-

February 9, 2024Breaking Barriers, Building FuturesBreaking Barriers, Building Futures: Dan Weidenbenner’s Vision of Multigenerational Change in Greenville. By Kristi Waterworth –...

February 9, 2024Breaking Barriers, Building FuturesBreaking Barriers, Building Futures: Dan Weidenbenner’s Vision of Multigenerational Change in Greenville. By Kristi Waterworth –... -

July 25, 2023Mindset Shift for Positive Change: A Spark ConversationMindset Shift for Positive Change: A Spark Conversation with Dan Pink, NYT best-seller, and David...

July 25, 2023Mindset Shift for Positive Change: A Spark ConversationMindset Shift for Positive Change: A Spark Conversation with Dan Pink, NYT best-seller, and David... -

July 12, 2023Women Power Rule BreakersWomen Power Rule Breakers – A Sparks Conversation Watch this powerful third conversation in our Virtual...

July 12, 2023Women Power Rule BreakersWomen Power Rule Breakers – A Sparks Conversation Watch this powerful third conversation in our Virtual... -

June 8, 2023Two More Bright Sparks Making a Difference in Housing and Money.“Two More Bright Sparks Making a Difference in Housing and Money” is a spotlight discussion...

June 8, 2023Two More Bright Sparks Making a Difference in Housing and Money.“Two More Bright Sparks Making a Difference in Housing and Money” is a spotlight discussion... -

May 25, 2023Three Bright Sparks in Financial Freedom Today.Three Bright Sparks in Financial Freedom Today, A Foolish Conversation between our new Rule Breakers...

May 25, 2023Three Bright Sparks in Financial Freedom Today.Three Bright Sparks in Financial Freedom Today, A Foolish Conversation between our new Rule Breakers... -

April 1, 2023Meet Dan WeidenbennerMotley Fool Recognizes Dan Weidenbenner as Rule Breaker. Dan Weidenbenner, Social Innovator, Founder and Executive Director...

April 1, 2023Meet Dan WeidenbennerMotley Fool Recognizes Dan Weidenbenner as Rule Breaker. Dan Weidenbenner, Social Innovator, Founder and Executive Director... -

March 30, 2023Black Wealth SummitThe Motley Fool Sponsors 2022 Black Wealth Summit David Gardner, The Motley Fool Co-Founder and Board...

March 30, 2023Black Wealth SummitThe Motley Fool Sponsors 2022 Black Wealth Summit David Gardner, The Motley Fool Co-Founder and Board... -

August 21, 2022Amplifying the Work you Do!Amplifying the Work YOU Do! In each issue of Amplify!, we’ll spotlight members creating new pathways to...

August 21, 2022Amplifying the Work you Do!Amplifying the Work YOU Do! In each issue of Amplify!, we’ll spotlight members creating new pathways to...

Financial Freedom Changes Everything.

The economic success of our country hinges on the ability of all Americans to thrive. Yet, 7 out of 10 Americans — more than 200 million people — are financially unhealthy, struggling to make ends meet. Standing in their way to achieving Financial Freedom are obstacles and barriers, which can limit their ability to lead lives filled with choice, dignity, and prosperity. The Motley Fool Foundation is devoted to changing this narrative. We are committed to finding, funding, and building equitable pathways to Financial Freedom. Our goal is to ensure that all 200 million Americans living paycheck to paycheck have the best opportunity to be smarter, happier, and richer.

The Pathway to

Financial Freedom: All Chutes and No Ladders.

Our research has shown us that a path to Financial Freedom exists, but it isn’t equitable for everyone. Only one-third of those who take the journey are successful, leaving the other two-thirds behind. Here’s why.

+We are Fools for Good

The Motley Fool has a long history of Paying it Foolward. Members and employees have given their time, talent, and treasure to help the lives of countless people. The Motley Fool Foundation continues that tradition.

+Join our Foolish Community For Good!

Don’t wait. Join the thousands of people who’ve already signed up to make a difference and become a part of our Foolish community.

+The Latest from The Foundation.

How Do You Measure Financial Freedom? Register Now For Our April Spark Conversation!

How Do You Measure Financial Freedom? Join us on April 30th, 2024, from 1-2 pm ET as The Motley Fool Foundation presents the April Spark Conversation Series. Learn about the collaborative approach taken by The Motley Fool Foundation and The Financial Health Network as they tackle this question head-on. Discover the creative process behind developing a groundbreaking first-ever measurement tool that illuminates the path toward Financial Freedom for people living paycheck to paycheck. From research to data analysis to expert input, explore how these two influential organizations collaborate to develop a unique tool that can potentially change the lives of millions of people. With its public launch expected later this year, this event offers a unique opportunity to be part of a historic conversation that can reshape the future of Financial Freedom for all!

REGISTER HERE!

What’s YOUR Financial Freedom Score?

Happy 2nd Anniversary, Motley Fool Foundation! To celebrate, we are tackling how to measure Financial Freedom with our friends at The Financial Health Network. Be among the first to sign up to help us build a one-of-a-kind assessment tool to help people understand where they are on the journey to Financial Freedom. Learn more and sign up!

Game Plan! The Motley Fool Foundation Strategy, FY24-26.

Dear Fools for Good,

We share The Motley Fool’s vision of a world that is smarter, happier, and richer. We are committed to serving the more than 200 million Americans currently living paycheck to paycheck or worse. By increasing knowledge and access to Financial Freedom, we believe we can empower more people to live a life of choice.

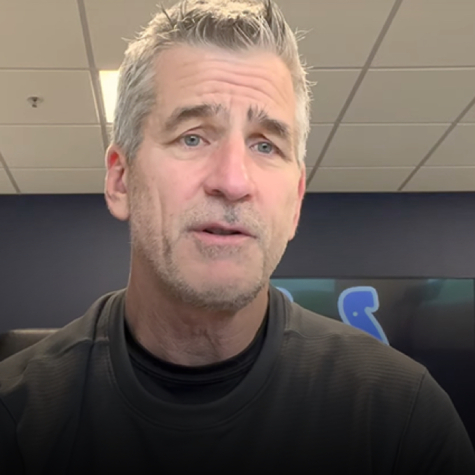

“Breaking Barriers, Building Futures”

Dan Weidenbenner’s Vision of Multigenerational Change in Greenville.

Transforming Greenville: From food deserts to thriving communities! Dan Weidenbenner’s Mill Village Ministries is breaking barriers, offering fresh starts and Financial Freedom through innovative projects like community gardens, bike repairs, and entrepreneurship incubators, empowering the marginalized communities in NC with over 1M lbs of food distributed and paving the way for future leaders. Discover how grassroots efforts are making real change.

New from The Motley Fool Foundation: Our first-of-its-kind research is now available!

On February 22, we held a Spark Conversation to reveal our first research study: Demystifying Financial Freedom: 4 Key Principles! Commissioned by The Motley Fool Foundation, we believe it’s a groundbreaking study that will elevate the voices of the people closest to the problems. This study offers a deep dive into the lives and challenges of over 100 social innovators, revealing a blueprint for action to achieve Financial Freedom for the two-thirds of Americans living paycheck to paycheck.

Watch the Spark Conversation or access the study.

Today is Friday, April 26, 2024

Explore the Sparks Lab!

Where Information and Insights Collide to Ignite Ideas of Change.

A collection of content updated daily and designed to keep you informed about our work, the work happening with our community, and that of our partners that helps strivers become thrivers.