When it comes to calculating interest, there are two basic choices: simple and compound. Simple interest simply means a set percentage of the principal amount every year.

For example, if you invest $1,000 at 5% simple interest for 10 years, you can expect to receive $50 in interest every year for the next decade. No more, no less. In the investment world, bonds are an example of an investment that typically pays simple interest.

What is compound interest?

What is compound interest?

On the other hand, compound interest is what you get when you reinvest your earnings, which then also earn interest. Compound interest essentially means "interest on the interest" and is why many investors are so successful.

Think of it this way. Let's say you invest $1,000 at 5% interest. After the first year, you receive a $50 interest payment, but instead of receiving it in cash, you reinvest the interest you earned at the same 5% rate. For the second year, your interest would be calculated on a $1,050 investment, which comes to $52.50. If you reinvest that, your third-year interest would be calculated on a $1,102.50 balance.

You get the idea. Compound interest means your principal gets larger over time and will generate larger and larger interest payments. The difference between simple and compound interest can be massive. Take a look at the difference on a $10,000 investment portfolio at 10% interest over time:

| Time Period | Simple Interest at 10% | Compound Interest (annually at 10%) |

|---|---|---|

| Start | $10,000 | $10,000 |

| 1 year | $11,000 | $11,000 |

| 2 years | $12,000 | $12,100 |

| 5 years | $15,000 | $16,105 |

| 10 years | $20,000 | $25,937 |

| 20 years | $30,000 | $67,275 |

| 30 years | $40,000 | $174,494 |

Note that 10% is, roughly, the long-term annualized return of the S&P 500. It was 9.65% for the 30-year period through 2022. Returns like this, compounded over long periods, can result in some pretty impressive performances.

It's also worth mentioning that there's a very similar concept known as cumulative interest. Cumulative interest refers to the sum of the interest payments made, but it typically refers to payments made on a loan. For example, the cumulative interest on a 30-year mortgage would be how much you paid toward interest over the 30-year loan term.

How to calculate compound interest

How compound interest is calculated

Compound interest is calculated by applying an exponential growth factor to the interest rate or rate of return you're using. The good news is that there are plenty of excellent calculators that will do the math for you.

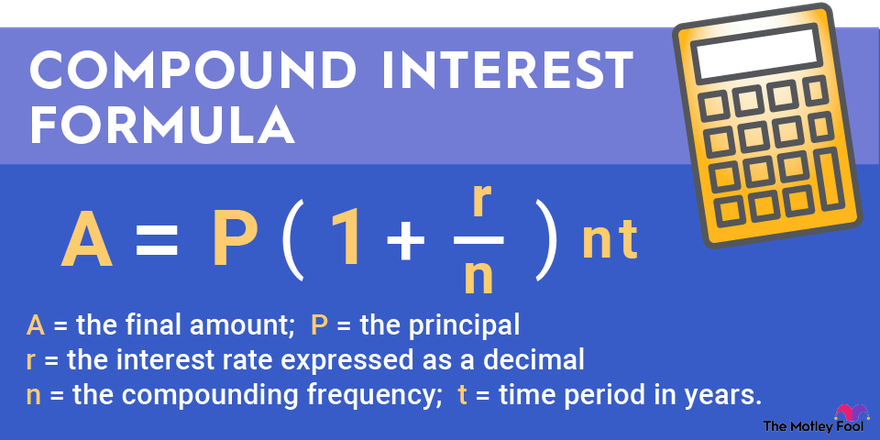

Below is a mathematical formula you could use for calculating compound interest over a certain period:

With "A" as the final amount, here's what all the other variables mean:

- Principal (P): The starting balance on which interest is calculated. For example, if you decide to invest $10,000 for five years, that amount would be your principal for the purposes of calculating compound interest.

- Interest rate (or expected rate of return in investing) expressed as a decimal (r): For calculation purposes, if you expect your investments to grow at an average rate of 7% per year, you would use 0.07 here.

- Compounding frequency (n): How frequently you're adding interest to the principal. Using the example of 7% interest, if we were to use annual compounding, you would simply add 7% to the principal once per year. On the other hand, semiannual compounding would involve applying half of that amount (3.5%) twice a year. Other common compounding frequencies include quarterly (every three months), monthly, weekly, or daily.

- Time (T): The total time in years. In other words, if you're investing for 30 months, be sure to use 2.5 years in the formula.

Compounding frequency

Compounding frequency and why it matters

In the previous example, we used annual compounding, meaning the interest is calculated once per year. In practice, compound interest is often calculated more frequently. For example, your savings account may calculate interest monthly. Common compounding intervals are quarterly, monthly, and daily, but many other possible intervals could be used.

The compounding frequency makes a difference. All other factors being equal, more frequent compounding leads to faster growth. For instance, the table below shows the growth of $10,000 at 8% interest compounded at several frequencies:

| Time | Annual Compounding | Quarterly | Monthly |

|---|---|---|---|

| 1 year | $10,800 | $10,824 | $10,830 |

| 5 years | $14,693 | $14,859 | $14,898 |

| 10 years | $21,589 | $22,080 | $22,196 |

Example

Example of calculating compound interest

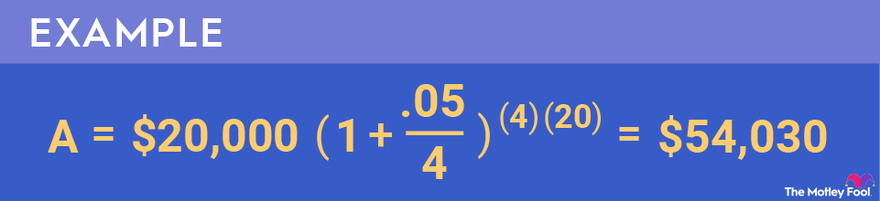

As a basic example, let's say you're investing $20,000 at 5% interest compounded quarterly for 20 years. In this case, "n" would be four, as quarterly compounding occurs four times per year.

Based on this information, we can calculate the investment's final value after 20 years like this:

Compound earnings vs. compound interest

Compound earnings vs. compound interest

You may hear the terms compound interest and compound earnings used interchangeably, especially when discussing investment returns. However, there's a subtle difference.

Specifically, compound earnings refers to the compounding effects of both interest payments and dividends, as well as appreciation in the value of the investment itself. In other words, it's more of an all-in-one term to describe investment returns that aren't entirely interest.

For example, if a stock investment paid you a 4% dividend yield and the stock itself increased in value by 5%, you'd have total earnings of 9% for the year. When these dividends and price gains compound over time, it is a form of compound earnings and not interest, as not all of the gains come from payments to you.

In a nutshell, long-term returns from stocks, exchange-traded funds (ETFs), or mutual funds are technically called compound earnings. However, it can still be calculated in the same manner if you know your expected rate of return.

Related investing topics

Importance of compound interest

Why compound interest is such an important concept for investors

Compound interest is the phenomenon that allows seemingly small amounts of money to grow into large amounts over time. To take full advantage of the power of compound interest, investments must be allowed to grow and compound for long periods.