Image source: Getty Images.

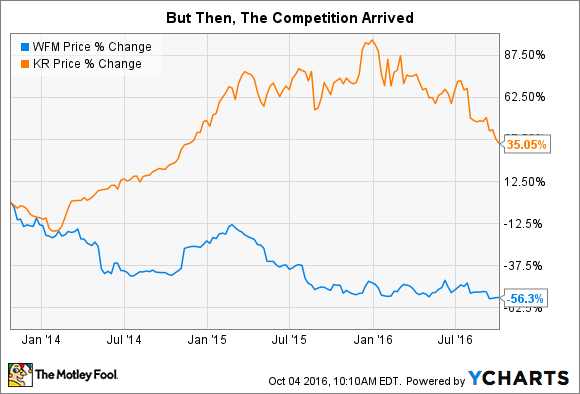

Coming out of the Great Recession, it seemed like no one could touch Whole Foods Market (WFM). While other grocers abandoned natural and organic fare during the downturn, Whole Foods plodded on in its course. When the recovery set in, it had the natural/organic sandbox all to itself, which led to great returns for investors.

Over the last three years, however, competition has arrived in droves. As traditional players have upped their natural/organic game, Whole Foods has experienced a wave of disappointments. One of the main benefactors has been Kroger (KR 1.80%), which has seen its sales of organic goods skyrocket...as well as its stock.

Given these dynamics, which is the better stock to buy today? I'll try to answer that below.

Financial fortitude

There's no replacement for cash in the bank. As boring as it is, cash provides both a measure of safety and ammunition to use at opportune times.

During economic downturns, companies with cash have options: outspend their rivals into oblivion, buy back stock, or even make acquisitions. Companies with debt have no options -- they must narrowly focus on just making ends meet.

Here's how Kroger and Whole Foods stack up in terms of their financial fortitude.

|

Company |

Cash |

Debt |

Net Income |

Free Cash Flow |

|---|---|---|---|---|

|

Whole Foods |

$625 million |

$1,050 million |

$476 million |

$203 million |

|

Kroger |

$319 million |

$12,420 million |

$2,066 million |

$1,334 million |

Data sources: SEC filings, Yahoo! Finance, and YCharts.

It should be noted that Whole Foods pays for its store expansion almost exclusively by using free cash flow. This helps explain the disparity between the company's net income and free cash flow. Kroger, on the other hand, has largely built out its footprint, although it continues to expand via acquisitions.

After taking into consideration that Kroger is valued at three times the size of Whole Foods, I'm left believing that Whole Foods has more financial fortitude. The company has a much better cash-to-debt position than Kroger. Kroger's decision to expand via acquisition has worked thus far, but it definitely makes the company more fragile should a downturn occur -- or should competition continue eating into margins.

Winner: Whole Foods

Sustainable competitive advantage

There's nothing more important than a company's sustainable competitive advantage, often referred to as a "moat." Without a moat, anyone can come along and offer the same thing for slightly cheaper. While that's great for end users, it can wreak havoc on your investment portfolio.

This has become crystal clear in the grocery business. Increasingly, shoppers approach their food the same way they approach airline tickets: As long as minimum for quality is met, they will go with the most cheapest and most convenient option.

For a while, Whole Foods had a considerable moat because of both its brand name and the fact that it was the only major grocer uber-focused on healthy eating. But those days are long gone, and the only sustainable competitive advantage that I can see anymore in the industry is scale: The more locations you have, the easier and more convenient it is for shoppers to patronize your business.

Whole Foods currently has 452 stores worldwide, while Kroger had over 2,700 locations at the end of 2015.

Winner: Kroger

Valuation

Finally, we need to figure out how expensive these stocks are. While there's no perfect metric to measure this, these are my four go-to ratios.

|

Company |

Price-to-Earnings |

Price-to-Free-Cash-Flow |

Price-to-Sales |

PEG |

|---|---|---|---|---|

|

Whole Foods |

18 |

45 |

0.6 |

1.9 |

|

Kroger |

13 |

21 |

0.3 |

1.8 |

Data sources: SEC filings, Yahoo! Finance, and YCharts.

It seems clear that Kroger is the better deal. I honestly believe that the grocery business in general will become harder and harder to compete in. Super-local start-ups are gaining traction with wealthier crowds, while those catering to the lower-end are in a race to the bottom in terms of price.

Given my own bleak outlook, I think it seems ridiculous that Whole Foods is priced at 18 times earnings. While the company's smaller 365-branded stores could end up being more popular than I think they will, the bottom line remains that fewer people are willing to travel the extra mile to Whole Foods when there are closer alternatives.

Winner: Kroger

A better retail grocer

Kroger's management has done an admirable job at remaining competitive in this industry. The company wins my nod in a battle between it and Whole Foods.