also have some key differences. Here's a closer look at how they compare and what sets the two of them apart from the more common 401(k).

The 403(b) plan

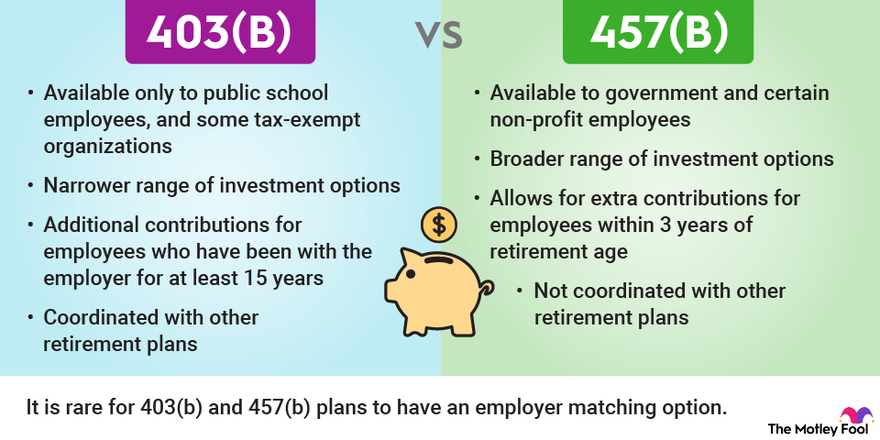

A 403(b) plan is available only to public school employees, certain ministers, and employees of tax-exempt organizations, like hospitals and charities. It's not available to employees of privately owned companies or government employees. The former would use a 401(k) while the latter would have a 457(b) plan, discussed below.

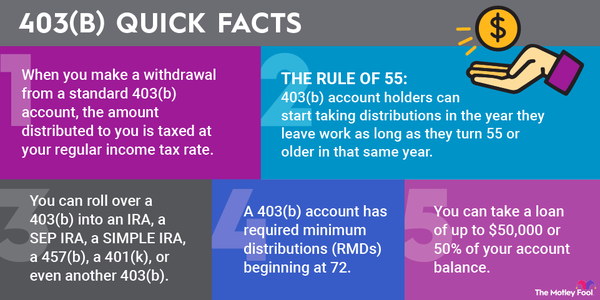

You may contribute up to $23,000 to a 403(b) in 2024 ($22,500 in 2023). Adults 50 and older may make an extra $7,500 in catch-up contributions in both 2023 and 2024. What makes the 403(b) unique is that it allows for additional contributions of up to $3,000 per year for employees who have been with the employer for at least 15 years. There's a $15,000 lifetime maximum on these catch-up contributions.

For a long time, you could invest only in annuities through a 403(b), but you can now invest in mutual funds as well. However, some plans may offer only annuities, which can make the plans more expensive than a 401(k) or 457(b) plan, with which you have a broader array of investment options.

Some 403(b) plans match employee contributions, but as with 457(b)s, this is rare. When 403(b)s do allow matching, vesting periods are often short or immediate. This enables you to keep your employer-matched funds as soon as you earn them, even if you leave the company.

The 457(b) plan

A 457(b) plan, also called a 457 plan, is a retirement plan available to government employees and some nonprofit employees. These plans have the same contribution limits as a 403(b) -- $23,000 for adults under 50 and $30,500 for adults 50 and older in 2024. In 2023, these figures were $22,500 for adults under 50 and $30,000 for adults 50 and older.

Long-standing employees don't get to make additional contributions, as they can with a 403(b), but 457(b) plans allow extra contributions for those who are within three years of the normal retirement age as specified by the plan. If you fall within this range, you may contribute up to twice the annual 457(b) contribution limit, or $46,000 in 2024 ($45,000 in 2023).

Another perk of 457(b) plans is that they're not coordinated with other retirement plans. Normally, if your company offers a 401(k) and a 403(b), your contributions to both count toward the same annual limit -- $23,000 in 2024 ($22,500 in 2023). But if your company offers a 457(b) plan and a 401(k) or 403(b), you may contribute up to $23,000 to each of them in 2024 ($22,500 to each in 2023). Plus, you may be allowed to contribute even more if you qualify for catch-up contributions under any of these plans. The rare 457(b) plan may offer matching as well, but you should be prepared to fund your retirement on your own if you have one of these accounts.

Non-governmental 457(b) plans are subject to some additional restrictions governmental 457(b) plans do not have. The most significant is that non-governmental 457(b) plan assets remain the property of the employer rather than belonging to the employee. This usually is not a factor, unless your company has serious debt problems. Then creditors can take the money that's in your 457(b) plan, even though you put it there.

Pension law also restricts which employees can use a non-governmental 457(b). Often it's available only to highly paid employees as a special perk, so the average employee isn't going to have access to one of these.

Which is right for you?

Often your company will dictate whether you have a 403(b) or a 457(b) plan. If you work for the government, you'll likely get a 457(b) plan, and if you work for a public school or a church, you will probably have a 403(b). The only people who may have to make a choice between the two are some nonprofit employees.

Both accounts can be smart places to save for retirement, but you may prefer one over the other based on your situation. For example, if you've been with your company at least 15 years, a 403(b) will offer you the chance to make extra contributions you may not get with your 457(b). But if you're close to the normal retirement age for your 457(b), it might enable you to contribute more than a 403(b).

You should also consider your investment options and the associated fees. If your 403(b) offers only annuities, you may find a 457(b), which often has more investment options, to be more affordable.

Ultimately, the most important thing is saving regularly, whichever type of account you have. You could have the best retirement account there is, but it won't matter if you're not actively using it. If you have any questions about how your 403(b) or 457(b) plan works, ask your employer for more information so you can make smart decisions about how to best save for your retirement.